Number of factors contribute to ground slipping away, as exit polls and election results impact developments

?

?

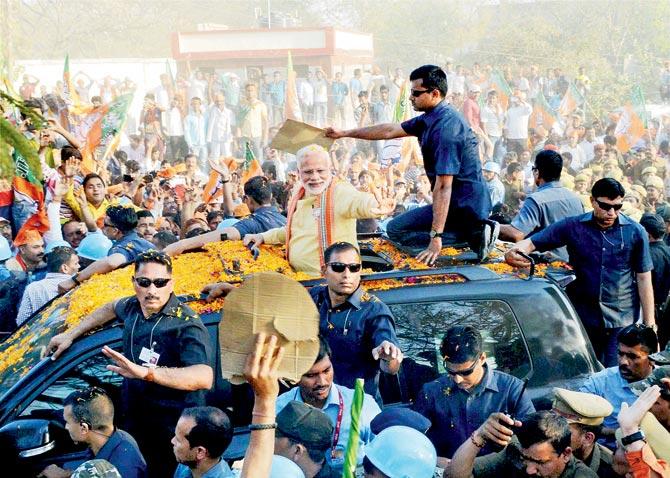

PM Narendra Modi during his second road show ahead of 7th phase of UP assembly elections in Varanasi. Pic/PTI

It was a flattish week at the markets with benchmark indices losing small ground. Markets were virtually flat with the BSESENSEX losing 60.52 points or 0.21 per cent, to close at 28,832.45 points while NIFTY lost 41.95 points or 0.47 per cent to close at 8,897.55 points. The broader indices saw the BSE100, BSE200 and BSE500 lose 0.56 per cent, 0.575 and 0.46 per cent respectively. BSEMIDCAP lost 0.91 per cent but BSESMALLCAP gained 0.24 per cent. In sectoral gainers, the top performer was BSEMETAL up 2.22 per cent followed by BSEIT 1.23 per cent and BSEREALTY 1.07 per cent. The top sectoral loser was BSEPSU down 2.59 per cent followed by BSEPOWER 2.21 per cent, BSEBANKEX 1.89 per cent and BSEOIL&GAS 1.81 per cent.

ADVERTISEMENT

Gain some, lose some

In individual stocks, the top gainer was Hindalco up 9.09 per cent followed by Reliance Industries 6.38 per cent and SAIL 3.49 per cent. The top loser was NTPC down 5.75 per cent. In other stocks Idea Cellular lost 7.56 per cent. OMCs were weak and saw BPCL lose 11.58 per cent followed by HPCL 8.66 per cent and IOC 2.62 per cent. The Indian Rupee gained 2 paisa or 0.03 per cent to close at Rs 66.81. Dow Jones gained 183.95 points to close at 21,005.71 points.

Indian election officials examining Electronic Voting Machines (EVM) from a distribution centre on the eve of the State Assembly Election in Bishnupur district, some 46 km from Imphal, capital of Manipur. Results are expected on March 11. Pic/AFP

An eye on issues

This week would see plenty of action in the primary markets with two issues opening and closing. Very clearly, the timing has kept in mind that election results could impact market sentiment and these issues would close before that. The first issue is from Music Broadcast Limited and the second is from Avenue Supermarts Limited. The first issue from Music Broadcast Limited, the company which runs the radio channel Radio City opens on Monday, March 6 and closes on Wednesday March 8.

The company is raising by way of a fresh issue Rs 400 crore in a price band of Rs 324-333. There is also an offer for sale of 26.58 lakh shares by promoters of the company. Looking at the size of the issue and the buoyancy in the primary and secondary markets, the issue would certainly get oversubscribed.

Expected to do well

The second issue is from Avenue Supermarts Limited, the owners of the D Mart chain of super markets. The company is looking to raise Rs 1,870 crore by way of a fresh issue in the price band of Rs 295-299. The issue opens on Wednesday, March 8 and closes on Friday, March 10. The company runs 118 stores in nine states and one union territory. It recorded revenues of Rs 8,803 crore, for the nine months ended December 2016 and a net profit after tax of Rs 387 crore. This means that on an annualised basis, the shares are being offered at a PE multiple of 32.53 times of the current earnings. The exact comparison for this company is difficult simply because the other stores are not in similar line of business. Companies like Trent or Shoppers Stop are not super markets.

Secondly, that the bulk of the stores run by Avenue are owned by them eliminating the risk of real estate and rentals. The issue is commanding a huge premium in the unofficial market and is expected to do very well.

Of exits and elections

This week sees exit polls being announced on Wednesday March 8, for the five states where elections have been held. The results are to be declared on Saturday March 11, followed by a holiday on Monday for Holi.

If the ruling party at the centre does well in Uttar Pradesh, markets would see further gains when they open on March 14, while if they do badly, there would be a negative impact. The market would start reacting to expectations based on the exit poll from Wednesday afternoon itself.

This week would be one of expectancy from election results followed by the actual results in the weekend. It will be a waiting game which is normally quite painful. Trade cautiously.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!