Shetty was arrested on March 6 in connection with Choksi's case. Earlier, he was in CBI custody till March 3 in connection with diamantaire Nirav Modi's case in the PNB scam

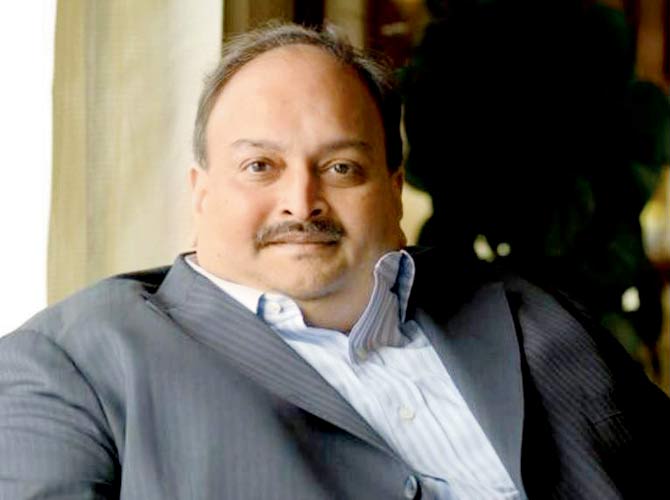

A special court here today extended till March 17 the CBI custody of former Punjab National Bank DGM Gokulnath Shetty in connection with a case related to diamond trader Mehul Choksi's firms in the multi-crore PNB fraud case. Shetty was arrested on March 6 in connection with Choksi's case. Earlier, he was in CBI custody till March 3 in connection with diamantaire Nirav Modi's case in the PNB scam. Modi's firms allegedly defrauded PNB of over Rs 6,000 crore and Choksi's firms Rs 7,080 crore.

According to the CBI, Shetty unauthorisedly enhanced the value of foreign letter of credit (FLCS) in favour of various overseas branches of Indian banks in blatant violation of prescribed procedure by obtaining required request, applications, documents deliberately omitting in making entries in the bank's system in order to avoid detection. The CBI alleged that firms controlled by Modi and Choksi obtained fraudulent LoUs and letters of credit (LCs), worth over 13,000 crore, from PNB in connivance with some officials of the bank.

Apart from Shetty, those arrested in connection with Choksi's firms are Nakshatra group and Gitanjali group CFO Kapil Khandelwal, Gitanjali group manager Niten Shahi, Aniyath Shiv Raman Nair (then director Gili) and Vipul Chitalia (VP Banking operations). On January 31, the CBI had registered an FIR against Modi, his companies, and Choski. The FIR had listed eight fraudulent transactions worth over Rs 280 crore, but based on further complaints from the bank, the CBI said the quantum of amount in the first FIR is over Rs 6,498 crore, involving 150 LoUs allegedly issued fraudulently by Shetty and Manoj Kharat, single-window operator at the Brady House branch of PNB.

The remaining 150 fraudulent LoUs worth over Rs 4,886 crore issued for Gitanjali group of companies were part of the second FIR registered yesterday by the agency against Choksi and his companies Gitanjali Gems, Nakshatra Brands and Gili. Rajesh Jindal, the then head of PNB's Brady House branch, had yesterday moved a bail application in the court saying his custodial interrogation was not necessary. The court is likely to hear the plea tomorrow.

Catch up on all the latest Mumbai news, crime news, current affairs, and also a complete guide on Mumbai from food to things to do and events across the city here. Also download the new mid-day Android and iOS apps to get latest updates

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!