In major setback for liquor baron Vijay Mallya, the Debt Recovery Tribunal (DRT) on Monday barred him from accessing USD 75 million (Rs 515 crore) exit payment from Diageo till the loan default case with State Bank of India is settled

Bengaluru: In major setback for liquor baron Vijay Mallya, the Debt Recovery Tribunal (DRT) on Monday barred him from accessing USD 75 million (Rs 515 crore) exit payment from Diageo till the loan default case with State Bank of India is settled.

DRT, allowing SBI plea, restrained Diageo from disbursing the money for now and set March 28 as the next date of hearing.

ADVERTISEMENT

SBI had sought DRT's intervention in seeking the lenders' first right on the USD 75-million payout from Diageo to Mallya as part of deal last month.

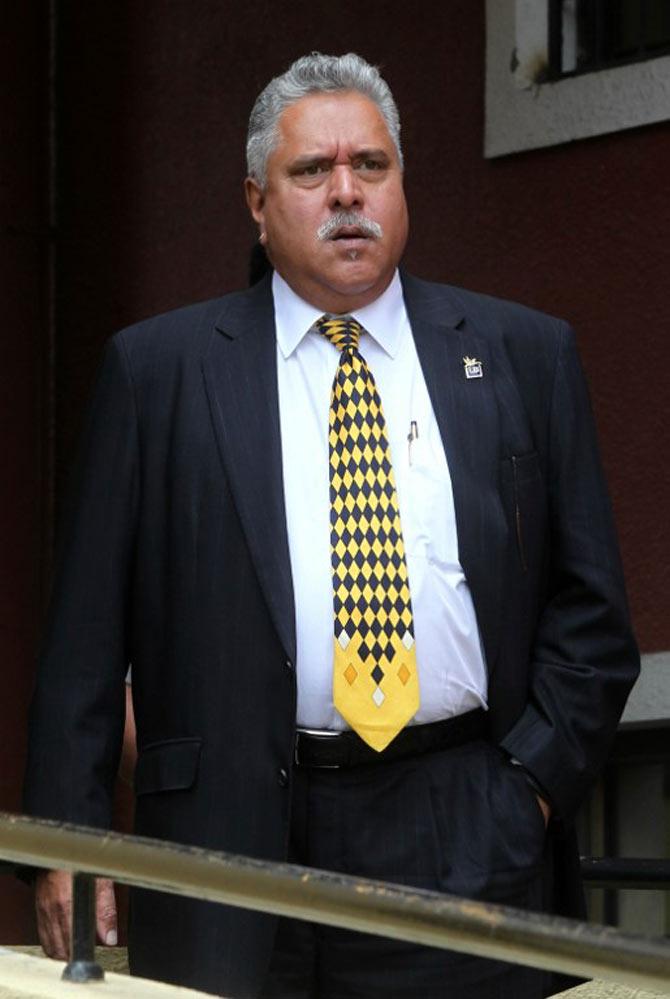

aVijay Mallya

aVijay Mallya

Under the deal Mallya was to step down as chairman of India's top spirits company United Spirits Ltd in a settlement with its new owner, Britain's Diageo. Mallya was to settle down in London after the deal.

SBI had filed three other applications, including one seeking Mallya's arrest and impounding of his passport, it approached DRT seeking action against him for defaulting on loans.

DRT in its order restraining Diageo from disbursing USD 75 billion, said the amount has been attached pending disposal of original application.

It directed Mallya and the companies concerned to disclose the details of the terminal agreement. The order came hours after Mallya said he was in talks with banks for a one-time settlement of debt that his now-defunct Kingfisher Airlines owes.

In a statement late last night, he had also stated that he had no plans to run away from his creditors.

SBI, which leads the consortium of 17 banks that lent money to the grounded Kingfisher Airlines, had moved DRT against the airline's chairman Mallya in its bid to recover Rs 7,800 crore. SBI had an exposure of over Rs 1,600 crore to the now defunct airline. Since January 2012, the loan was not serviced.

Other lenders include Punjab National Bank, Bank of Baroda, Canara Bank, Bank of India, Central Bank of India, Federal Bank, Uco Bank and Dena Bank among others.

Last year, SBI declared Mallya as wilful defaulter while PNB had followed suit last month to declare him, his group holding company United Breweries Holdings and Kingfisher Airlines as wilful defaulters.

Diageo was to pay Mallya USD 40 million immediately and the balance in equal installments over the next five years. The deal also absolved Mallya of all liabilities over alleged financial lapses at the company founded by his family.

After the deal with Diageo plc, Mallya, 60, resigned with immediate effect as Chairman of United Spirits Ltd, which the

British firm bought in April 2014.

United Spirits, maker of McDowell's No.1 whiskey and Romanov vodka, had sought his resignation after an internal inquiry found he diverted funds to other companies under his control. Mallya has denied any wrongdoing.

Mallya, who took over United Breweries Holdings or UB Group from his father in the 1980s, had last month signed a global five-year "non- compete, non interference and non solicitation" agreement with United Spirits. He was to take on a ceremonial title as founder emeritus of the Diageo unit.

He started Kingfisher Airlines in 2005 but it was grounded in 2012 amid mounting debt.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!