Mutuum Finance (MUTM) presale hits 90 percentage of Phase 6, raising USD 18.5M. Analysts predict up to 5,600 gains as the DeFi token nears mainnet launch.

Mutuum Finance

Mutuum Finance (MUTM) is rapidly emerging as one of the best cryptos to buy now as investors position ahead of the next market expansion. The token’s presale, now in Phase 6 and 90% filled, has already raised $18,580,000 and drawn in 17,850 holders.

Priced at $0.035, up 250% from its Phase 1 rate of $0.01, the structured growth and investor demand are signaling a strong start for what many expect to become a major DeFi success story. Analysts now project that MUTM could reach between $1.5 and $2 before the end of the upcoming bull cycle, a rise of up to 5,600% from its current price.

Structured Presale Nearing Final Allocation

Mutuum Finance (MUTM) continues to advance through its multi-phase presale system, designed to maintain transparency and reward early participants. Once Phase 6 closes, Phase 7 will open at $0.04, a 20% increase ahead of the $0.06 launch price. This system creates predictable value appreciation at every stage and helps investors evaluate what crypto to invest in with clarity and confidence. Phase 6’s near sell-out reflects increasing urgency as this is the final opportunity to purchase MUTM before the next price rise.

MUTM’s presale model has already proven successful, with large and small investors participating steadily rather than speculating short-term. The 24-hour leaderboard, rewarding the top daily buyer with $500 MUTM, and the $100,000 giveaway for ten winners have amplified participation. These interactive incentives, combined with the upcoming protocol release, have positioned MUTM among the best cryptos to buy now before the presale closes.

MUTM Price Prediction And Comparative Growth Logic

Mutuum Finance (MUTM) has the potential to deliver exponential returns as it transitions from presale to mainnet launch. The projected range of $1.5 to $2 is based on multiple converging factors: a capped supply, audited protocol security, a dual lending model integrating both Peer-to-Contract and Peer-to-Peer systems, and an active investor community driving liquidity. This trajectory resembles the rise of Binance Coin (BNB) during the previous market cycle, where clear fundamentals and strong platform utility translated to massive price growth.

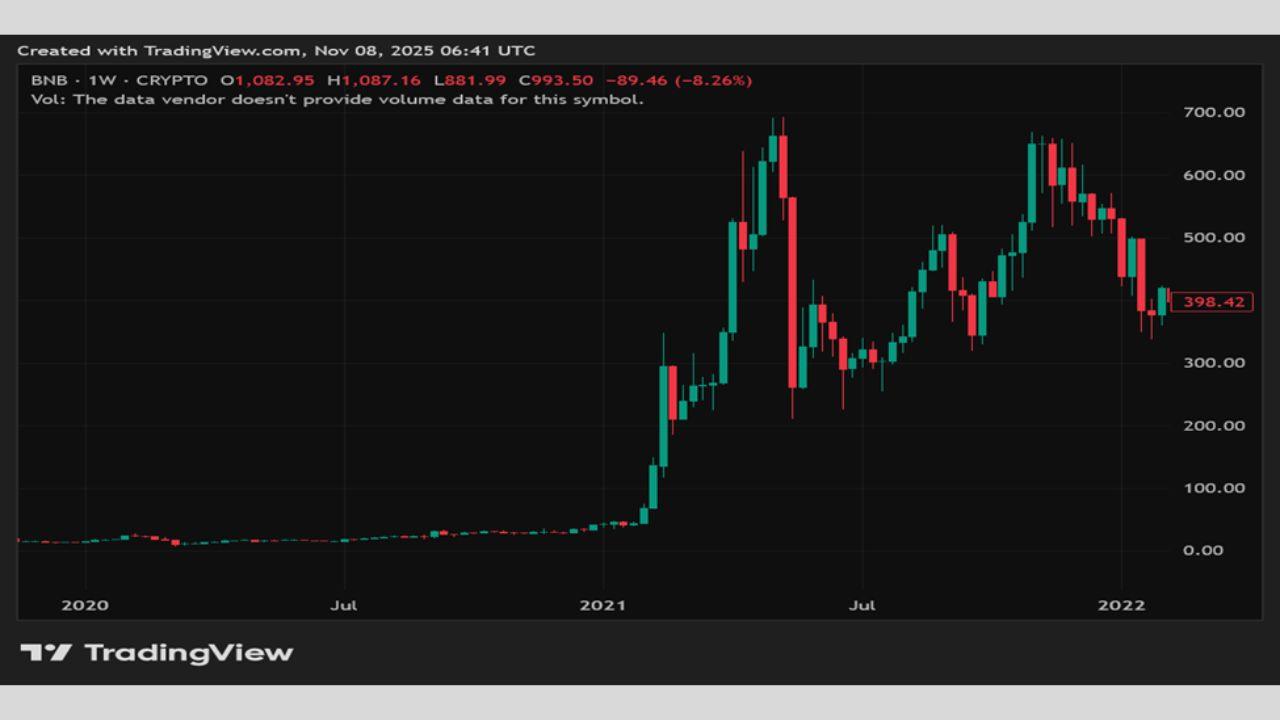

BNB traded near $15 in early 2020 before rallying to $690 in May 2021, a 4,500% increase in less than 18 months. Its rise was propelled by consistent exchange adoption, burning mechanisms, and real platform usage, much like how Mutuum Finance (MUTM)’s lending and yield mechanics are fueling its intrinsic value. Both assets share a key trait: token demand directly tied to platform activity.

As BNB thrived on exchange volume, MUTM will benefit from lending and borrowing transactions within its DeFi ecosystem. Based on this pattern, a climb from $0.035 to $1.5–$2 by the end of the next cycle reflects a comparable growth multiple, aligning with the historical ROI seen in BNB’s early acceleration phase.

Core Utility Driving Growth Potential

Mutuum Finance (MUTM) is building a dual-market structure that enhances liquidity efficiency and risk management. The Peer-to-Contract system pools assets like ETH and USDT for automated yield generation, while the Peer-to-Peer model supports flexible direct lending arrangements for more tailored use cases. This dual setup creates continuous protocol activity, ensuring consistent fee generation and token utility.

Additionally, the protocol features a buy-and-distribute mechanism, where a portion of platform revenue is used to repurchase MUTM from open markets and redistribute it to mtToken stakers. This structure creates a cyclical demand loop that strengthens the token’s value base. With a 90/100 CertiK audit score and a $50,000 bug bounty for added security, MUTM stands out among new crypto projects prioritizing safety and real yield generation.

Stablecoin Integration Enhances Long-Term Viability

Beyond its lending framework, Mutuum Finance (MUTM) is preparing to launch an overcollateralized stablecoin designed to maintain a 1:1 peg with the U.S. dollar. This asset will serve as a reliable liquidity anchor within the platform’s ecosystem, offering stability during volatility while generating interest for the protocol’s treasury. The addition of a stablecoin increases functional use cases, positioning MUTM as one of the best cryptocurrencies to invest in for consistent performance during both bull and bear cycles.

As Phase 6 nears its conclusion, Mutuum Finance (MUTM) is quickly becoming the next big crypto in decentralized finance. Investors recognize that once the presale transitions to Phase 7 at $0.04, early ROI margins will shrink. Current participants at $0.035 stand to gain substantially from future appreciation as the platform moves toward mainnet testing and subsequent listings.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer : The information provided on the Website does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not interpret any of the Website's content as such. Midday does not recommend that you buy, sell, or hold any cryptocurrency. Please conduct your own due diligence and consult with a financial advisor before making any investment decisions. Midday does not endorse or promote any such activities, and you access them at your own risk, fully understanding the monetary and legal consequences involved. Midday shall not be held responsible for any losses you may incur as a result of using any such apps or websites. Cryptocurrency products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for losses resulting from such transactions.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!