FM announces a slew of measures to deal with stress in the financial sector, says more moves to stimulate economy will be announced next week

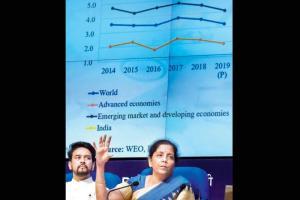

FM Nirmala Sitharaman and MoS for Finance Anurag Thakur during a press conference in New Delhi on Friday. Pic/PTI

New Delhi: In a bid to boost the economy, capital markets and consumption, Finance Minister Nirmala Sitharaman on Friday announced a slew of measures including the rollback of a controversial tax surcharge on foreign portfolio investors (FPIs) and equities of domestic investors announced in the Budget last month.

Amid economic slowdown fears, she addressed a press conference in which she announced the withdrawal of 'angel' tax provision for start-ups and their investors. The impact of rollback of enhanced tax surcharge will be about Rs 1,400 crore. "The surcharge levied by on long and short term capital gains tax is being withdrawn," Sitharaman said. "More moves to stimulate the economy will be announced by the middle of next week. To address concerns of homebuyers, measures will be announced soon and another package will follow shortly," she added.

ADVERTISEMENT

India's GDP growth in the January-to-March quarter slid to a near five-year low of 5.8 per cent. She said India's growth is still comfortably high compared to the global economy which is growing at 3.2 per cent. She said CSR violations will not be treated as a criminal offence. For start-ups and their investors, angel tax provision has been withdrawn. Also, banks will issue improved one-time settlement plan for micro, small and medium enterprises, Sitharaman said. The government will infuse upfront Rs 70,000 crore into public sector banks to enable the release of R5 lakh crore liquidity in the market. Banks will have to pass on repo rate reduction to consumers.

Aadhaar-based KYC will be permitted for the opening of Demat accounts and investing in mutual funds. Pending GST refunds so far will be paid to small businesses within 30 days. In future, all settlements will be done with 60 days. Meanwhile, non-banking finance firms will be permitted to use Aadhaar authenticated bank KYC to avoid repeated processes. For the automobile sector, which has seen faltering sales in recent quarters, she said the higher registration fee has been deferred till June 2020. An additional 15 per cent depreciation will be provided on vehicles acquired from now till March 2020, taking the total depreciation to 30 per cent.

Electric vehicles and internal combustion vehicles will continue to be registered. Vehicles complying with BS-IV norms purchased up to March 2020 will remain operational for their entire period of registration. At the same time, the Centre will replace its old vehicles with a new one and come up with a new scrappage policy, she said.

Key measures

- Home, vehicle, loans to become cheaper

- Angel tax on start-ups removed

- CSR violations not to be treated as a criminal offence

- MSMEs to get pending GST refunds within 30 days

- Enhanced surcharge on foreign portfolio investors removed

- Proposed increase in registration fee deferred till June 2020

- Lifts ban on purchase of vehicles by govt

- Aadhaar-based KYC for demat, mutual funds

Catch up on all the latest Crime, National, International and Hatke news here. Also download the new mid-day Android and iOS apps to get latest updates

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!