With Lok Sabha elections on in India, the stock markets seem to be sensing that a stable government will be formed and are doing well as a result

The markets have been making new intraday highs every week and are riding the wave of optimism that there will be a stable government post these elections. In a shortened week which saw trading for a mere 4 days, all the action seemed to happen on Wednesday when markets rose over 1.6 per cent and then on Friday where they were weak and lost ground.

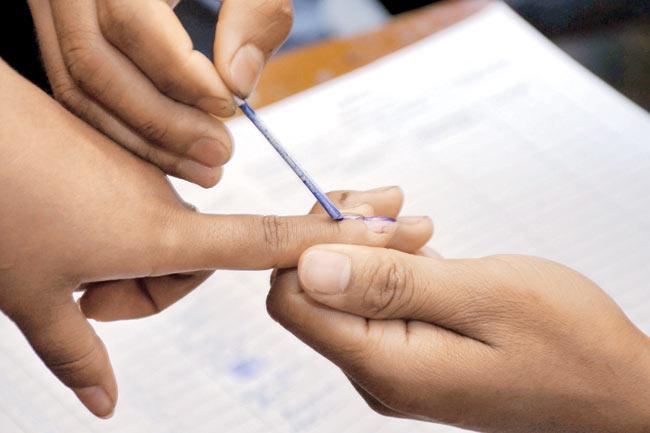

Election expectation: An Indian polling official marks a voter with indelible ink prior to voting inside a polling station at Bungthuam, on the outskirts of Aizwal, the capital of Mizoram. Pic/AFP

ADVERTISEMENT

Sensex

The new intraday high made were 22,792 on the Sensex and 6,819 on the Nifty. The BSESENSEX gained 269.46 points or 1.21 per cent to close at 22,628.96 points. The Nifty gained 81.95 points or 1.22 per cent at 6,776.30 points.

The BSE100, BSE200 and BSE500 gained 1.43 per cent, 1.40 per cent and 1.49 per cent respectively. The Midcap gained 1.96 per cent while the Smallcap gained 3.55 per cent. The top sectoral gainer was BSEPOWER up 3.35 per cent followed by BSEPSU up 2.70 per cent and BSEMETAL up 2.40 per cent. The losers were led by BSEIT down 0.49 per cent, BSETECH down 0.38 per cent and BSEFMCG down 0.10 per cent.

Stocks

In individual stocks the biggest gainer was LIC Housing Finance up 10.61 per cent. Other gainers included Sun Pharma up 9.77 per cent, Union Bank up 9.31 per cent and NMDC up 7.31 per cent. The losers were led by Just Dial down 17.33 per cent. Other losers included Jindal Steel and Hero Moto down 3.47 per cent. Since the lows made in February the Sensex and Nifty are up about 13.5 per cent while the BSEMIDCAP in the same period is up 17.5 per cent. The rally in this sector would bring many a smile on the face of retail investors.

FIIs continued to be buyers during the week which had four trading sessions and bought equities worth R 1,847 crore while domestic institutions were sellers of R 521 crore for the week. The Indian rupee was quite stable during the week even though it lost R 0.10 or 0.17 per cent to close at R 60.18.

Sun Pharma is to acquire a majority stake in Ranbaxy in an all share deal with the ratio fixed at 0.8 share of Sun Pharma for every share of Ranbaxy. This explains why shares of Ranbaxy had rallied sharply in the previous week.

Last week shares of Sun Pharma gained 9.77 per cent while those of Ranbaxy gained 1.82 per cent.

IIP numbers for February were poor with IIP declining 1.9 per cent against a positive 0.8 per cent in the previous month. This decline takes the current numbers to a nine month low which does not augur well for our economy. Trade data for March and the year 2013-14 also points to the sluggish state of the economy. Exports in the financial year were up 4 per cent at 412.35 billion dollars while imports were down 8.11 per cent at 450.92 billion dollars. Non-oil imports were significantly down and signify the continuing slowdown in the economy. The Dow Jones saw a sharp sell-off on Friday and closed at 16,026.75 points, a weekly loss of 386 points or 2.35 per cent.

Polls

Elections in four of the nine phases have been completed and very clearly the standard of electioneering is hitting new lows. What is happening is certainly not good for the country and shows the desperation that has emerged among some of the political parties. Hopefully in just about a month all of this would come to an end and all indications available point to there being a stable government post this exercise. The markets are sensing this as well and are attracting FII money in large amounts. As long as FII money continues to be there markets at worst may see corrections but they cannot fall.

The week begins with Infosys declaring results on Tuesday. The company is expected to report a net profit of R 2810 crore while its revenues would be R 12,970 crore for the quarter ending March 2014. These are the consensus numbers and the current weakness takes care of these numbers. The stock could see movement based on guidance for the year 2014-15 and react accordingly if these consensus numbers are of the mark positively or negatively.

The week ahead has holidays on Monday and Friday and this would shorten the week to a mere three days. With Friday being a near global holiday as far as world markets are concerned, this truncated week would make the markets dull and circumspect.

Traders are likely to avoid taking large positions and this may affect volumes. In such a scenario, volatility is likely to increase even though markets may remain range-bound.

Vote wish: Indian voters queue at a polling station in Trivandrum in southern Kerala to cast their votes. PIC/AFP

Markets

Markets are likely to remain lacklustre though the customary new highs would happen. Key levels for the Sensex are 22,455 and 22,875 while they are 6,725 and 6,845 for the Nifty. The support for the Sensex is at 22,544 points, then at 22,391 points, then at 22,280 points, and finally at 22,040 points. It has resistance at 22,696 points, then at 22,871 points, then at 22,985 points and finally at 23,195 points. The Nifty has support at 6,749 points, then at 6,703 points, then at 6,678 points and finally at 6,586 points. It has resistance at 6,796 points, then at 6,844 points, then at 6,932 points and finally at 7,015 points.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!