The Bank of Japan and ECB are taking steps to control global inflation; the RBI governor will reveal India’s move on Tuesday

The markets continue to be in a super volatile mood and the last trading day of the week and the month saw markets rally strongly all over the world. Sensex rallied 400 points on Friday and gained 435.03 points or 1.78 per cent for the last week to close at 24,870.69 points.

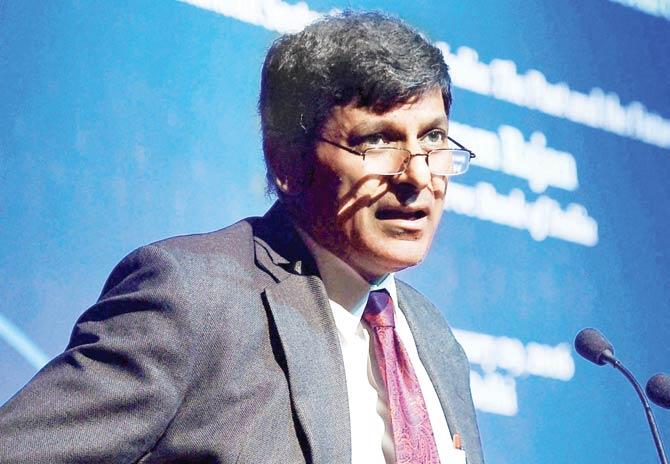

RBI Governor Raghuram Rajan delivered a lecture in New Delhi on Friday ahead of the monetary policy meet, tomorrow. Pic/PTI

Nifty gained 140 points on Friday and gained 141.10 points or 1.90 per cent for the week to close at 7,563.55 points. Incidentally, Friday was the first day of trading in the new February series.

Indices

The broader indices saw the BSE100, BSE200 and BSE500 gain 1.81 per cent, 1.85 per cent and 1.91 per cent respectively, while BSEMIDCAP gained 2.20 per cent and BSESMALLCAP 2.56 per cent. The top sectoral gainer was BSEHEALTHCARE up 4.89 per cent followed by BSECONDUR 3.58 per cent and BSEMETAL 3.49 per cent. On the losing side were BSECAPGOODS down 1.41 per cent and BSEBANKEX 0.12 per cent.

In individual stocks, Vedanta gained 10.73 per cent followed closely by Sun Pharma at 10.51 per cent. Others included PFC 9.94 per cent, Yes Bank 9.27 per cent and Union Bank 8.39 per cent. On the losing side, they were led by BHEL 5.74 per cent, Axis Bank 3.76 per cent and Bank of Baroda 8.39 per cent.

Dow Jones fared similarly with a 400-point gain on Friday and a cumulative gain of 372.79 points or 2.32 per cent for the last week to close at 16,466.30 points. What it effectively meant is, whether it is India or the US without Friday’s gains, markets after four days of trading were effectively neutral. The Friday rally changed global sentiment.

Inflation

Bank of Japan introduced negative interest rates and is determined to see that they pump money and bring about some inflation of 2 per cent in Japan. The ECB (European Central Bank) is also willing to cut rates further to provide stimulus.

In these circumstances, what Reserve Bank Governor Raghuram Rajan does tomorrow when the RBI meets for the monetary policy would be interesting. The consensus is that rates would remain unchanged and the possible surprise could be a cut. However, the cut seems most unlikely, currently.

In primary market news, the IPO from Precision Camshafts was subscribed 1.92 times. The company had tapped the capital markets with its IPO and an offer for sale in the price band of R180-186. This was also the first issue where it was compulsory for retail investors to apply through ASBA (Application Supported by Blocked Amount).

The issue has received good response, however one would know the actual results of ASBA in a couple of days after the bid applications are blocked. I believe of the applications received from retail about 10-15 per cent may get rejected as the amount to be blocked does not happen. This is still the learning and one cannot comment on the efficiency of the system as yet.

Business

This week, yet another IPO (Initial Public Offering) from TeamLease Services Limited opens tomorrow February 2, and closes on Thursday, February 4. The price band is R785-850 and the combined offer size 51.30 lakh shares. At the top end of the band the company that is into the staffing business would raise R436 crores. The issue looks expensive considering the business model but would be subscribed simply because this is the first of its kind to be listed.

The government completed the OFS (Offer For Sale) of Engineers India Limited. The floor price was R189 and a discount of 5 per cent was offered to retail investors. The issue was oversubscribed and the total bids received were for 8.56 crore shares which was 2.54 times the issue size of 3.37 crore shares.

The clearing price or allotment price to non-retail was R190.10 and to retail investors substantially higher at Rs 197.15. the closing price of the share was R193.05, which effectively means that retail investors have surrendered of their 5 per cent discount or Rs 9.45 at the floor price, an amount of Rs 4.10 or 2.12 per cent to acquire the shares.

Further, the actual price at which they would receive these shares is therefore Rs 187.30 or R5.75 cheaper than the closing price, effectively realising a discount of 2.91 per cent. There is an inherent risk that market price could fall today when trading resumes.

Monthly review

Markets have gained effectively on the first trading day and last trading day in January. The markets in January have lost close to 1300 points on the Sensex and 383 points on the Nifty. With the union budget due on February 29, it would be interesting to see how this month of February fares.

I believe, volatility will continue to be high and though we have registered the first weekly gain in January 2016, markets are not yet out of the woods. Global concerns about growth and the geo political situation will continue to be a drag on markets and with Q3 results not providing any trend change, uncertainty would continue. Trade cautiously as the worst is certainly not over.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!