Exclusive: With elections round the corner, will the RBI be prevailed upon to bypass rules and release insurance to depositors? Or will the central bank find a way to force those who got 'irregular' advances to return the money?

The irony of a board declaring PMC Bank's 24-hour ATM is not lost on its account holders. Pic/Rudransh Sharma

On Tuesday morning, depositors of Punjab and Maharashtra Cooperative Bank (PMC Bank) woke up to news that they can withdraw only Rs 1,000 from their accounts, for the next six months. The harshness of RBI's action on a profitable, dividend-paying bank raises an important question: What is the Bank, and the banking regulator, hiding? How bad is the situation, that it warrants such draconian action and punishes the innocent and ordinary depositors so harshly?

On Tuesday morning, depositors of Punjab and Maharashtra Cooperative Bank (PMC Bank) woke up to news that they can withdraw only Rs 1,000 from their accounts, for the next six months. The harshness of RBI's action on a profitable, dividend-paying bank raises an important question: What is the Bank, and the banking regulator, hiding? How bad is the situation, that it warrants such draconian action and punishes the innocent and ordinary depositors so harshly?

Although PMC Bank is largely unknown outside Mumbai, it has a unique character and is very well known to senior central bankers. But more about that later. The Bank's customers are mainly small and medium businesses that will be devastated by RBI's seemingly thoughtless action at a time when almost every business is facing a liquidity squeeze and financial constraints. According to sources, one businessman who had just deposited R10 lakh to make payments to suppliers fainted on hearing that his money was frozen. When would such a draconian action be warranted that an administrator is appointed? Well, only if the accounts were totally fudged and its books cooked, like at Satyam Computers.

A harrowed account holder outside a shuttered PMC Bank branch on Wednesday. Pic/Anmol Jail

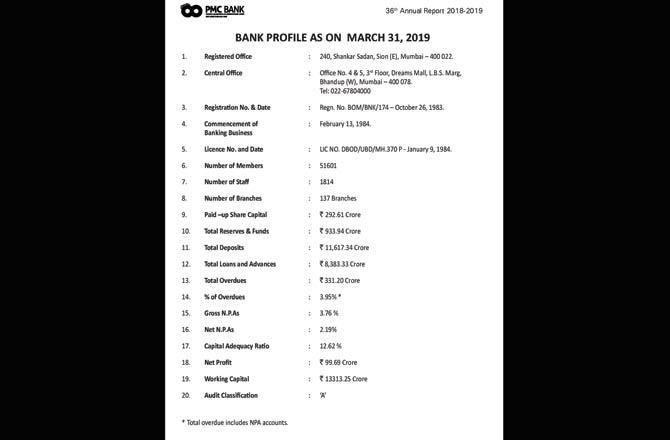

The Bank's financials for the year ended March 31, 2019, certified by the statutory auditor, Lakdawala & Co, are excellent. It earned a net profit after tax of Rs 99.69 crore and declared a dividend of 11 per cent. Its non-performing assets (NPAs) are only 2.19 per cent, doubtful assets are R26 crore and its statutory auditor's report is squeaky clean. (Fig 1). Is the report pure fiction? What are the dangerous 'irregularities' that warrants such drastic action?

All that the depositors know has come as two messages from the Bank's managing director, Joy Thomas, informing them that the Bank had been put 'under regulatory restriction' for six months, promising that all effort would be made to rectify irregularities and remove restrictions in that time. Another message assured depositors that their money is safe. Later in the day, the MD claimed to Zee Business that there was an issue with the Bank's advances and they hoped to realise their assets.

How does this mild and benign statement warrant such harsh action that hurts customers and could even cause permanent damage to small businesses? Clearly, there is a lot more and the rumour mills on social media have been working overtime.

The PMC Bank profile as per its annual report for the year 2018-19

A business channel has reported that PMC Bank may have exposure to a tottering non-banking finance company (NBFC). However, a Twitter-thread from November 2018, probably, provides a more plausible clue. It says that the notorious HDIL Ltd (Housing Development and Infrastructure Ltd), which has gone into liquidation, owns 1 per cent of PMC Bank and that it has received loans on concessional terms from PMC Bank in the form of overdraft facilities (OD).

It further says that Ravi Jyot, a financial subsidiary of HDIL, has raised money on similar lenient terms from PMC Bank. Since HDIL filed for insolvency in August 2019, these dangerous OD facilities will end up as unsecured lending and could vanish. There could be others. This realty company, with a shady reputation, has been in deep trouble for a while. An Economic Times report says that it has previously settled bankruptcy actions by Jammu & Kashmir Bank and Andhra Bank.

Can one realistically expect PMC Bank to be able to close out these irregular ODs and recover the money in six months? The RBI action indicates otherwise. With the HDIL before the NCLT (National Company Law Tribunal) and being run by a resolution professional, it is unlikely that the company will have any leeway to return PMC Bank's money ahead of others. Given that the RBI has pressed the panic button and, literally, stopped all lending activity of the Bank, one can only assume the worst.

Assuming the HDIL connection is correct, until RBI or the Bank provide any clarity, we have no idea about the size of this exposure and whether it is large enough to wipe out the Bank.

However, on September 25, Mumbai Mirror reported that exposure to HDIL is a massive R2,500 crore, which would certainly take the bank down. There is no official confirmation on this. If true, this would make PMC Bank's case similar to that of Madhavpura Mercantile Cooperative Bank, which was brought down by its dubious lending of over Rs 800 crore to scamster Ketan Parekh in 2000-01. Despite all the efforts to save it, the Bank was finally liquidated and its licence cancelled in 2012. With elections around the corner, RBI had broken its own rules to release the R1 lakh per depositor that is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) even before the Bank was liquidated.

One of RBI's responsibilities is to ensure there is no run on the Bank through misinformation and worse. But the banking regulator is silent. Some senior journalists have been told that RBI alone is not responsible for the regulation of cooperative banks. They are under joint regulation of RBI and the registrar of cooperatives; neither bothers to do its job.

And, yet, there is a nice revolving door that allows senior RBI officials in the urban banks department to accepting lucrative consulting assignments with the very same cooperative banks that they supervised (or failed to supervise) after retirement. These are accepted after a perfunctory two years and top central bankers turn a blind eye to it. Retired central bankers tell us that this is true of PMC Bank, too, and we know it is true of Bombay Mercantile Cooperative Bank.

The irony is that this Bank, under former chairman, the late Charanjit Singh Chadha, used to sponsor the MR Pai Foundation Awards, in the name of the crusader for bank depositors rights. The programmes have invariably had senior central bankers as chief guests as well as awardees. PMC Bank had a high reputation for customer service. It was open 360 days a year and had a sharp focus on computerisation and digitisation. Many cooperative housing societies had their corpus and accounts with the Bank. A look at the annual report would show that it is a Sikh community bank, which means that it had a large number of traders and businesses as customers.

As trustees of Moneylife Foundation, a not-for-profit organisation engaged in spreading financial literacy, we have always emphasised that people should not keep their money with cooperative banks, except to the extent of R1 lakh, which is covered by the DICGC. The failure of one of the most reputed cooperative banks would only underline what we have been saying. Unfortunately, most depositors fail to understand the serious implications of poor regulatory accountability in India.

With elections round the corner in Maharashtra, it will be interesting to see whether RBI is again prevailed upon to bypass rules and release insurance. Or will it find a way to force those who enjoyed the 'irregular' advances to return the money? The best way out will be to remove the incumbent management and find a quick buyer for the bank. Its size, past reputation of customer service and investment in technology will make it a good acquisition.

But it is important the RBI calms depositors and allows a quick deal, like it did with Global Trust Bank, which also collapsed in the Ketan Parekh scam. Once the bad loans are quantified, there should be a lot of interest in this bank. It will ensure that no depositor or customer suffers a loss.

Sucheta Dalal is co-founder and managing editor, Moneylife. This piece first appeared in moneylife.in on September 25

Catch up on all the latest Crime, National, International and Hatke news here. Also download the new mid-day Android and iOS apps to get latest updates

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!