Crisis-hit Sahara today said ithas been cheated by US-based Mirach Capital with a "forged letter" of USD 2 billion funding through Bank of America -- a major blow to the group's fund-raising efforts to secure bail for its chief Subrata Roy

New Delhi: Crisis-hit Sahara today said ithas been cheated by US-based Mirach Capital with a "forged letter" of USD 2 billion funding through Bank of America -- a major blow to the group's fund-raising efforts to secure bail for its chief Subrata Roy. Stung by the forgery, Sahara said it will initiate all suitable legal action, including civil and criminal proceedings in India and in the US, against Mirach and its officers.

There was no immediate reply to queries made on Sahara's charges to Mirach, which is run by Indian-origin businessman Saransh Sharma, who had earlier in the day claimed he was committed to complete the deal and hinted at sabotage attempts by his rivals to scuttle the deal. The Sahara-Mirach deal had taken a mysterious turn after Bank of America's disclosure that it was not the banker as claimed by Mirach in its proposed financing for Sahara.

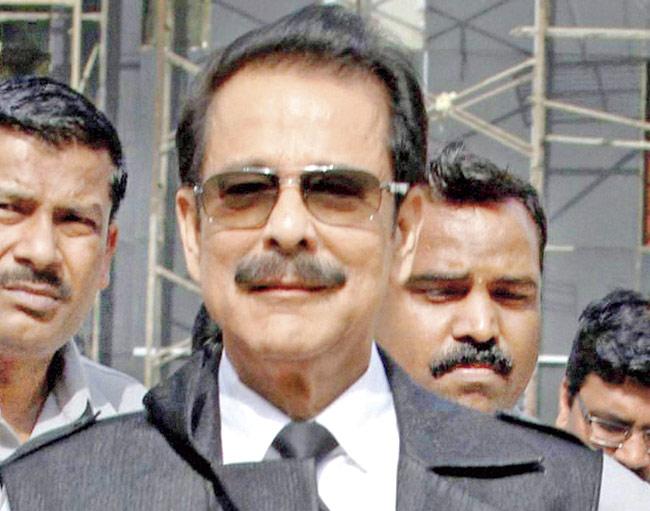

Subrata Roy

"We are in no way connected with this transaction," a spokesperson for Bank of America Merrill Lynch told PTI. The purported transaction was to involve transfer of loans on Sahara's three iconic overseas hotels -- two in New York and one in London -- to a syndicate of investors, for which Mirach had claimed to have initially deposited USD 1,050 million in a Bank of America account. The financing package was to be expanded to about USD 2 billion eventually.

Sahara was looking to use part of these funds to ensure release of Roy and his two colleagues from Tihar Jail, where they have been lodged for almost a year in a case relating to repayment of investors' money totalling over Rs 20,000 crore. "We will take up all suitable legal proceedings including - civil and criminal, against Mirach Capital Group and their all officers involved in the transaction - both in India and in the USA, for such reckless conduct of Mirach," Sahara said in a strongly-worded statement.

"Because of having focus on this transaction, we could not take up other offers for last three ¿ four months. We are astonished and feel cheated in such an adverse environment against us. We strongly condemn such inhuman conduct of Mirach and its officers and make it clear that Sahara will not spare them," it added. Sahara said Sharma claimed to have "billions of funds with him" and had entered into pacts with the group and was paid "crores of rupees towards facility fee in the matter".

Sahara said it got some "disturbing information" about Mirach deal on February 1, following which it began its own due diligence to check the veracity of BofA letter. This is the second time that a proposed deal regarding Sahara's properties has fallen through in quick succession. Earlier, a deal with Sultan of Brunei could not fructify. Sahara said it has received a report from its London-based counsel, who visited the concerned Bank of America branch in the US, that the letter given to it by Mirach was "a forged letter".

As per submissions made before the Supreme Court last month, Mirach was to conduct this deal through funds deposited in an account with Bank of America, which was proposed to transfer funds to the accounts of two Sahara entities. Earlier in the day, following Bank of America's disclosure, Sharma had said that Mirach has "determined" a bank for the Sahara transaction but did not give any direct reply on BofA's denial of being the banker.

Sources said that BofA came to know through media reports that its name was being mentioned in the court documents as a banker for the deal, following which it did the due diligence that indicated possible misuse of its name. Sahara said it had entered into agreements of financial arrangements with Mirach to arrange the bail amount for release of Roy and his two colleagues, on the security strength of three foreign hotel properties -- the Plaza and Dream Downtown in the US and Grosvenor House in the UK. Sharma, as CEO of Mirach, also met the amicus curiae and senior counsel for Sebi to assure about the veracity of the transaction and was personally present in the Supreme Court on last date of hearing on January 9 to understand the case.

"The transaction had got approval of the Supreme Court, when Mirach filed a letter of Bank of America showing that Mirach had blocked sufficient funds with Bank of America for this transaction. "On insistence of Mirach, an Affidavit for clarification was also filed before Supreme Court. Mirach meanwhile also received crores of rupees towards facility fee in the matter," Sahara said.

As per a Supreme Court order, dated January 9, Sahara lawyers placed before the bench "a communication dated January 5, 2015 addressed by Bank of America to Sahara India Pariwar, inter alia stating that under directions from Mirach Capital Group LLC, an amount of USD 1,050 million remains blocked and, earmarked till February 20, 2015 for the transactions being processed between Mirach and Sahara".

As per the letter placed before the court, Mirach had advised BofA to disburse USD 650 million out of the said unencumbered funds of USD 1,050 million, for junior loan transaction as agreed between Amby Valley (Mauritius) Ltd and Mirach after execution of legally binding agreements. The purported BofA letter further stated that Mirach had advised Bank of America to disburse USD 400 million out of the said unencumbered funds of USD 1,050 million for the purpose of making an investment in Sahara Hospitality Ltd.

ADVERTISEMENT

These disbursements were to take place as per "offer letter" dated December 15 and issued by Mirach.

It was also stated that BofA was instructed by Mirach to unblock the entire funds of USD 1,050 million if the junior loan arrangement for USD 650 million and investment agreement of USD 400 million could not be executed by the end of business on February 20, 2015. Last month, Sahara Group's Head of Corporate Finance Sandeep Wadhwa had said that documentation process was progressing and the deal with Mirach Capital was expected to be completed before February 20.

The said deal comprised of investments to the tune of USD 1.1 billion and a senior loan of close to USD 882 million having a one-year tenure. The latter amount was to replace loan from Bank of China related to Sahara's three overseas hospitality properties. As per Sharma, Mirach has access to earmarked funds from its syndicate of investors and these entities and their funds are located in multiple jurisdictions.

On pending lawsuits against him and other charges, Sharma had said, "While there are pending allegations against me, there is a public defamation campaign underway against myself and my family, by individuals and/or a collective that have identified me as a target. "There have been active attempts to extort funds, evidence of which is in my possession. These open litigations were with intermediary groups, with questionable backgrounds and lack of credibility, none of whom actually incurred any financial loss."

The Supreme Court had allowed Sahara Group to go ahead with its proposed transactions for foreign loan as part of raising Rs 10,000 crore to ensure release of Roy from jail. In its today's statement, Sahara said, "Regarding criminal manipulation by Mirach - we also found that the BofA letter was forged. That is why, we put an Affidavit informing the Court on last Monday."

In this affidavit, Sahara had said it received information through an e-mail on February 1, which was "quite disturbing" and the veracity of the letter of Bank of America dated January 5, 2015 may be in doubt. It also informed the court that it had asked its counsel in London, H S Gyani, to visit the concerned branch of Bank of America at Los Angles an d personally verify the position.

"We have now received the report from our Barrister Harpreet S Gyani that he visited Branch in Los Angles and found that the information to us is absolutely right and it was a forged letter," the Sahara statement said.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!