A Mumbai-based financial wiz, who has been living cashless for 280 days, shares his primer on how to beat demonetisation blues with minimum stress

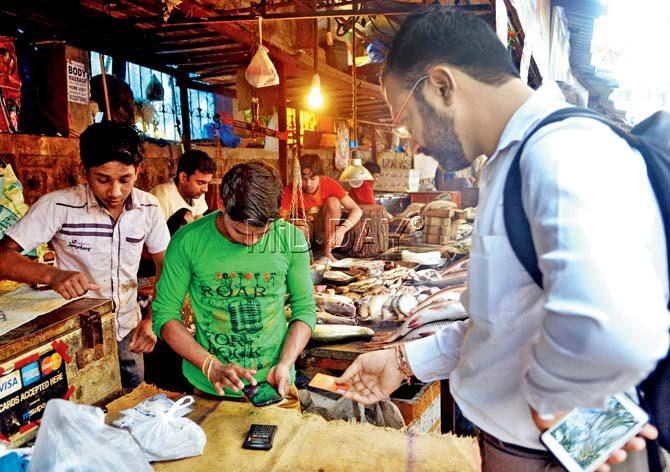

Abhishant Pant makes a debit card transaction at Bengali Fish Centre near IIT Powai. The vendor has invested in an mPOS machine that connects to a smartphone via bluetooth and accepts card payments. Pics/Datta Kumbhar

For Abhishant Pant, the cashless experiment began in February, much before PM Narendra Modi gobsmacked the nation with news of demonetisation. Unable to convert his Indian currency beforehand, Pant spent five days in Singapore on his debit card. “When I shared my hassle-free experience on social media, many users commented that living cashless in Mumbai would be the real challenge. That was the trigger,” says the 35-year-old fintech (financial technology) professional, who has been thriving without a paisa in his wallet for 280 days now (from March 13, to be precise). Recently, he was invited to speak at the Swedish Institute in Stockholm, and is the subject of a soon-to-air BBC documentary.

ADVERTISEMENT

Pant paid the autorickshaw driver using a mobile wallet with mVisa QR code, a mobiler-based payment solution for micro-merchants

Click and pay

On Pant’s smartphone, you’ll find 32 mobile apps that help with his day-to-day needs — whether it is buying a local train ticket or finding a neighbourhood barber. He uses digital wallets and Internet banking methods to pay his monthly bills and transfer funds into the accounts of his vegetable vendor and domestic help. “During the first week of my experiment, I intimated my domestic help that I would credit the salary directly into her account. She didn’t agree and I had to convince her by sending an advance payment. Recently, she said it has increased her savings,” says Uttarakhand-born Pant, who has been living with his wife in Powai for the last six years.

The challenges

While he has been able to find more retailers willing to take digital cash, thanks to demonetisation, Pant has been in sticky situations during trips outside the city. “It hasn’t been easy. A bhelpuriwallah in Delhi thought I was a con artist when I told him I would transfer money to his bank account. Finally, he agreed to receive a mobile recharge of equivalent value,” he recollects.

It’s cheap

Many may worry that going cashless can lead to an increase in expenses, but Pant asserts, “There’s no additional cost. In fact, you get several benefits and cashbacks when you use the same app regularly.” Pant has also launched Each1Teach10-Reach100, a crowdfunded campaign where tech-savvy individuals are encouraged to teach people how to make digital payments. “The idea is to build a people’s movement.”

Log on to: www.each1teach10reach100.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!