Millionaires adopt a proactive approach to their children's education, blending insurance, investment, and foresight to create a secure future.

Aajay Beell

Education is one of the most significant investments parents make in their children's futures. Millionaires, in particular, adopt a strategic and methodical approach to ensure their children receive the best opportunities, regardless of life’s uncertainties. Aajay Beell, a Certified Financial Planner, shares valuable insights into how the wealthy plan their kids' education while preparing for unforeseen challenges.

Building a Financial Framework: Securing the Future

The first step millionaires take is creating a robust financial framework that ensures their children’s education is unaffected by any unfortunate events. They increase their life coverage through term policies as soon as a child enters their life. This enhanced coverage acts as a safety net, ensuring that, in the event of an untimely demise, their children's educational aspirations remain intact.

Key Insight: Life insurance is not just about covering immediate expenses-it’s about securing long-term goals, like education, even in the face of adversity.

Investing for Education: A Two-Part Strategy

Millionaires don’t just rely on savings; they strategically invest to build a substantial corpus over time. Here’s how they approach it:

1. Mutual Fund Investments for Educational Expenses:

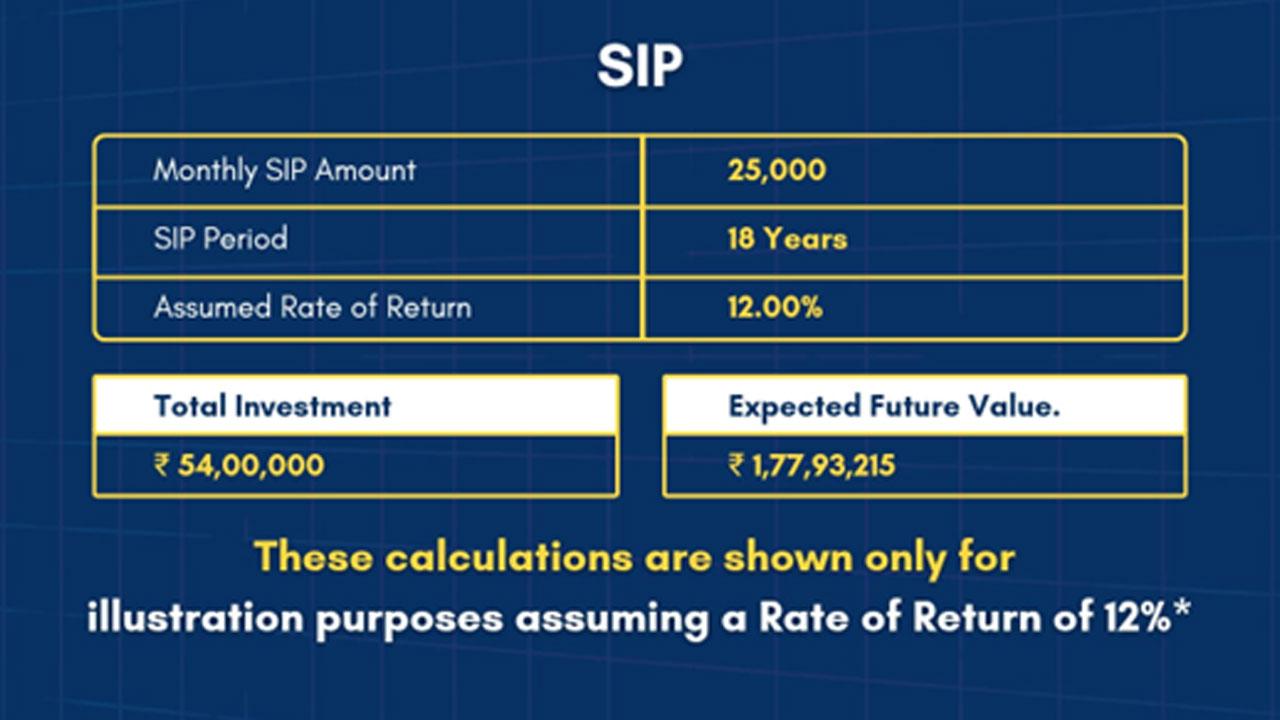

They open investment accounts under their child’s name and start systematic investment plans (SIPs). For instance, a monthly investment of ₹25,000 in mutual funds, growing at an annual rate of 12%, can accumulate a significant amount by the time the child turns 18. This corpus ensures that educational expenses, including tuition fees and other costs, can be covered without relying on student loans.

2. Ensuring Long-Term Financial Independence:

The second part of the strategy involves creating a future cash flow for their children. By pausing investments at 18 and allowing the funds to grow further, a monthly income stream is established through a systematic withdrawal plan (SWP) when the child reaches 23 or 24. This ensures financial independence, providing confidence and security as they begin their professional journey.

Combatting Currency Fluctuations and Inflation

For millionaires planning to send their children abroad for higher education, currency fluctuations and rising costs are critical factors. For example, the INR-USD exchange rate has increased from ₹80 in 2020 to ₹86 in 2025. This 7.5% increase significantly impacts education costs, especially for students studying in the USA, where annual tuition fees often exceed ₹40 lakh. Payment gateway charges and the rising cost of living add further strain.

To counter these challenges, millionaires leverage investments that grow at a rate surpassing inflation, ensuring that their corpus meets future requirements without compromising quality.

Holistic Planning: Beyond Tuition Fees

Education planning for millionaires extends beyond tuition. Aajay Beell emphasizes accounting for other essential expenses, such as accommodation, food, and travel. For students studying overseas, these costs can be substantial, making a well-rounded investment strategy essential.

Why Millionaires Take Education Planning Seriously

The wealthy understand that education costs are rising at double-digit rates annually. A well-planned financial strategy not only combats inflation but also ensures their children are well-prepared to seize global opportunities or contribute to family businesses with confidence and expertise.

Millionaires adopt a proactive approach to their children's education, blending insurance, investment, and foresight to create a secure future. Their methods offer valuable lessons for parents at every income level-start early, plan for uncertainties, and ensure investments grow faster than inflation. As Aajay Beell wisely highlights, securing your child’s education today means empowering them for a brighter tomorrow.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!