Mutuum Finance launches its V1 protocol on Sepolia, proving utility ahead of presale close and positioning MUTM for major 2026 growth.

Mutuum Finance

A functional prototype is among the strongest predictors of success in the crypto market. Mutuum Finance (MUTM) has reached this critical milestone with the public release of its V1 protocol on the Sepolia testnet. This working model allows for comprehensive testing of its advanced lending systems in a risk-free environment, providing tangible proof of the project's technical capability. This level of proven development, just as the presale enters its final phases, positions this defi crypto for significant recognition and sets a clear foundation for a major price revaluation in 2026.

The Significance of a Live Testing Environment

The launch of the V1 protocol on the Sepolia testnet is a major technical achievement. This environment allows anyone to interact with and verify the core mechanics of Mutuum's dual lending ecosystem. Users can explore the Peer-to-Contract (P2C) automated pools, testing features like loan origination, interest accrual, and liquidation processes.

This transparency is rare for a project in its presale stage and de-risks the investment by demonstrating a finished, auditable product. It confirms the team's execution ability, building immense confidence that often precedes substantial valuation growth for a new crypto coin.

Presale Phase: The Last Access Point Before Launch

The ongoing presale represents the final opportunity for foundational pricing. Mutuum Finance is currently advancing through Phase 7. Following a structured multi-phase model, the price increments with each stage, rewarding early commitment. The subsequent mainnet launch and exchange listings are expected to catalyze a powerful demand surge.

Given the proven technology from the testnet, the strong holder base of over 18,900, and strategic exchange partnerships, a conservative post-launch price target is set near $0.38. This represents a near 10x increase from the current presale price.

Historical Precedent: The BNB Blueprint

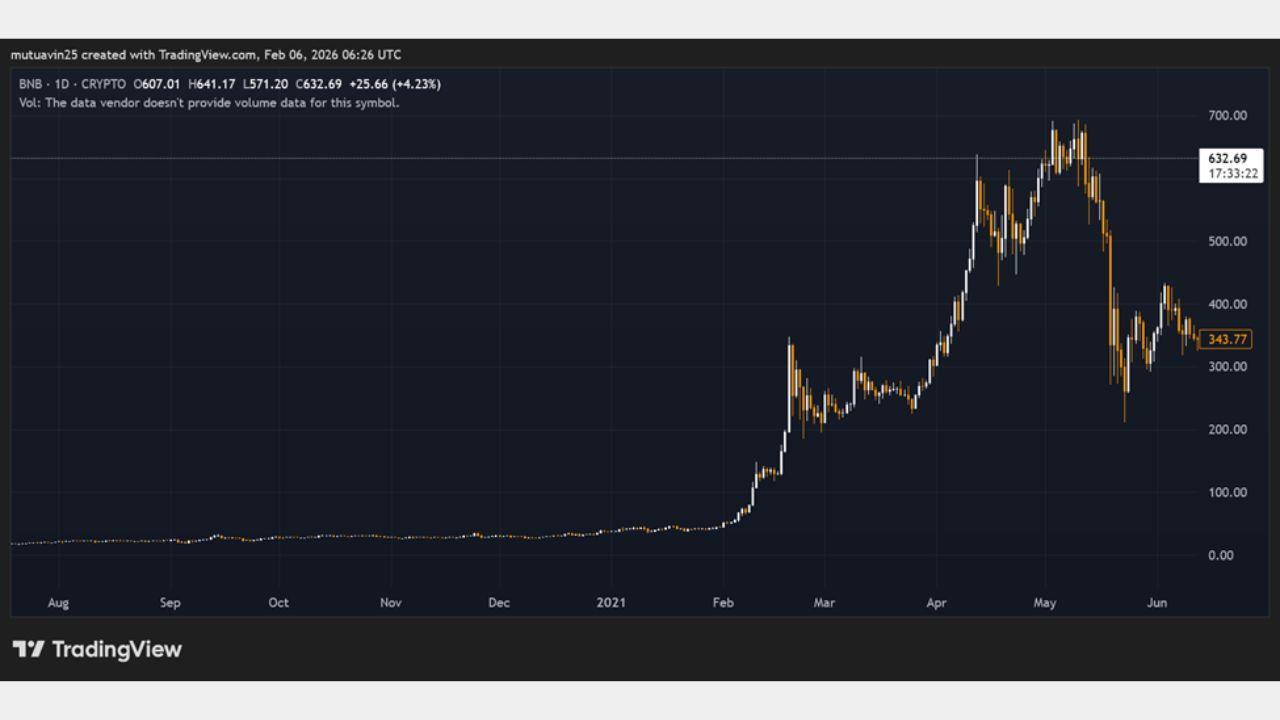

The trajectory for a utility-driven token launching in a promising sector is not without precedent. Consider Binance Coin (BNB) in 2020. It was a new crypto coin trading around $11, backed primarily by the utility of reducing fees on the Binance exchange. As the platform's adoption and use cases exploded, so did BNB's value, skyrocketing to over $690 in 2021-a gain of more than 6,000% in roughly 18 months.

Mutuum Finance mirrors this blueprint: it is a DeFi crypto with essential utility (lending/borrowing), a working product ready for mainnet, and a token (MUTM) integral to its ecosystem's fee distribution and governance. This combination of utility and proven technology suggests a similar potential for exponential growth.

Dual-Market Lending: An Engine for Sustainable Demand

The core utility that will fuel this growth is Mutuum's dual lending model. Unlike single-market platforms, it caters to all risk appetites. The P2C pools offer automated, low-touch yield for stable assets. For example, supplying $3,000 of USDT into a pool with a 14% APY would generate about $420 in annual interest.

Simultaneously, the P2P system allows for direct negotiations on niche assets, opening high-yield opportunities. This comprehensive approach captures a wider user base and transaction volume, directly generating the protocol fees that will power the buyback-and-distribute model, creating a sustainable cycle of demand for the MUTM token.

Positioning for a Breakout Year

The convergence of a live-tested protocol, a closing presale window, and a robust utility model creates a compelling case for Mutuum Finance. The project is transitioning from concept to tangible product at a rapid pace, a key differentiator in a crowded market.

For investors analyzing the best cryptocurrency to invest in for 2026, MUTM presents a scenario reminiscent of other foundational tokens before their parabolic rises. With its technical foundations verified and its economic model poised for activation, this DeFi crypto is strategically positioned to climb the annual performance charts.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:The information provided on the Website does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not interpret any of the Website's content as such. Midday does not recommend that you buy, sell, or hold any cryptocurrency. Please conduct your own due diligence and consult with a financial advisor before making any investment decisions. Midday does not endorse or promote any such activities, and you access them at your own risk, fully understanding the monetary and legal consequences involved. Midday shall not be held responsible for any losses you may incur as a result of using any such apps or websites. Cryptocurrency products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for losses resulting from such transactions.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!