The markets gave investors a lot to celebrate about in the last week which proved to be short and sweet for all

The week gone by had plenty of celebrations on account of Diwali. The Hindu calendar Samvat 2070 ended with gains of 26 per cent which could be termed as excellent by all counts.

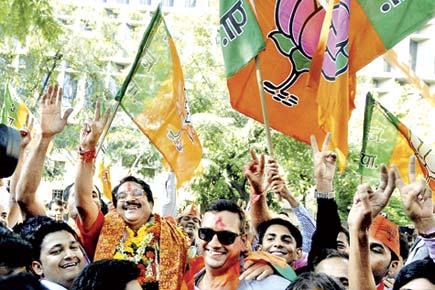

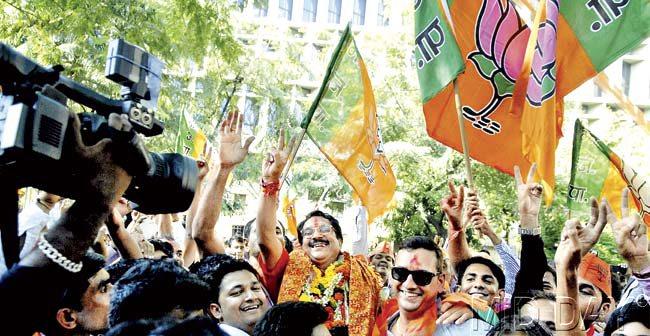

BJP supporters celebrate the party getting a majority in the Maharashtra state polls. Pic/Bipin Kokate

ADVERTISEMENT

Samvat 2071 began with lot of optimism and hope and made a cautious start with Nifty regaining the 8,000 mark. While people expect a bumper performance, I believe that the year would be good considering the larger base, the long term average returns on the market of around 15 per cent would be par for the course.

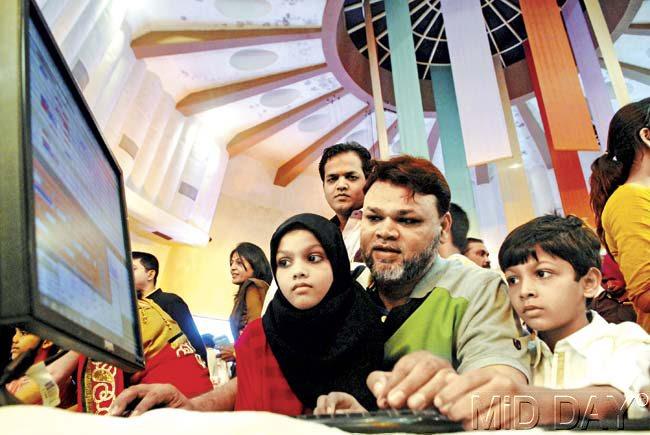

Family members of stock traders watch the trade happenings on their computers during special trading (Mahurat Trading) on the occasion of Diwali. Pic/Shadab Khan

Going up

The BSESENSEX gained 678.70 points or 2.60 per cent to close at 26,787.23 points while the Nifty gained 216.20 points or 2.78 per cent to close at 7,995.90 points. The broader indices like the BSE100, BSE200 and BSE500 gained similar with gains of 2.87 per cent, 2.92 per cent and 2.90 per cent respectively.

The BSEMIDCAP had a great week and gained 3.27 per cent while BSESMALLCAP gained 1.84 per cent. In sectoral indices, the top gainer was BSEAUTO up 5.89 per cent followed by BSECAPGOODS up 5.70 per cent and BSEPOWER 4.61 per cent. There was no sectoral loser but the one which gained the least was BSEIT at 0.12 per cent.

In individual stocks, the top gainer was Tata Motors up 9.19 per cent followed by Hero Motocorp 8.31 per cent and GAIL 7.47 per cent. There were few losers and they were led by Infosys down 1.53 per cent and ITC 1.34 per cent.

The strong rally in a truncated three day week was on the back of strong global cues and the fact that the government is being seen as one willing to take and introduce reform.

New state government

Maharashtra would have a new government led by BJP and supported by its estranged ally Shiv Sena in the next few days. The government in Haryana is settling down and elections have been announced for Jammu & Kashmir (J&K) and Jharkhand.

Seeing the success of the BJP in the states of Maharashtra and Haryana, they would be tipped to win Jharkhand and the dismal performance of the present government in J&K will ensure a change of government.

The defence ministry has cleared projects worth Rs 80,000 crores and quite a tidy sum of this would be under the technology transfer with public-private partnerships. This will not only save money for India but also make our defence technology advanced and domestic.

The coal ordinance has been sent to the President of India for his assent and this would probably be for the first time in the country that such a contentious issue has seen the response from the government after the Supreme Court cancelled the blocks in less than four weeks. Transparency and e-auction will send the right signal to investors all over the world looking to invest in India.

Investment galore

The above two events will help create the conducive investment climate required to bring big ticket investments. The Dow Jones had a stellar week and gained 425 points or 2.59 per cent to close at 16,805 points. Even though Europe is struggling with growth, there has been a sharp recovery in US which has fuelled this rally. The other positive factor is falling crude oil prices.

FIIs turned buyers during the truncated week and bought equity worth R 1,650 crores while domestic institutions were net sellers of R 289 crores. The Indian rupee gained 16 paise to close at Rs 61.28. The week ahead has October series futures expiring on Thursday, October 31.

The September series had expired at a level of 7,911.85 points giving the bulls a comfortable 1 per cent margin. This month has been range bound and both bulls and bears have had an equal opportunity. DLF recovered from its lows and closed with gains of 8.63 per cent for the short week, but this seems to be just a technical corrective bounce.

The issues concerning the company are far from resolved and the new Haryana government has made it clear that it would be investigating the land deals of the company with the politically connected person.

Under the scanner

Not only DLF, but there are some half a dozen companies with political connections which are under the scanner and investors would do well to stay away from such companies. Just some names would suffice where in Tamil Nadu the Sun group companies are involved and ex-MP Navin Jindal’s Jindal Steel and Power is involved in the coal block cancellation.

The open offer for Mangalore Chemicals from Deepak Fertilisers and Zuari Chemicals has ended on Monday, October 20 with preliminary data indicating that Deepak Fertilisers has received 6 per cent of the share capital.

The last word on this issue is not yet over but since the closure of the issue the share price has fallen to close at Rs 88.55 a loss of Rs 7 or roughly Rs 5 below the open offer price.

Trading movements in the next few days would decide the course of action but I believe that shares could be picked up from the market by Deepak as long as the purchase price does not exceed the open offer price.

The government divestment is all set to begin in November with ONGC. Retail investors are going to be beneficiaries as they would be allowed to bid at cut-off an there would be a bucket or retail quota of roughly 20 per cent. Whether this round of divestment depresses the market or creates fresh interest only time will tell.

This week will take cues from global markets, falling crude prices and the formation of a stable government in Maharashtra. Markets would open with gains and expiry will determine future moves. Buy fundamentally good stocks with a medium term horizon only.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions.

Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!