Overseas events have positive impact on movements here

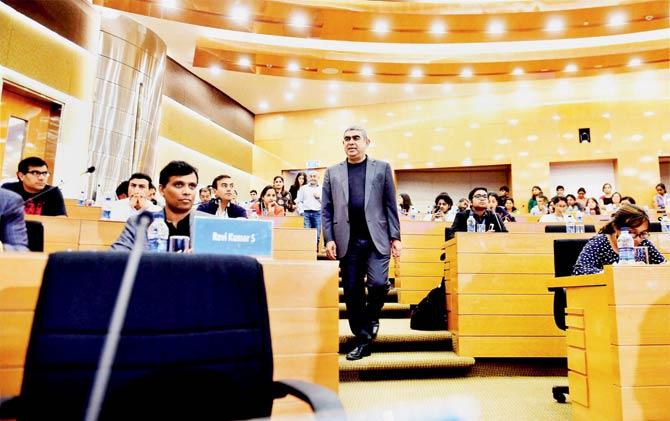

Infosys Technologies CEO Vishal Sikka arrives at the 3rd quarter financial results of the company at the headquarters in Bengaluru. Pic/PTI

NIFTY closed positively on Friday, above 8400 and it is likely to open with a positive gap up, due to strong closing of foreign markets. Nifty faces resistance at 8443 and 8450 levels in the short term and it may get good support at 8374 and 8315 levels. Beginning this week, we can expect sideways movements and consolidation after a firm opening on Monday. Later, we can expect sharp one sided movements. If that happens, then Nifty may move above 8500 and at the lower end it will get good support at 8283. Price corrections can be utilised to buy front line stocks, because monthly charts are suggesting further uptrend to resume ahead of the budget.

ADVERTISEMENT

It is not advisable to write options in the near month and far month, especially February series because implied volatility of the Nifty options can jump up ahead of the budget which will have high risk of price move.

As expected metal stocks performed well last week, the sector is positive but it is slightly overbought. Nifty metal index has support at 2917 and 2850. It will have resistance at 3016. Like Nifty, price declines can be utilised to buy metal stocks due to higher demand.

Eye on IT stocks

IT stocks took a toll especially after the quarterly earnings of TCS and Infosys. The front line IT stocks will face more sell-off due to technical and fundamental reasons; one should wait some more to get lower prices. Nifty IT index has support at 10150 and 10014. Nifty IT index has resistance at 10263.

The Domestic Front Industrial production data came out. It surged to a 13-month high at 5.7 per cent in November. Manufacturing production also jumped 5.5 per cent. Mining rebounded 3.9 per cent after three months of poor performance. Monthly inflation based consumer price index dipped to a 25-month low of 3.41 per cent in December, which resulted in optimism amongst investors.

American stock markets are looking very positive, S&P 500 VIX is also falling and it is at 11.23 on Friday. The lower VIX suggests further up move to continue in the later days. Dow Jones has support at 19783 and facing resistance at 20008 and 20337. American stock market players are very keen in getting cues from the US President Donald Trump on various policy decisions including the relationship with Russia and North Korea.

Gold has sheen

Now, retail sales, inflation rate, industrial production and initial jobless claims are due from US and Inflation, Balance of trade and unemployment rate are expected from the Euro Zone. WPI Manufacturing, WPI Food, WPI Fuel, WPI inflation numbers will be announced. Quarterly earnings like Reliance and Axis Bank and lots of mid-cap and small-cap stocks will unveil their quarterly earnings next week. So it is important to watch out for the numbers before investing in to these company’sstocks.

Gold has recovered smartly and tested a seven-week high, but, on Friday it came off from highs due to the strong dollar. We can expect minor correction in the short term, with support at $1187 and $1175 per troy ounce. The immediate resistance for gold is at $1206. A decisive move above this level can take gold further towards $1220 plus in the medium term.

Alex K Mathews is the founder of www.thedailybrunch.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!