How will reduction of Corporate Tax affect your day-to-day life and business? We meet a typical Mumbai joint family of 10 members at Peddar Road, to decode the Union Budget 2015

How does the Foreign Exchange Management Act affect your day-to-day life? To what extent does abolition of Wealth Tax boost business sentiment in the country? Do senior citizens over 80 years of age greatly benefit from plans in Budget 2015 for ‘Super Senior Citizens’?

Also read: Highlights from the Union Budget 2015

ADVERTISEMENT

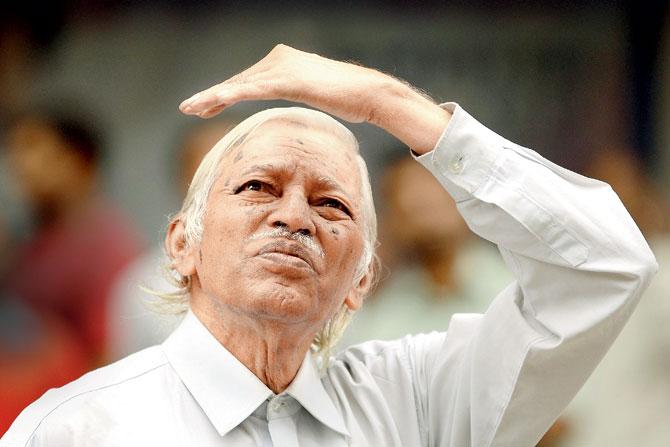

Achhe din in sight?: A man keenly watches the digital screen telecasting Finance Minister Arun Jaitley’s Budget speech, at the Bombay Stock Exchange (BSE). Pic/AFP

For a better understanding of the Union Budget and its implications on the lives of the common man, sunday mid-day spends a day with three generations of the Sheths, a 10-person joint family at Peddar Road. The family members, who fall between the ages of 19-82, discuss what the following year holds for them, as the Union Budget unfolded on their television screen.

Rushil Sheth (Grandson)

Age: 22

Profession: Management trainee and avid traveller

Provisions: Corporate Tax cut from 30% to 25% for four years. Exemptions for individual tax payers to continue. National Skills Mission with skill initiatives spread across several ministries. An additional allocation of R1,000 crore to Nirbhaya Fund. Increase in transport allowance up to Rs 1,600 a month. Proposal to raise visa on arrival facilities to 150 countries from the current 43.

His take: “The Corporate Tax cut is a positive step towards boosting confidence among businessmen and investors. For transport, the limit is still slightly short of actual expenses in metros. It will also give the students and also the salaried class some relief.”

Arishti Seth (Granddaughter)

Age: 19

Profession: FY-BMM student

Provision: Stress on women’s security. Excise duty on footwear having retail price of more than Rs 1000 per pair reduced by 6 per cent. Allocation of R68,968 for the education sector.

Her take: “Women’s security is of prime importance, so I am glad about the provision. For youngsters, who live on pocket money, any subsidy is always welcome.”

Manjula Sheth (Grandmother)

Age: 80

Profession: Housewife

Provision in the Budget: For Super Senior Citizens (senior citizens over the age of 80), limit of deduction in health insurance premium will be Rs 30,000.

Her take: “This provision pays special attention to senior citizens above 80, which is definitely a welcome move. However, at present, medical and other expenses are much higher than the mentioned sum.”

Rima Sheth (Daughter-in-law)

Age: 50

Profession: Yoga teacher

Provision: Yoga is included under charitable activities. Gold monetisation scheme to allow depositors to earn interest.

Her Take: “Including yoga under the charitable activities will boost the practice. Homemakers can now earn returns on gold.”

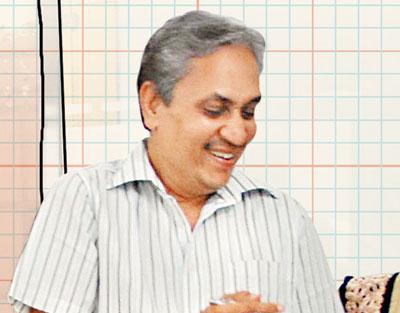

Ashit Sheth (Son)

Age: 50

Profession: Chartered accountant, stock market investor

Provisions: Service Tax increased from 12.36% to 14%. FMC to be strengthened by merging with SEBI. Removal of the capital gains tax anomaly that existed for Real Estate Investment Trust (REIT) units and other listed securities.

His take: “The increase in Service Tax is a very bad provision, especially for corporates. It will only deter more people from showing annual turnover.

Unlike in excise for SSI, where exemption remains the same regardless of previous year’s turnover, in Service Tax, once an individual or a company is in the tax bracket, he/it ends up paying from the very first transaction.

I feel all the positive effects of the Income Tax rules have been nullified by increasing Service Tax (as Income Tax is on the net income and Service Tax on the gross tax).

On the brighter side, in the amendment of the REIT law (where property investors had to wait for three years to claim long term capital gains), tax exemption has finally been removed.”

Paresh Shah (Son-in-law)

Age: 46

Profession: Corporate Trainer

Provision: GST implementation from FY 16-17

His take: “It will create a level playing field for each individual regardless of size of the company or location. However, if Income Tax and Excise can have a yearly exemption, why not Service Tax?”

Bijal Shah (Daughter)

Age: 40

Profession: Homemaker and Corporate Trainer

Provision: Rs 6,335 crore have been so far transferred directly as LPG subsidies to consumers

Her take: “Rationalising subsidies is the need of the hour. For the woman of the house, running the family kitchen in the most cost-effective way is priority. Hopefully, the skyrocketing vegetable prices will be

under control.”

Pushpa Mehta (Grand-aunt)

Age: 75

Profession: Housewife

Provision in the Budget: Commencement of the Atal Pension Yojana will provide a defined pension starting at the age of 60. The Pradhan Mantri Suraksha Bima Yojana will provide accidental insurance coverage of Rs 2 lakh.

Her take: “Prima facie, these announcements seem attractive. But optimum implementation is key, and it should reach those who are economically challenged.”

Jayantilal Sheth (Grandfather)

Age: 82

Profession: Tax practitioner

Provision in the Budget: To enact a comprehensive law on black money, concealment of income will be prosecutable with rigorous imprisonment; Foreign Exchange Management Act to allow for seizure of foreign properties and assets.

His take: “This is a very positive step towards the curbing of corruption and black money practices. The first step is to admit that we have this problem. Then, we must build an effective law to curb it and dissuade people. Lastly, we must ensure its continuous and swift implementation. The step is in the right direction but the government must follow-up effectively, too.”

Provision in the Budget: Abolition of Wealth Tax/Reduction in Corporate Tax

His take: “This means one less thing to worry about. Anyway, the tax base of Wealth Tax was very small. It is a good step and will reduce regulatory compliances. The procedural costs are much higher than the actual revenue earned, abolishing this tax makes sense.

Reduction in Corporate Tax is again a very positive step taken by the government and will help boost the business sentiment in general.”

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!