Niranjan Vaidhya has to undergo a Rs 3-lakh heart surgery tomorrow. But the money for the operation is stuck, as the Reserve Bank banned premature withdrawal of fixed deposits from Kapol Bank

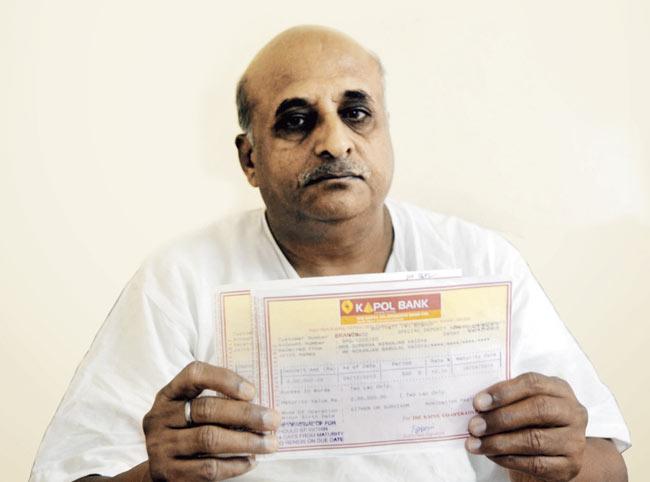

Vaidhya says he went to the Borivli branch of the Kapol bank with his medical documents, but was asked to go to the Vile Parle branch instead

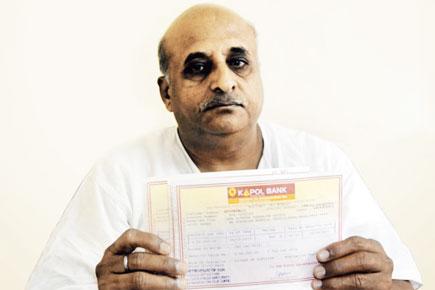

Imagine not being able to access your rainy day fund when crises come pouring down on you. That’s exactly the situation 55-year-old Borivli resident Niranjan Vaidhya has found himself in after he got admitted to a hospital with chest pain recently, and was told that he had a 90% blockage in his arteries and would have to undergo an angioplasty immediately.

Niranjan Vaidhya

ADVERTISEMENT

With the Rs 3-lakh surgery scheduled for tomorrow at Hinduja Hospital, Vaidhya has been trying to encash his R4-lakh fixed deposit (FD) at Kapol Cooperative Bank, only to be told he could not do so because the RBI appointed an administrator to the bank and banned premature withdrawals of FDs last week.

The Borivli branch of Kapol Bank that Vaidhya visited, to cash-in his Rs 4 lakh fixed deposit

The RBI appoints an administrator to protect the interest of the depositors or when it is dissatisfied with the management of the bank. In the case of the 75-year-old Kapol Bank, the RBI had reportedly also superseded the bank’s board of directors, owing to concern over its conduct.

Vaidhya says he went to the Borivli branch of the bank with his medical documents, but was asked to go to the Vile Parle branch instead

Vaidhya, who had opened his savings account with the bank in 1999, is now anxious about how his family would be able to afford his treatment. “We were counting on the money in the FD account so we could foot the hospital bills.

I am a retiree and used to run a small business and these are the only savings I have. Neither my son, nor my kin will be able to arrange the funds in such a short period,” he said.

Pillar to post

When Vaidhya approached the Borivli branch of Kapol Bank recently with his medical files and other documents to request the bank to allow him the premature withdrawal of his fixed deposit, he was told to approach the Vile Parle branch.

“I am in no state to run from pillar to post to request the bank authorities, as I can barely walk for more than a few minutes without feeling dizzy and weak. This is the money I had managed to save over the years and it is completely inaccessible to me in my time of need,” he said.

His worried kin are now clueless whom to approach for help. Vaidhya’s son, Prashant, told mid-day that he is supposed to get admitted to the hospital today.

“We were informed that a doctor from Japan would conduct the angioplasty and provide the best possible treatment to my father. We can only hope the bank officials respond to our repeated requests.”

Officialspeak

When contacted, K D Vora, chairman, Kapol Cooperative Bank said, “Earlier, when someone wanted to withdraw the fixed deposit amount prematurely, we would give them 95% of the amount without any delay.

However, our hands are tied. Vaidhya has no other option but to wait for the due date, which is the only time he can withdraw the entire amount.”

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!