Hammered and battered, the situation calls on investors to keep vigil as they play a waiting game

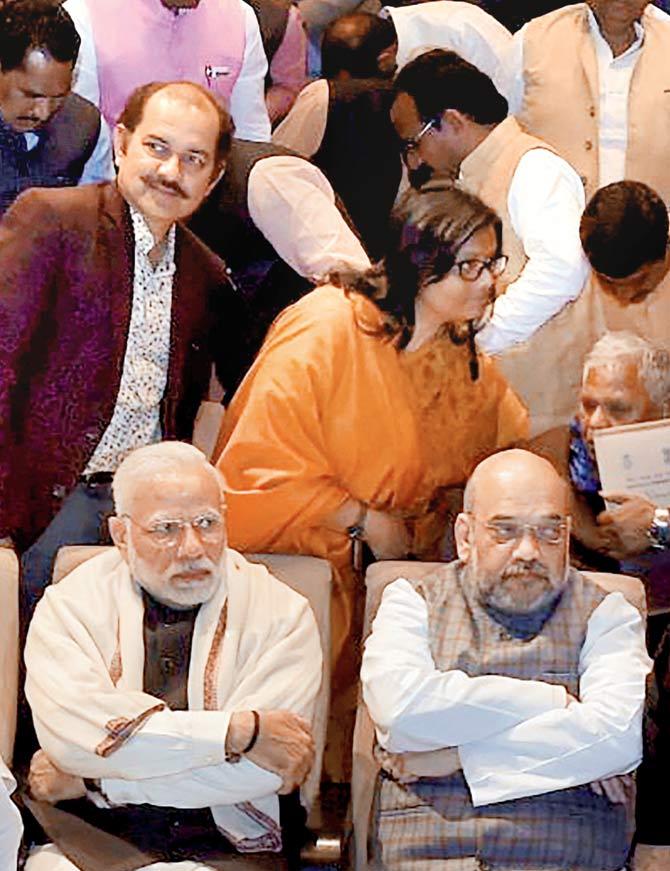

PM Narendra Modi with BJP President Amit Shah attending a BJP parliamentary party meeting

Last week, market participants witnessed huge volatility, heavy profit booking by domestic institutional investors, HNIs and retail investors brought down the market towards 10,760. Weak global market cues, implementation of LTCG tax, fiscal deficit slippage and higher crude prices are key reasons for the market fall. Higher margins and margin calls are other reasons for bull liquidation.

ADVERTISEMENT

The US market on Friday ended in the red, recording nearly a 2.54 per cent decline. The US benchmark 10-year T-bill yields moved up sharply on expectation of increasing interest rates, which is a key reason for the market fall. Real estate and utility stocks were hammered down heavily in US.

Patience pays

Both the US and Indian markets were in overbought territory caused the heavy bull liquidation, despite higher job creation in January which was above analyst's expectations in the US. US Dow Jones has only supply support at 25,142, means we can expect minimum of 400 points correction more in the days to come. In the domestic market, Nifty has support at 10,620 and 10,472. It has resistances 10,845 and 11,000. During the last week, Nifty mid-cap and Nifty small-cap indices corrected more than 5 per cent each. Retail investors who were active in these two segments lost heavily due to the sudden crash. As the technical indicators in the Indian markets are still weak, it is prudent to stay on the sidelines for some more time.

Private stocks

Bank Nifty is also looking weak and it has support at 26,282 and 25,096. Among the banking sector, private banking stocks are expected to correct more in the days to come. The PSU banking Index has already entered the oversold region and may recover by Tuesday or Wednesday. Nifty Pharma Index has also entered the oversold region and may get support on Tuesday. Like private sector bank index, metal stocks are also weak and continuation of selling can be expected. Nifty metal index has support at 14657. Nifty IT sector stocks may continue their decline some more time because this sector was holding on during the last week. Prominent companies like BASF, Century Ply, Cochin Shipyard, Timken, Tata Motor, Apollo Tyre, Hero Motors, Siemens, Auro-Pharma, BEML, Gati, ABB, BHEL, SAIL, BOB, BPCL and GE Ship will announce their quarterly earnings.

Balancing act

US Balance of Trade, Continuing Jobless Claim and US Rig Count are the key macro data's are due from US. From India, Nikkei Service PMI, RBI Interest rate decision, Industrial Production, Manufacturing Production and Balance of Trade data will be announced. Crude is slightly weak due to higher US Oil Rig Count in US and higher US Job Data. Crude has support at $64.3 per barrel and $63.58 per barrel. Resistance for Crude is at $66.48 per barrel.

Alex K Mathews is the founder of www.thedailybrunch.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!