Support is where buyers step in repeatedly. If identified early, it can offer low-risk entry points.

Vishal B Malkan

As thousands of new traders enter the stock market, many are overwhelmed by complex jargon and tools. But understanding just two simple concepts can significantly improve your trading: support and resistance.

What Is Support?

Support is also called the demand zone or bottom. It's the price level where a stock tends to stop falling and bounce back up. Think of it as the market's floor.

Example: When a stock repeatedly falls to the same level and then rises again, that level is support. If Nifty falls to 22,000 in March, bounces, and then again finds buying interest near 22,000 in April, that forms a support level.

"Support is where buyers step in repeatedly. If identified early, it can offer low-risk entry points."

How Support Zones Appear on a Chart:

Why Support Matters:

Knowing support levels helps traders to:

- Enter trades with a small stop loss

- Improve risk-reward ratios (e.g., risk 2 to potentially earn 5 or 10)

- Trade with confidence by following price structure

Watch how price behaves when it approaches known support. A bounce confirms the level is working.

What Is Resistance?

Resistance is the supply zone. It is where a stock tends to stop rising and falls again. Think of it as the market's ceiling.

Example: If a stock hits 400, falls to 300, then again hits 400 and reverses, the 400 level is resistance.

"At resistance, sellers dominate. It's often a signal to exit long trades or consider shorting (with the right knowledge and strategy)."

How Resistance Zones Appear on a Chart:

Support and resistance are powerful tools when understood correctly. The idea is to not get distracted by too many indicators.

Risk Management with Support & Resistance

- If price holds above support, consider entering long trades

- If the price nears resistance, look for signs of weakness to exit or short

- Always use a stop loss just beyond the zone

Support and Resistance on daily, weekly and monthly charts:

- Daily charts show short-term trends

- Weekly charts show medium-term trends

- Monthly charts show long-term trends

Support on a weekly chart might offer weeks of upside; on a monthly chart, it could mean months of potential. Along with trends, concepts like support and resistance help traders identify where prices might reverse.

The chart will start talking to you if you practice 100 charts a day. So, start practising. Look at charts, draw lines, and observe patterns. That’s how you build the skill of real technical analysis.

About the Author

Vishal B Malkan has been trading since 1996 and has taught thousands of students the art of structured, rule-based trading. Watch more tutorials on his YouTube channel with over 1000 videos.

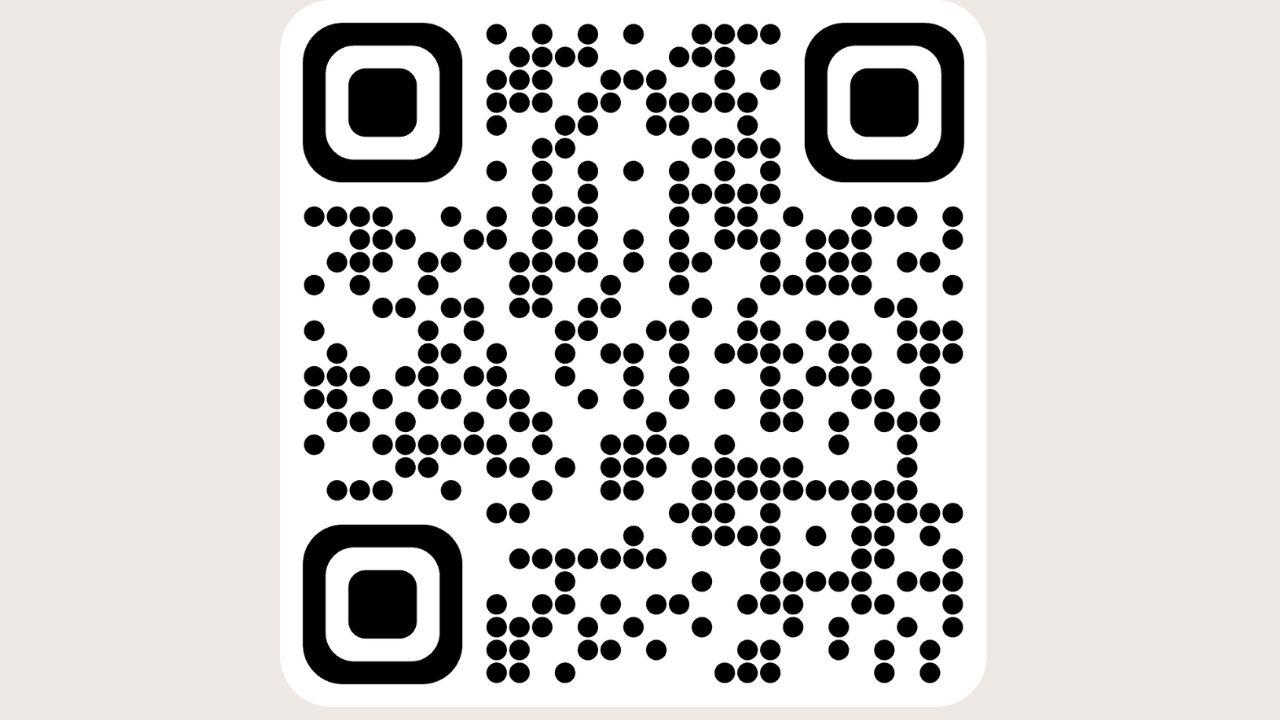

For a More Detailed Explanation (in Gujarati), you can watch a dedicated video in Gujarati on Vishal B Malkan’s YouTube channel.

https://www.youtube.com/@malkansview5305

Disclaimer:The information provided on the Website does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not interpret any of the financial content as such. Please conduct your own due diligence and consult with a financial advisor before making any investment decisions. Midday does not endorse or promote any such activities, and you access them at your own risk, fully understanding the monetary and legal consequences involved. Midday shall not be held responsible for any losses you may incur as a result of using any such apps or websites

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!