All ATMs, from November 11 will be open for transactions. Here's is a list of things that you should be aware of and accordingly plan your visit to the bank

Indians queue up outside the Bank of India branch to deposit and exchange 500 and 1000 currency notes in Mumbai on November 10, 2016. Long queues formed outside banks in India as they reopened for the first time since the government's shock decision to withdraw the two largest denomination notes from circulation. Pic/AFP

Indians queue up outside the Bank of India branch to deposit and exchange 500 and 1000 currency notes in Mumbai on November 10, 2016. Long queues formed outside banks in India as they reopened for the first time since the government's shock decision to withdraw the two largest denomination notes from circulation. Pic/AFP

All ATMs, from November 11 will be open for transactions. Here's is a list of things that you should be aware of and accordingly plan your visit to the bank.

ADVERTISEMENT

>> Old Rs 500 and Rs 1000 notes are yet to be fully flushed out from ATMs. Process of reconfiguring the machines still on. So your patience will be tested.

>> ATMs will only dispense Rs 100 notes, some will have Rs 50 notes. SBI chief Arundhati Bhattacharya says it will take 10 days for ATM operations to normalise.

>> SBI's cash deposit machines have started accepting up to Rs 50,000 from Thursday midnight.

>> Surcharge on use of ATMs beyond 5 free transactions has been waived.

>> The old notes can be used for paying fees, taxes and penalties for central and state governments, including municipal and local bodies.

If you are planning to withdraw cash, this is what you need to do

>> Bank counters, post offices are open for the same

>> The limit is 10,000 per day. There is a weekly limit, of 20,000, including ATM withdrawals, up to Nov 24, 2016

>> You need cheque or withdrawal slip. At ATMs, the withdrawal limit is 2,000 per day till November 18 and 4,000 per day from November 19 onwards till further notice.

Don't rush to the banks, they will remain open tomorrow and on Sunday. All major banks say they will work till late to meet demand.

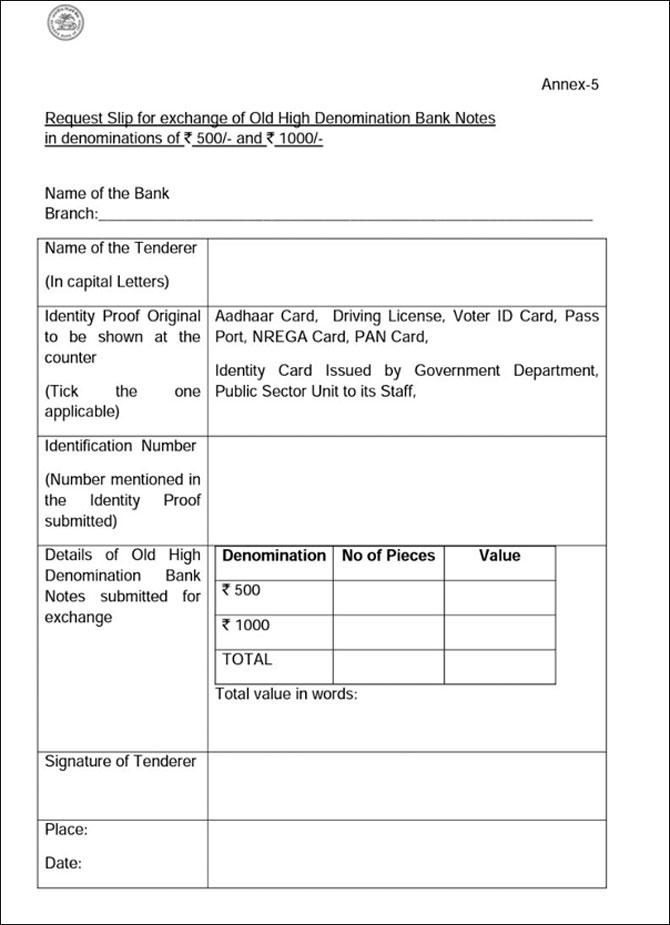

Form for exchange of old high denominations

Form for exchange of old high denominations

FAQs

How should I get rid of my old Rs 500 and Rs 1,000 notes?

You can do that by visiting any branch of your own bank or that of any other bank, or any post office. Old notes of 500 and 1,000 amounting to 4,000 can be exchanged for denominations of 50 and 100 till December 31.

What do I submit as ID proof?

Original and photocopy of Aadhaar card, voter ID, ration card, passport, PAN. You need fo fill up a declaration form which will then be verified.

What if I don't have a bank account?

If your relative or friend has a bank account, you can use that, provided the account holder gives you permission in writing, which must be produced to the bank. You also need an identity proof.

Should I go to my bank branch only?

For exchange up to 4,000 you may go to any bank branch with valid ID proof. For exchange over 4,000, which will be credited to bank account only, you may go to the branch where you have an account or any other branch of the same bank. In case, you want to go to a bank where you don't have an account, you will have to submit valid ID proof and account details required for electronic fund transfer to your account.

Can I send my someone else on my behalf?

It is best that you go on your own but you may also send your representative with written authorisation. The representative should produce authority letter and his/her valid ID proof.

If you still have a problem, you can contact RBI control room by email or telephone:

publicquery@rbi.org.in, (011 23093230)

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!