Bold decisions are leading to optimism and a cheery outlook that is here to stay

Finance Minister Arun Jaitley (l) with Chief Economic Adviser Arvind Subramanian in New Delhi. Pic/PTI

Markets continued their upward movement last week, even though the rate of change seems to have slowed down. The BSESENSEX gained 93.73 points or 0.33 per cent to close the week at 28,334.75 points, while NIFTY gained 52.60 points or 0.60 per cent to close at 8,793.55 points. The broader markets saw BSE100, BSE200 and BSE500 gain 0.62 per cent, 0.75 per cent and 0.79 per cent respectively. BSEMIDCAP gained 1.385 while BSESMALLCAP gained 1.34 per cent. The top sectoral gainer was BSECONDUR up 5.20 per cent followed by BSEIT 3.83 per cent and BSETECH 3.63 per cent. The losers were led by BSEMETAL down 1.64 per cent followed by BSEHEACARE 0.77 per cent and BSEPSU 0.18 per cent.

ADVERTISEMENT

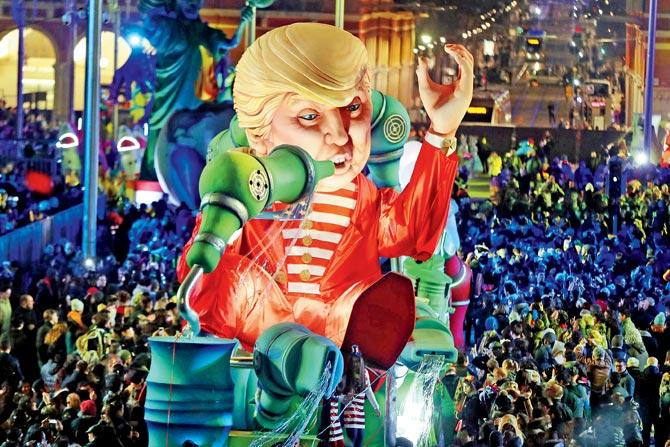

People look at the float ‘Wind of Change’ depicting US President Donald Trump as it parades in the streets of southeastern France. Pic/AFP

The top gainer was BHEL up 10.37 per cent followed by TCS 7.29 per cent and Infosys 3.54 per cent. The losers were led by SAIL down 5.49 per cent followed by Dr Reddy 5.30 per cent, Hindalco 5.01 per cent and Cipla 4.77 per cent. The Indian Rupee had a strong showing gaining 43 paisa or 0.64 per cent to close at Rs 66.88. Dow Jones gained 197.91 points or 0.99 per cent to close at 20,269.77 points.

A brave, strong statement

The Reserve Bank of India (RBI) Governor Upen Patel and the monetary policy committee in a unanimous 6-0 decision chose to keep interest rates unchanged. This is a very strong statement and helped the markets recover almost all the losses for the day. While markets fell initially post the policy, they regained to close with minor losses. The stance was appreciated by the markets because in a scenario where the US is raising rates and is expected to do more this year, India would virtually cease to see inflows in the debt segment. This step would keep the interest rates attractive for investors looking at interest income and the outflow of recent times would not happen. One would see this segment attracting inflows all over again.

A question of balance

Markets have seen inflows from domestic institutions on the back of mutual funds attracting contributions through SIPs and other schemes. Against this inflow, one saw foreign investors being sellers, and, the inflow was largely balanced. Post the budget and clarifications on GAAR, one saw FIIs turn buyers. With them bringing inflows with inflows from domestic institutions, the flow would become bigger. With this kind of momentum in the markets, there seems little possibility of their being a meaningful correction in the immediate short term. Secondly, the results for the period October to December 2016 would be ending in this week. The expected slowdown because of demonetisation doesn’t seem to have happened. Results declared so far are better than expected with only a few companies being affected. The eight week period from November 9, to end December may have seen a liquidity concern but results give a different picture.

Election to the state assemblies are on and have been concluded in two states. They are being keenly contested and, as is expected, in democracy may spring surprises. While results against the present incumbents could see some knee jerk reactions in the market in the short term, the secular trend would ensure that the correction is short lived. Use any such situation as an opportunity to enter the market.

So many wrong reasons

Infosys is in the news for the wrong reasons. It was earlier in the news for the H1-B visa. The founders of the company seem to be unhappy with the way things are going. Whether it is a question of this being a case of the loss of control over the company leading to this situation, one cannot be sure. However one thing is certain, the news flow is not good and is hurting the company. There are issues currently with the sector with visas and travel under the Donald Trump regime. Battling them and also spending bandwidth on this issue with founders is surely affecting the management to run the company. In the greater interest of the company and various stakeholders, one hopes that the issues are resolved at the earliest.

The markets are in a strong grip and there is plenty of momentum currently. The next big news will be election results. It makes sense to invest in larger stocks as the movement in smallcap is quite volatile, and, at times too sharp for comfort. Invest wisely.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!