GST Council lowers tax rates for 66 items; but Finance Minister says the rate on hybrid cars will not be reviewed

GST Council has reduced tax rates of 66 items as against representations received for 133 items, Arun Jaitley said.

GST Council has reduced tax rates of 66 items as against representations received for 133 items, Arun Jaitley said.

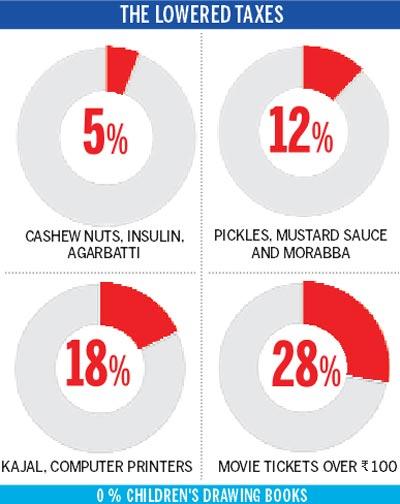

Tax rates on certain kitchen items like pickles and mustard sauce, as well as movie tickets costing up to Rs 100 have been lowered as the Centre and states yesterday reduced levies on 66 items.

ADVERTISEMENT

Movie tickets costing Rs 100 and below will now attract 18 per cent tax, as against 28 per cent proposed earlier, while those above Rs 100 will continue to attract 28 per cent GST.

Kitchen use items like pickles, mustard sauce and morabba will attract 12 per cent GST, as against 18 per cent proposed earlier. Also, tax rates on cashew nuts have been cut to 5 per cent from 12 per cent.

The GST Council also decided that traders, manufacturers and restaurant owners with turnover of up to Rs 75 lakh can opt for a composition scheme and pay taxes at the rate of 1, 2, and 5 per cent respectively.

The Council also lowered GST rates on children's drawing books to nil from 12 per cent. Computer printers will attract 18 per cent tax as against 28 per cent earlier.

GST on insulin and agarbatti has also been lowered to 5 per cent, while school bags will attract tax of 18 per cent. Tax rate on kajal has been lowered to 18 per cent from 28 per cent.

"GST Council has reduced tax rates of 66 items as against representations received for 133 items," Finance Minister Arun Jaitley told reporters here after the 16th meeting of the GST Council.

Tax rate on hybrid cars

Jaitley yesterday hinted that the tax rate on hybrid cars will not be reviewed, saying the industry demands were not in sync with a study conducted by tax officers.

The council had fixed 43 per cent tax (28 per cent GST plus 15 per cent cess) on hybrid cars, a rate that industry felt was too high.

"We have done a detailed study on auto industry demand and a paper has been made which will be circulated among members. And, if necessary, it will come up for discussion. The fact that is being presented (by the industry), according to the paper, is not correct," Jaitley told reporters.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!