Things are beginning to move and groove towards an action-packed end of the year

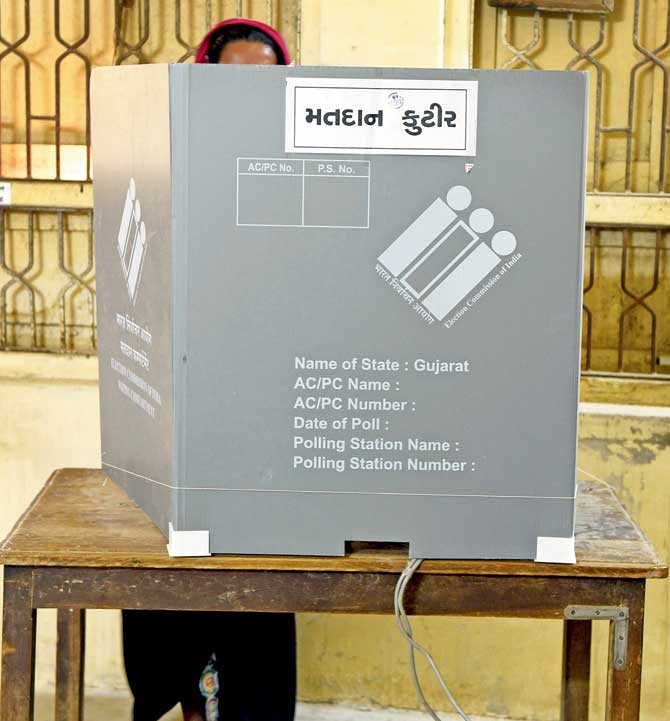

A voter casts her ballot during the first phase of the much anticipated Vidhan Sabha Gujarat elections at Limbdi, which is approximately 100 km from Ahmedabad

After sharp technical correction, Nifty moved up due to short covering and Nifty's oversold situation. On Thursday, Nifty Bank's expiry day, investors and speculators were forced to cover their shorts which led the market rally. On Friday, FMCG and Banking stocks further helped the market recover. Going forward, the market may face strong resistance at 10,410 and 10,500 levels, and Nifty may get support at 10,037. Broadly speaking, we can see sideways to positive movements at the beginning of the week.

A voter casts her ballot during the first phase of the much anticipated Vidhan Sabha Gujarat elections at Limbdi, which is approximately 100 km from Ahmedabad

ADVERTISEMENT

Closely watched

Market participants are expecting a stunning victory for BJP in the Gujarat elections which can further fuel the market rally. On the other hand, if the NDA gets only a marginal lead then we can expect profit booking. Global investors are also keenly watching the Federal Reserve's move on interest rates. The US Fed meeting will be held on December 14.

Positive outlook

Technically, indices are yet to give a major buying indication, but falling India VIX is a good sign. S&P 500 VIX is also in decline mode, and, closed on Friday at 9.58 per cent suggesting positive outlook for the US equity markets. Dow has immediate resistance at 24,515 and 24,585. Do not expect a sharp rally above these levels. On the downside, Dow has support at 23,773. Technically, Dow is still in overbought levels, which can give a sell signal in the near future.

Earnings due

On the macro-economic front, India's Balance of Trade, Industrial Production, Manufacturing Production, Inflation Rate, WPI Inflation YoY, WPI Manufacturing YoY, WPI Fuel YoY and WPI Food YoY data's are due next week. US Industrial Production data YoY is also due. Companies like Nitin fire, Orient Abrasive, Speciality Rest, DCM, Mercator, Sangam Ind, SMS Pharma, Atlas Cycle etc will come out with their quarterly earnings.

Give signal

Last week, Nifty Bank recovered from lower levels due to short covering but has yet to give a buy signal. Nifty Bank has resistance at 25,466 and 26,095. Strong support can be expected at 24,838 level. Among Nifty, PSU Bank Index and Nifty. Private Bank Index the former is relatively weak. Like Nifty Bank, Nifty Metal Index shows a minor uptrend but is yet to give a strong buying indication, which means if there is a sell-off in the market, then indices which are yet to give a buy signal, will face heavy liquidation by the Bulls.

Nifty FMCG index has given a break out pattern, which may help FMCG stocks to outperform markets. Nifty FMCG Index has support at 25,864 and resistance at 27,703. Both Nifty Infra and Nifty Auto Indices will have limited upside.

Alex K Mathews is the founder of www.thedailybrunch.com

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!