The staggering influence of this important bill has rating agencies predicting a slew of positive movements on the Nifty and Sensex

Last week, Rajya Sabha approved the Goods and Services Tax (GST) constitutional amendment bill, but the markets discounted the news. Last Wednesday and Thursday, we saw profit booking and on Friday, FII led buying kept the Nifty above the 8650 mark.

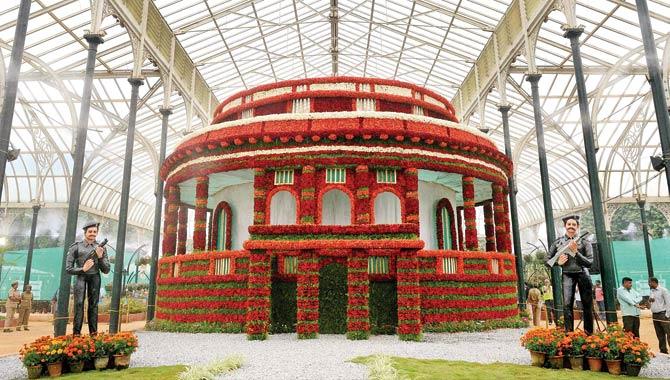

Parliament house made with flowers during a flower show to mark upcoming Independence Day in Bengaluru. Rajya Sabha approved the GST constitutional amendment bill. Pic/PTI

ADVERTISEMENT

Going forward, Nifty is likely to move up further towards 8720 and 8769. Even though the markets are likely to witness minor technical correction, it is prudent to buy options of Nifty rather than selling it, because of lower VIX. Short covering can be expected if Nifty manages to close above 8700 this week.

Independence weekend

Technically, markets are likely to remain light especially on August 14, ahead of Independence Day. Fundamentally, equity valuations are slightly over stretched, but implementation of GST in August is giving firm support to the market. According to estimates, our economy can attain double digit growth very soon because of GST.

According to Moody’s, the rating agency, the implementation of GST is positive credit for Indian Sovereign and non-financial corporate. In their view, the auto sector is likely to be a major beneficiary of the GST regime as lower GST rate will further keep the vehicle demand strong. Right now, many of the front line auto stocks are trading in their 52 week highs and are ripe for a minor correction. Price declines can be utilised to buy these stocks.

Global equity market participants relentlessly supported our markets; they bought $4.8 billion worth shares as on August 2. If the global market sentiments are improving, the same trend may continue for a while. Bank of England in a surprise move, pared borrowing cost to a record low. UK shares hit a one year high, after the rate cut.

Steel strong

To support the domestic steel manufacturers, the government extended minimum import price on steel for two months until October 4. Once the domestic demand picks up the government may roll back the Monthly Income Plan (MIP).

More than 500 mid-cap and small-cap companies are coming out with numbers this week, the list includes the names like Bayer Corp, Britannia, Hero Motor, Idea, Max India, Polaris, Adani Port, Apollo Tyres, Century Tex, JK Tyre, Edelweiss, Geometric, Lupin, Manappuram, M&M, Motherson Sumi, Rajesh Exports, Suven, Thermax, Dhan Bank, GE Ship, IPCA Lab, MRF, WABAG, AIA Eng, FDC, Glenmark, Hindalco ,Jet Air, Shree Cement, Sun Pharma, UBL etc.

RBI meeting

On August 9, the Reserve Bank of India (RBI) will meet on the policy review. Investors are not expecting any positive surprise as inflation is high. But we can expect volatility in interest rate of sensitive sectors including banking. This week important macro data like inflation and balance of trade will be out. Both these data can give sharp volatility to the markets.

Gold came off from highs due to strong dollar, and weak demand. It is likely to remain subdued for some time, but long term outlook is still positive. Gold has support at $1325 and $1310 per troy ounce and it has resistances at $1363 and $1374 per troy ounce. Price declines can be utilised to invest in gold because of currency volatility and BREXIT related uncertainty.

Alex K Mathews is the founder of www.thedailybrunch.com.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!