Inching closer towards rolling out of GST, the GST Council yesterday approved a law to compensate states for any loss of revenue from the implementation of the new national sales tax, but deferred approval for enabling laws to next meeting.

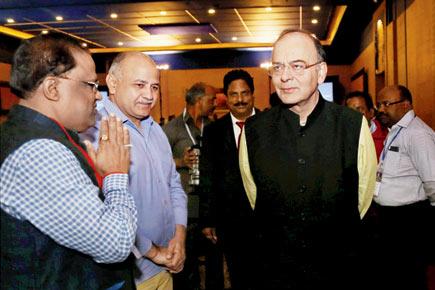

Arun Jaitley, Manish Sisodia

Arun Jaitley with Delhi deputy CM Manish Sisodia during the 10th meeting of GST council at Udaipur on Saturday. Pic/PTI

Udaipur: Inching closer towards rolling out of GST, the GST Council yesterday approved a law to compensate states for any loss of revenue from the implementation of the new national sales tax, but deferred approval for enabling laws to next meeting.

The all-powerful GST Council will meet again on March 4 and 5 to approve the legally vetted draft of the supporting legislations for Central GST (C-GST) and Integrated GST (I- GST), days before the start of the second leg of the Budget Session beginning March 9, where the Centre is hoping to get them approved. It will also approve the State GST (S-GST) law, Finance Minister Arun Jaitley said after the meeting.

After laws are approved, the Council will get down to fixing rates of taxes for different goods and services by fitting them into the four approved slabs of 5, 12, 18 and 28 per cent, he said.

Jaitley added that the approval essentially means the Centre will provide to make up for any loss of revenue to states in first five years of rollout of GST regime.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!