The Fed raised interest rates by 25 basis points after almost a decade. US markets were strong till Wednesday, the day rates were announced, and, fell sharply on the remaining two days

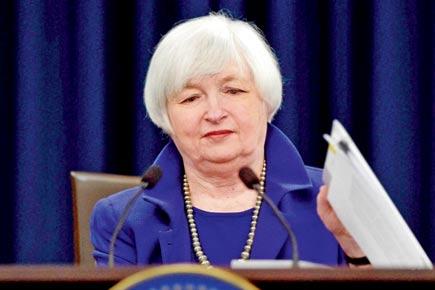

Janet Yellen

The markets were volatile last week, though they reversed the losing streak of the previous week. Markets gained on four of five trading sessions. They lost only on Friday to cement the adage, ‘Buy the rumour and sell the fact’. The Fed raised interest rates by 25 basis points after almost a decade. US markets were strong till Wednesday, the day rates were announced, and, fell sharply on the remaining two days.

Federal Reserve chair Janet Yellen holds a news conference in Washington, following an announcement that the Federal Reserve raised its key interest rate by quarter-point, heralding higher lending rates. Pic/AP/PTI

ADVERTISEMENT

The BSE SENSEX gained 474.79 points or 1.90 per cent, to close at 25,519.22 points. NIFTY gained 151.50 points or 1.99 per cent to close at 7,761.95 points. The broader market gained more with the BSE100, BSE200 and BSE500 gaining 2.24 per cent, 2.28 per cent and 2.32 per cent respectively. BSEMIDCAP gained 3.25 per cent and BSESMALLCAP 2.84 per cent.

In sectoral gainers, beaten down sector metals rallied strongly and BSEMETAL gained 4.07 per cent followed by BSEPOWER 3.39 per cent and BSEREALTY 3.06 per cent. There were no sectoral losers, and, the one to gain the least was BSEFMCG up 0.94 per cent. In individual stocks, the metal pack was the outperformer with Tata Steel up 6 per cent followed by SAIL 5.56 per cent, Tata Power 5.25 per cent, Hindalco 4.72 per cent and HindUnilever 4.64 per cent. The losers were far fewer in number, and, were led by Axis Bank down 1.68 per cent followed by Mah & Mah 1.43 per cent and ITC 1.14 per cent.

Dow Jones ended a volatile week with losses of 136.76 points or 0.79 per cent to close the week at 17,128.45 points. The Indian rupee gained 49 paisa or 0.79 per cent to close at R 66.39 for the week.

The week ahead is truncated with a Christmas holiday and only equity market trading on Thursday.

Closing look

With the year end festival mood setting in, trading volumes are likely to reduce, and, volatility increase. FII activity continued to be largely negative, barring some spiked purchases, seen post the Fed hike. That seemed to be more like an aberration. Fresh activity on the FII front is likely in mid-January next year.

The primary market would see listing of two new IPOs during the week. They are Dr Lal Pathlabs and Alkem Laboratories. The secondary offering from Narayana Hrudayalaya closes today. The company is offering shares in a price band of Rs 245-250. Selling shareholders would be raising about R 600 crore from the same. After two of the three days for subscription, the company has garnered subscription for about 30 per cent of the issue. The QIB portion is 46 per cent subscribed, retail 32 per cent and HNI 2 per cent. The poor response may be because it is expensive.

Markets are looking for cues and the Fed interest increase was one big driver. Attention would now shift to China. Oil prices continue to fall. Initially, the softening of crude oil rates was welcome, but they are not helping at these levels. India receives a large amount of remittances from people working in the Gulf countries which would start drying up in the immediate future. Once the year comes to an end, people will start talking about the December quarter results, hoping that some green shoots are visible in corporate performance as well. 2015 has been a negative year for stock markets with the benchmark indices down, close to about 10 per cent. One hopes that 2016 would be a better year.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!