The year 2014 ended with a bang for investors and hopes are high for a continuation of good trade in the New Year

The markets ended 2014 on a positive note and had once again a fantastic Friday to end last week. Friday was as expected by Gyan Sangam, the banker’s conclave held at Pune over the weekend. What was it that the market was expecting is baffling? But the meet ended with three key takeaways.

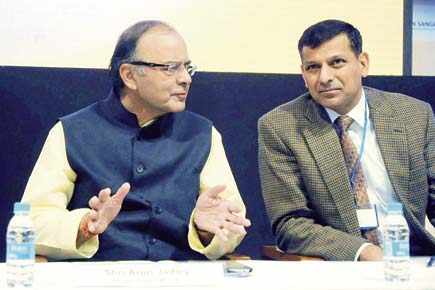

Finance Minister Arun Jaitley with RBI Governor Raghuram Rajan at Gyan Sangam, a two-day retreat function for the chiefs of financial institutions. Pic/PTI

ADVERTISEMENT

The government is seriously considering dilution of government stake in PSU bank, the second is the complete assurance of no interference in the bank functioning and thirdly acceptance of the fact that current levels of NPA’s are unacceptable and that a concerted effort needs to be taken to bring them down.

Gaining time

Sensex gained 646.12 points or 2.37 to end at 27,887.90 points while Nifty gained 194.75 points or 2.37 per cent to end the week at 8,395.45 points. BSE100, BSE200 and BSE500 gained 2.64 per cent, 2.78 per cent and 2.88 per cent respectively while BSEMIDCAP was up a big 4.10 per cent and BSESMALLCAP 3.79 per cent.

The top sectoral gainer was BSECAPGOODS up 4.28 per cent followed by BSECONDUR 4.27 per cent and BSEPOWER 4.08 per cent. There were no losers and the least to rise was BSEOIL&GAS up 0.39 per cent. In individual stocks, PSU machinery and capital goods maker BHEL was the top gainer up 9.39 per cent followed by GE Shipping at 6.93 per cent and Yes Bank at 6.89 per cent.

Other gainers included Jet Airways at 14.99 per cent after a huge cut in ATF prices and LIC Housing at 11.84 per cent. There were hardly any losers and they were led by Mah & Mah down 2.39 per cent, followed by PNB at 1.22 per cent and Bajaj Auto at 0.83 per cent.

FII’s were buyers of equity of Rs 1,096 crore but were net sellers of Rs 864 crores for December which is the second month of sale in the calendar year 2014 after January. For 2014, FII’s were net buyers of Rs 98,170 crores. Domestic institutions were buyers of Rs 787 crores during the week and Rs 7,037 crores for December, which incidentally was the best month in 2014. The year 2014 saw domestic institutions buying equity worth Rs 23,558 crores.

Planning ahead

The new name for Planning Commission has been finalised as ‘NITI Aayog’. The acronym NITI stands for National Institution for transforming India. There would be discussion and comments on this name but it stands as final and is not subject to change. The year 2014 was a decent one for equity markets with the benchmark indices Sensex and Nifty reporting gains of about 30 per cent.

BSESMALLCAP reported the best performance gaining 69.24 per cent while BSEMIDCAP index rose 54.69 per cent. In sectoral indices, the top performer was BSECONDURABLE at 66.18 per cent followed by BSEBANKEX at 65.04 per cent. Three of the top 5 of the 30 Sensex stocks were banks led by Axis at top, SBI at third and ICICI at fifth spot.

The week ahead will be a tough one for the markets as volumes will increase and FII’s are likely to be back in action. Their allocations are typically done in the first fortnight of January and even though they may not be done they would become active. Dow Jones lost 220.72 points or 1.22 per cent to close at 17,832.99 points.

The Indian rupee gained 27 paisa or 0.42 per cent to close at Rs 63.28. The FM would begin his round of talks with various stake holders about the impending budget and take their views. The job on hand where our neighbour seems to be becoming aggressive on all fronts to divert attention from their internal mess is becoming bigger day by day and is likely to be dealt with a firm hand.

What next

The markets seem to be building up expectations faster and greater than reality. This is always dangerous and leads to some sort of sell-offs sooner than later. The possible move on Friday looks like one such move and could result in a sell off. Cautions are therefore advised. Stick to the frontline stocks and midcaps only on sharp dips.

Plenty of buying opportunities will be available and do not be in a hurry to buy. This year will probably see many more issues from the government by way of OFS and FPO and primary market should become vibrant once again.

Action during the week will shift to Gujarat where there are back to back events of the NRI and Vibrant Gujrat over the next 10 days. World business leaders will be converging at one city Ahmedabad. Trade cautiously in a week which will look for news flow for trends and direction.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions.

Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!