Thugs are remotely taking control of phones of those unable to repay loans, threatening to leak photos, shaming them among all their contacts

Credit default notice form

Amid the financial crisis that the COVID-19-induced lockdown has caused, borrowers are having to contend with loan recovery agents who have resorted to new ways of harassment. Loan companies are accessing phonebook data of their borrowers through mobile apps that they are made to download to apply for the loan. The recovery agents then not only abuse defaulters and their families, but also threaten to send personal pictures to all their contacts.

A few borrowers approached the police but could not get an FIR registered. Others chose not to go to police, fearing their phones would be confiscated.

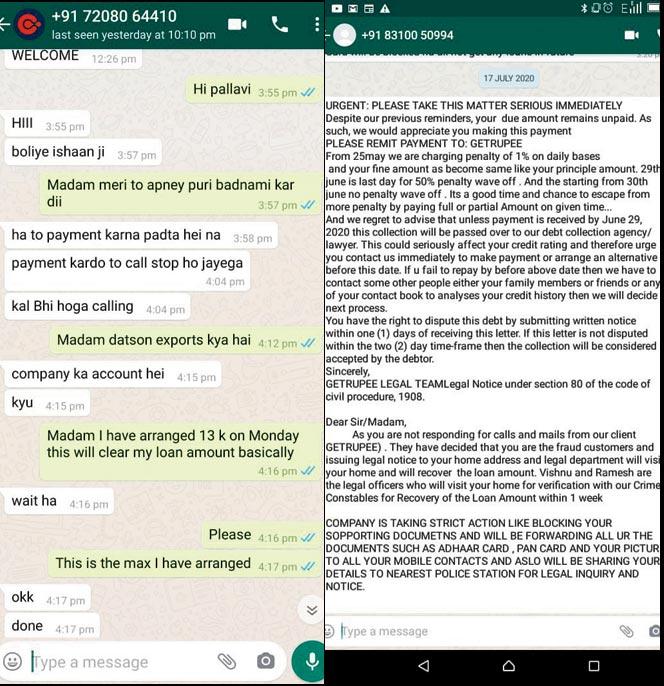

A screenshot of Ishaan Vandoor's chat with a loan recovery agent; (Right) A notice for defaulting on loan repayment

Private professional Ishaan Vandoor, 30, a resident of Chira Bazaar at Marine Lines, told midday that he had taken a loan of Rs 25,000 from Creditt, in March and was supposed to repay it on April 22. When he defaulted, his relatives, friends, colleagues, wife, mother and several others were contacted by recovery agents, who defamed him.

Needed money for meds

"I had borrowed the money for a medical emergency. I had sincerely requested the recovery agents to give me some time as I suffered pay cuts during the lockdown. They called over 60 people from my phone contacts. I don't know how they accessed them. They are threatening to form a WhatsApp group and abuse me there," Vandoor said.

Representation pic/Getty Images

"They also threatened my diabetic mother. Her health deteriorated. She gave me all her jewellery to repay the loan.

"With several fines and high rate of interest, I ended up paying Rs 48,000," said Vandoor, who did not approach the police as he wanted to be rid of the recovery agents.

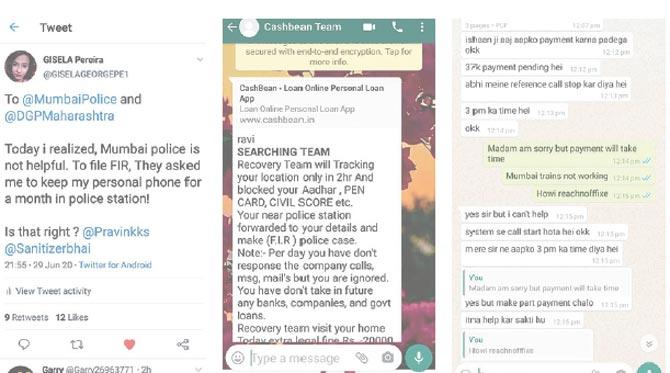

(From left) Gisela Pereira's tweet; CashBean’s message on WhatsApp to a defaulter; Ishaan Vandoor's WhatsApp chat with a loan recovery agent

Account assistant at a resort, Chetna Kadu, 32, hails from Sion. She took a loan of Rs 13,900 from CashBean and another of Rs 4,500 from MoneyMore to buy medicines for her mother. Due to financial difficulties, she could not repay the loan.

"The recovery agents verbally abused me. MoneyMore sent me a list of contacts saved in my phonebook and threatened to call everyone if I didn't pay up. I am stuck near Matheran and I can't even visit the police station in Sion to register the complaint," she said.

Gisela Pereira, 27, took a loan of Rs 5,000 from GetRupee but lost her job during the lockdown. "I received a list of contacts in my phonebook. My father, cousins were contacted.

"I approached Vikhroli police but they did not register an FIR. Recovery agents say they have all my phone data including photos," Pereira said.

COVID patients not spared

Korobi Pramanik, 24, from Ulhasnagar, said, "I took a loan of R5,000 from Rupee Loan in March.

"I lost my job and also got infected by COVID-19 and could not repay. When I told them I am infected, they said, 'First repay the loan and then go to COVID hospital'. How can someone be so insensitive?"

Access through apps

Govind Ray, a cybercrime consultant, said, "As everyone tries to cope with the financial crisis, loan companies are using malicious means to recover dues. Here, users are required to download mobile applications to apply for loans.

"These apps can access the phonebook. But if you default, the recovery agents will use the information in the phone book to call relatives. In a few cases, recovery agents send the entire copy of phone books to the borrower to threaten and scare them."

According to Ray, the phone book data is accessed from the mobile while the user is filling the application form.

"Trading of data through illicit means has been a problem in the past 10 years. There is a possibility of the data being used for unlawful purposes.

"Another observation is that in a lot of companies, one of the partners is a Chinese individual," Ray said.

Ray added that borrowers can approach police if recovery agents are using illegal means such as blackmail, threats, abuse, etc.

"The borrower can take legal action against the recovery agent, the agency along with the bank that has hired the agency.

"As per RBI guidelines, this can be reported to police and to RBI too," he said.

In this case, since the malicious activity also involves offences in cyberspace, it would also involve penal provisions of the IT Act 2000 for unauthorised access and breach of privacy.

What cops say

"Cyber criminals have always been in search of new modus operandi to target people.

"This is a new one that I am hearing. To the best of my knowledge, no such case has been registered in Mumbai. But if any borrower approaches us, we will definitely probe for illegal activities like data breach," Shahaji Umap, spokesperson for Mumbai police said.

Rs 25,000 Amount Ishaan Vandoor had borrowed

Rs 48,000 Amount Vandoor had to pay after fines and interest

Rs 5k Amount borrowed by Korobi Pramanik, who got infected by COVID-19

60 No. of Ishaan Vandoor's contacts called by the recovery agents

Rs 5k Amount borrowed by Gisela Pereira

Catch up on all the latest Mumbai news, crime news, current affairs, and a complete guide from food to things to do and events across Mumbai. Also download the new mid-day Android and iOS apps to get latest updates.

Mid-Day is now on Telegram. Click here to join our channel (@middayinfomedialtd) and stay updated with the latest news

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!