Markets had a bad outing on Friday and geo-political tensions saw them registering their biggest fall in the calendar year 2017

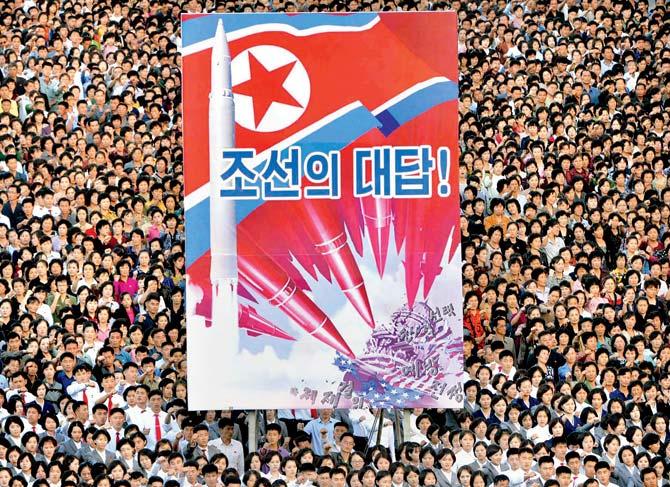

This photo released from N Korea's Korean Central News Agency (KCNA) shows an anti-US rally in Kim Il-Sung Square in Pyongyang. Pic /AFP

Markets had a bad outing on Friday and geo-political tensions saw them registering their biggest fall in the calendar year 2017. BSESENSEX lost 350.17 points or 1.09 per cent to close at 31,922.44 points. The markets were up at the end of Thursday, on a weekly basis by about 100 points on the Sensex. NIFTY lost 121 points or 1.20 per cent to close at 9,964.40 points. The broader indices saw the BSE100, BSE200 and BSE500 lose 1.54 per cent, 1.66 per cent and 1.73 per cent respectively. BSEMIDCAP lost 2.27 per cent and BSESMALLCAP was down 2.37 per cent.

ADVERTISEMENT

The only gainer

The only gainer amongst sectors was BSEHEACARE up 0.73 per cent. The top loser was BSEREALTY down 5.70 per cent followed by BSEMETAL 4.78 per cent and BSECONDUR 3.01 per cent. In individual stocks, the top gainer was Dr Reddy’s, up 10.05 per cent, followed by Bharti Infratel 4.22 per cent. The top loser was ACC down 7.64 per cent followed by Gujarat Ambuja Cements 7.69 per cent and Hindalco 6.87 per cent. While Indian markets were battered, the US closed last week with gains. Dow Jones was up 81.25 points or 1.11 per cent to close at 22349.59 points. The Indian rupee lost 72 paisa or 1.12 per cent to close at Rs 64.79.

Full of action

The week gone by saw a lot of action in the primary market there were three listings and two issues closing for subscription. A third issue opened for subscription on Friday and closes on Tuesday, September 26. The first issue to lose was Dixon Technologies, where shares were issued at TRs 1,766 and the issue closed the week with gains of 50 per cent.

The second issue was Bharat Road Networks Limited, which listed on Monday along with Dixon and closed with losses of 6 per cent. The issue was priced at R 205.

The third issue to list was Matrimony, the marriage site which issued shares at R 985 and listed on Thursday. This company had given a discount of R 98 to retail investors. This issue closed with losses of 16 per cent for the week.

Open season now

The two insurance giants had their issues open during the week. These were ICICI Lombard and SBI Life Insurance Company Limited. Both issues were subscribed on the back of institutional support. Non-institutional response was muted and certainly much less than expected. ICICI Lombard was subscribed 2.98 times, with the HNI portion remaining undersubscribed. It was the QIB portion subscription which was subscribed 8.17 times, which saw the issue through. The company is raising money through the offer for sale in a price band of R 651-661. The issue is expected to list in the week and is likely to be under pressure on Day One itself.

Eye on insurance

The second issue was from SBI Life Insurance which had a similar fate and performance. The issue was subscribed 3.58 times with QIB portion subscribed 12.56 times. HNI, retail and shareholder quota were under subscribed. Here again, the issue was an offer for sale in the price band of R 685-700 and was extremely expensive. The share is likely to be under pressure when it is listed and would happen just before the chief of SBI retires.

Track the snack

The issue, which opened for subscription on Friday was snack maker Prataap Snacks which closes on Tuesday. The

Rs 930-938. The company reported a topline of R 900 crore for the year ended March 2017. Its profits were very subdued due to the sharp rise in prices of its two key ingredients; namely edible oil and potatoes. The PE multiple at which shares are being offered after this one time hit of about R 20 crore last year and is about 196 times. The company sells its products under the Yellow Diamond name. The company merits investment.

Feeling the heat

The week ahead will see September futures expiring on Thursday. With four trading days to go, the current lead is a mere 46 points or 0.47 per cent. This could go either way and one needs to be cautious.

Geo-political tensions seem to have hit India much more than the world and things could get rough going into expiry day. Maintain light positions and look to buy in sharp dips that may happen during this week. Also, the listing of ICICI Lombard this week and SBI Life next week will have a bearing on the direction markets take.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!