Finance Minister Arun Jaitley on Saturday said cases of willful default and bank fraud will have a detrimental impact on the government's objective of ensuring ease of doing business

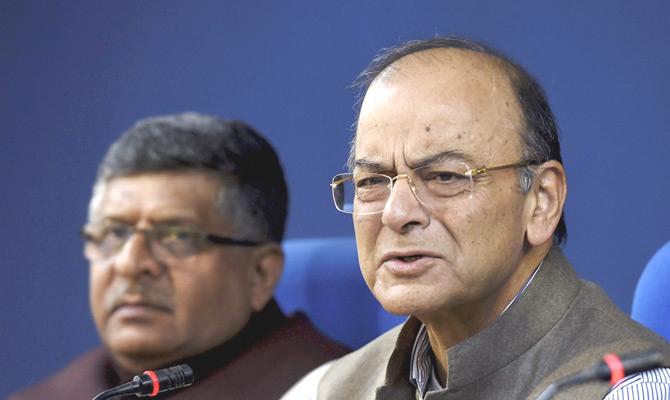

Arun Jaitley

Finance Minister Arun Jaitley on Saturday said cases of willful default and bank fraud will have a detrimental impact on the government's objective of ensuring ease of doing business.

ADVERTISEMENT

Speaking at the ET Global Business Summit 2018 here, Jaitley said repeated occurrence of fraud causes major setbacks to efforts for improving ease of doing business, and this subsequently creates room for criticism on the economy.

"Cases of willful default and bank frauds are much more than a business failure. If you periodically have incidents like these, the entire effort around ease of doing business goes into the background and these scars on the economy take the front seat. If a fraud is taking place in multiple branches of the banking system and no one raised the red flag, it is a matter of concern for the country. Similarly, the indifference of the top management and multiple layers of auditing system which chose to look the other way has created a worrisome situation," he said.

Highlighting the role of regulators in the economy, Jaitley hinted at the introduction of new regulations, adding that they need to keep a "third eye" on the sector. He also said tighter laws need to be implemented to ensure criminal acts in business lead to punishment, wherever the culprit is.

"Unfortunately, in the Indian system, we politicians are accountable, but regulators are not," he added. In lieu of the 1.77 billion dollar Punjab National Bank (PNB) fraud involving top jewellery designer Nirav Modi, and his uncle Mehul Choksi, Jaitley had earlier stressed on the need for supervisory agencies to assess what new systems had to be put in place to find those who were cheating banks.

"What were auditors doing? If both internal and external auditors have looked the other way and failed to detect, then I think CA professionals must introspect. Supervisory agencies also must introspect what are the additional mechanisms they have to put in place," he said.

The public sector Punjab National Bank had earlier this month detected a 1.77 billion dollar scam in which Nirav Modi had acquired fraudulent letters of undertaking from one of its branches in Mumbai for overseas credit from other Indian lenders.

Catch up on all the latest Crime, National, International and Hatke news here. Also download the new mid-day Android and iOS apps to get latest updates

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!