As the new government rolls in changes, the economy is expected to improve slowly and steadily. Patience is the key

The markets were in correction mode and lost ground on two days and remained neutral on the remaining three days. Markets seem to have run out of steam currently and are witnessing profit taking.

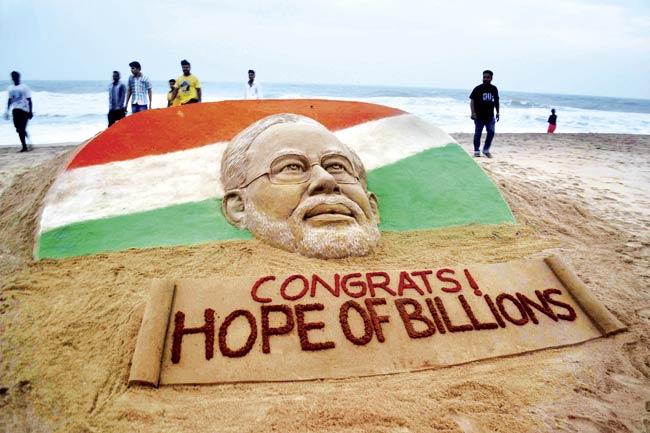

PM Narendra Modi is hoping to resurrect the Indian economy. PIC/AFP

Gainers and losers

The BSESENSEX lost 476.01 points or 1.93 per cent to close at 24,217.34 points. The NSENIFTY lost 137.15 points or 1.86 per cent to close at 7,229.95 points. The broader indices like BSE100, BSE200 and BSE500 lost 2.07 per cent, 2.07 per cent and 2.05 per cent. The BSEMIDCAP lost 2.32 per cent while the BSESMALLCAP lost 1.23 per cent.

Amongst sectoral gainers the top gainer was BSEHEALTHCARE up 2.41 per cent, followed by BSEFMCG up 1.03 per cent and BSEIT up a tad at 0.18 per cent. The losers were all big losers with BSEPSU down 6.5 per cent, BSECONDURABLE down 6.34 per cent and BSEOILGAS down 5.99 per cent.

In individual stocks, Hindustan Unilever was the biggest gainer up 7.07 per cent while others included Mahindra and Mahindra up 6.30 per cent and Dr Reddy up 6.11 per cent. The losers were led by Bank of Baroda down 11.73 per cent and followed by Canbank down 11.62 per cent, GAIL down 11.36 per cent and BHEL down 11.12 per cent.

It is pertinent to note that stocks from the IT and Pharma space have gained last week, after losses over four weeks or so. Infosys was however, an exception losing ground as yet another top executive quit the company.

Records reached

The Dow Jones closed at yet another all-time high of 16,717.17 points up 174.09 points or 1.05 per cent. The old adage of “Sell in May and go away” did not work as global markets were up.

In India, FIIs were back to buying on Friday after the MSCI rejig and Kotak Bank promoters selling a part of their stake to meet Reserve Bank of India (RBI) requirements.

FIIs were net buyers of R 2,245 crore for last week and Rs 16,400 crore for May. Domestic institutions were buyers of Rs 382 crore last week and net sellers of Rs 700 crore in May.

The Indian Rupee depreciated Rs 0.58 or 0.99 per cent to close at Rs 59.10. Thursday saw the expiry of May futures passing off peacefully with the Nifty closing at 7,235.65 points up 199 points or 2.99 per cent. In the last week, the market had given up quite a bit of its earlier gains.

Jammu and Kashmir Bank was hammered out of shape on Friday when a J&K newspaper reported about three large accounts turning into NPA and not being treated as NPA’s in the bank's balance sheet.

The management of the bank tried to assure analysts of there being prudence in the bank, and that all was well but the share price indicated otherwise. The share closed at Rs 1,501 down Rs 372 or 19.86 per cent.

RBI review

On Tuesday, RBI will have its review meet where the wide consensus is that things would remain unchanged. Playing the contraria, my hunch is that there may be a token rate cut.

The logic for the cut is that with the government and RBI governor on the same side as far as inflation is concerned, a concerted thrust could be given to kick start the economy.

Already agri commodity prices have started to soften and with the government intent on cutting subsidies, reducing inflation and improving the supply side, if a small cut could help why not?

A similar example was there when just before the 2013-14 budget was to be presented, the then RBI governor had announced an unexpected rate cut. The Railway Minister did raise fares and his party, forced a roll-back of fare hikes and subsequent resignation of its Railway Minister.

When the RBI could take a view on the basis of intent of the government which was already three years old, why can't a similar view be taken when the government is just one-week-old?

I believe there is sound logic and this can be a long shot on the RBI view. This is not expected and would create a pleasant surprise and also bring new momentum in the market.

New hopes

The government was sworn in on May 24 and within a week announced the setting up of a Special Investigation Team (SIT) as per the Supreme Court’s directive to bring black money back.

The 10 point agenda was also announced and all inter-ministerial committees have been scrapped. Soon, Parliament will be in session which will give an indication of the vision and focus of the new government.

Other than the pleasant surprise from the RBI governor, there is not much to look at this week. The strategy going forward would be to buy on dips and be patient to cash on profits. This government will perform and the economy will improve.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd. Readers are invited to read more about these and other issues on his website https://ak57.in

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only and under no circumstances should be used for actual trading or making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment or trading decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at his or her risk.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!