With no credible leads, cops relying on public assistance to nab accused; Although police have secured a photograph of Goyal, officials say they currently have no digital or financial trail to track him, making the manhunt challenging

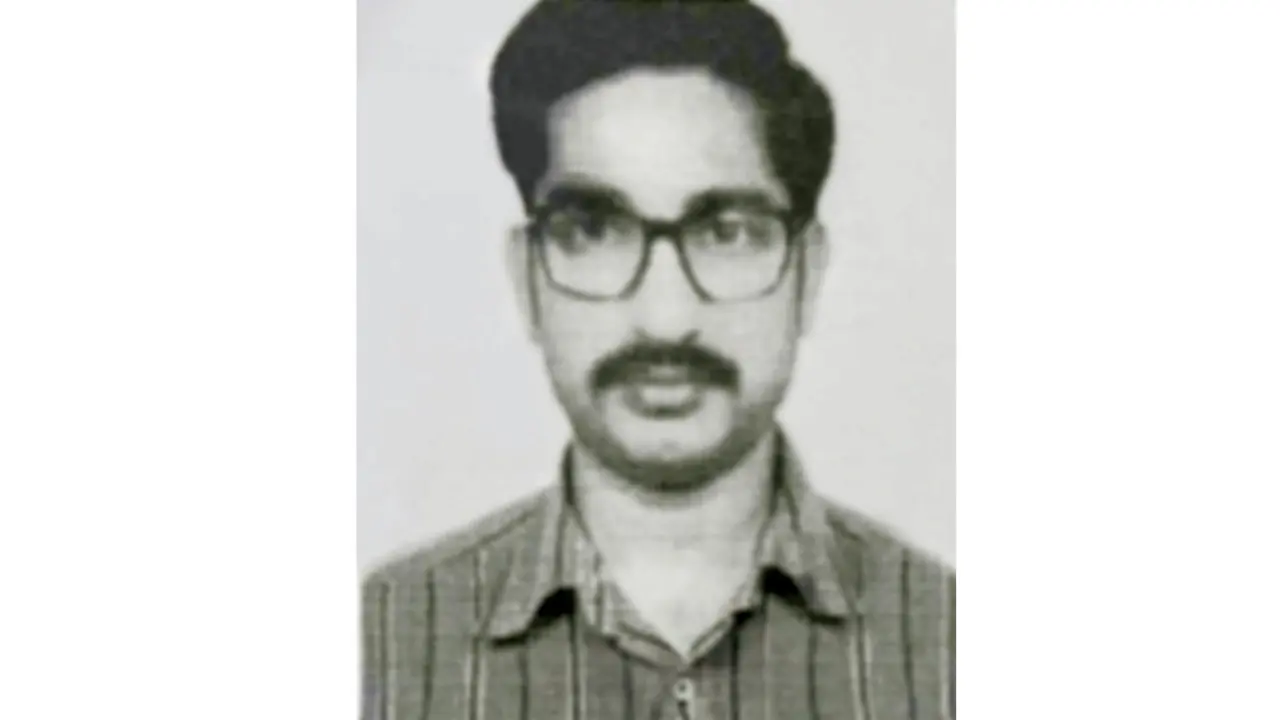

Bhupendra Mahajan Goyal. FILE PIC/BY SPECIAL ARRANGEMENT

The Mumbai police’s Property Cell is intensifying its search for Bhupendra Mahajan Goyal, 43, accused of masterminding a high-stakes Demat fraud in which he allegedly siphoned off Rs 75.99 lakh worth of shares from the bank account of a US-based tech executive by posing as her husband.

Although police have secured a photograph of Goyal, officials say they currently have no digital or financial trail to track him, making the manhunt challenging. “He has gone completely off the grid,” a senior official said, confirming that the probe is now being handled by the Property Cell under the Crime Branch.

Modus operandi

According to the FIR registered at the Cuffe Parade police station on April 14 this year, Goyal forged multiple documents to impersonate the husband of a 48-year-old senior director at a US-based tech firm. She had 31,690 shares of Wipro credited in her Demat account at a private bank in their JP Nagar branch in Bangalore and discovered the fraud in 2022, when she visited the bank to update her KYC details.

Police said Goyal created a full set of counterfeit identity documents in the victim’s name, including an Aadhaar card with a false number, a fake voter ID (she never had one), and a PAN card using her actual PAN number but with a forged photograph and incorrect father’s name. He also generated a lookalike email ID, and provided a fake mobile number to complete the profile.

Using these documents, Goyal allegedly opened savings, Demat, and trading accounts in her name at the bank’s Lalbaug branch and its Cuffe Parade office. He then convinced officials that he held a power of attorney on her behalf, and had her original Demat account in Bangalore linked to the newly created Mumbai-based accounts.

In December 2019, 7000 shares were transferred from her genuine account, followed by the sale of the remaining 24,690 shares. The proceeds, Rs 75.99 lakh, were first deposited into a bogus savings account at the bank’s ' and then moved to an account at another bank located in Powai.

Inside help suspected

The FIR names several bank officials for allegedly enabling the fraud, including Suraj Kamble, Kundan Kumar, Prashant Bagul, Aditya More, and Deepti Killedar. The submitted documents were reportedly notarised in both Hyderabad and Mumbai to give them legal cover.

The Bombay High Court had earlier pulled up the police and the bank for delays in registering the case, terming it a potential insider job. The court has also directed that the stolen shares be restored to the victim and frozen until further notice.

Police action

The accused remains on the run. As per standard procedure, the police have circulated his photograph and details to police departments across all states to aid in the lookout. However, no actionable tip-offs have been received so far. Officers said they have scanned CCTV footage from all possible locations where the accused might have been during the suspected timeline of the crime, based on witness accounts and the panchnama, but with little success. Even technical surveillance has yielded no breakthroughs. Officials say they are now hoping for leads through social media or public assistance, should anyone recognise or spot the accused.

2022

Year fraud came to light

2019

Year shares were fraudulently transferred

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!