India may see poor rainfall due to ‘El Nino’, and a new government coming to power on May 16, counting day. The markets are currently seeing influence of both factors

For a second week running markets closed flat. However the customary new highs were there during the last week as well. Last Friday saw a sharp correction on account of the possibility of a poor monsoon due to the ‘El Nino’ effect.

One must remember India is a large country and in the same year different parts of the country have extreme weather ranging from excess rains to drought.

ADVERTISEMENT

The Friday fall saw markets give up almost all its gains of the earlier three days and close marginally positive. The BSESENSEX gained 59.23 points or 0.26 per cent to close at 22,688.07 points.

The Nifty gained 3.35 points or 0.05 per cent at 6,782.75 points. The BSE100, BSE200 and BSE500 gained 0.17 per cent, 0.23 per cent and 0.29 per cent respectively.

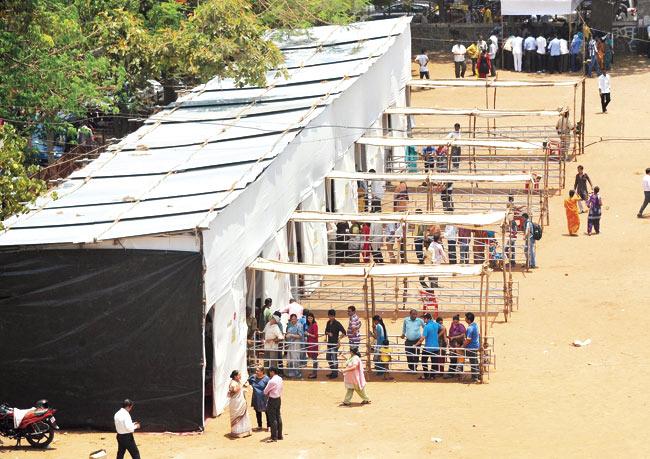

The markets are reflecting the expected outcome of the elections. PIC/AFP

The markets are reflecting the expected outcome of the elections. PIC/AFP

The BSEMIDCAP gained 0.47 per cent and the BSESMALLCAP gained 0.97 per cent. The top sectoral gainer was BSECAPGOODS up 4.72 per cent followed by BSEBANKEX up 1.95 per cent and BSEMETAL 1.61 per cent. The losers were led by BSEFMCG down 2.46 per cent followed by BSEPOWER down 1.48 per cent and BSEIT down 1.35 per cent.

Stocks

In individual stocks the top gainer was M&M up 7.32 per cent followed by L&T up 6.29 per cent. Others included BHEL up 5.36 per cent, Bank of Baroda up 5.06 per cent and Axis Bank 4.71 per cent. The losers were led by Wipro down 11.24 per cent. Others included last week’s top gainer Cairn down 8.91 per cent and Hindustan Unilever down 4.73 per cent.

The expiry for the month of April passed off peacefully and the series closed at 6,840.80 points a gain of 199.05 points or 2.99 per cent. The rupee lost some ground losing R 0.33 or 0.55 per cent to close at R 60.62. FIIs continued to be buyers during the week and bought equity worth R 1545.81 crore while domestic institutions sold shares worth R 1,467.30 crore.

Dow Jones

The Dow Jones was virtually flat and lost 47.08 points or 0.28 per cent to close at 16,361.46 points. Friday was a losing day for the Dow and Ukraine, Russia and Crimea was back in focus which was responsible for the weakness. The issue from Wonderla was very well received and was oversubscribed over 38 times. The issue received oversubscription of 160 times in the HNI category while retail applicants will get the minimum 100 shares by way of lottery.

Polls

Stock markets are reflecting the expected outcome of the general elections which should be known on May 16. So far six rounds have been held which have decided the fate of 349 seats and the remaining three phases would decide the fate of 223 seats. Elections are to end on May 12.

I believe there are just two factors for the rally which has come in three phases. The first driver is the change in government and the second is the continued investment by FIIs in the market. As far as the three phases of the rally are concerned the first was from end August 2013 when the Sensex rose from 18,000 levels to 20,700 in about a month and further to 21,200 at Diwali.

The second phase was post state assembly results when the Sensex made new lifetime highs and rose from 20,100 to 21,700 in December. The third and final phase is currently on with the Sensex rising from 20,000 in February to the current 22,700.

Politics

The fall on Friday was a healthy correction and augurs well for the markets. The political drama is building up into a crescendo. The body language of the UPA seems to be one of tired people who seem to have given up on the elections and are unable to accept the fact that there can be only one winner in a contest each time.

The drivers for the market will be partly developments on the monsoon and the sanctions against Russia. However elections will overtake all other drivers and the voting percentage would be a key figure to watch out.

May 1 is a global holiday for May Day, Labour Day and in Maharashtra for Maharashtra Day so markets could be volatile on Wednesday. Markets would be volatile and as usual would make a couple of new intraday highs this week also.

Key levels for the Sensex are 22,325 and 22,925 while they are 6,735 and 6,885 for the Nifty. The support for the Sensex is at 22,583 points, then at 22,355 points, then at 22,195 points, and finally at 22,024 points. It has resistance at 22,866 points, then at 22,985 points, then at 23,148 points and finally at 23,335 points.

The Nifty has support at 6,747 points, then at 6,705 points, then at 6,657 points and finally at 6,627 points. It has resistance at 6,844 points, then at 6,895 points, then at 6,941 points and finally at 6,985 points.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!