From skirt lengths to serotonin-fuelled shopping, Gen Z is decoding the economy through pop culture, not policy

The “Lipstick effect” is a theory that suggests that during economic turmoil, people turn to smaller-ticket-size indulgences, such as lipstick. Pic/iStock

Times have been tough lately. US President Donald Trump is announcing tariffs, meanwhile back home we almost had a war. We have been consuming way too much information, all the while being anxious about the future. In such a time, a new word has entered the lexicon — “recession indicators”. To gauge their way through this economic instability, Gen Z isn’t quoting GDP graphs or inflation rates. Instead, they’re clocking in their clues from lipstick sales and skirt lengths. Welcome to the age of Recession Core.

Recession indicators are informal signs of an incoming recession. They don’t really need to have any formal backing, they are generally circulated around the Internet as memes. One of the most outlandish recession indicators is the cartoon show Phineas and Ferb. The show first aired in 2007, right before the market crash in 2008. And now, for the first time in 10 years, a new season of the show is set to air in June.

Sunday mid-day does a deep dive into these informal indicators: What are they? How exactly does something become a recession indicator? And most importantly, are they legitimate?

Indicator 1: When you buy more lipstick

Kahkashan Sehgal is an aspiring actress and make up artist

Kahkashan Sehgal is an aspiring actress and make up artist

Kahkashan Sehgal is freshly graduated from college. Right now she is in acting school, pursuing her dreams of being on a film set. She’s also a big makeup and beauty enthusiast. “I mean, there is a recession coming for sure, the obvious signs are all around us. Budgets seem to be tight for everyone,” says the 21-year old, “Since I just graduated, I am also speaking to employers and even they have very little money to offer salaries. You hear of so many lay-offs and even my friends who are job hunting, have had such bad luck.”

The “Lipstick effect” is by far the most popular “recession indicator” in the recent zeitgeist. It’s a theory that suggests that during economic turmoil, people turn to smaller-ticket-size indulgences, such as lipstick. We still want to buy, to regain a sense of normalcy, to fulfill our desire to consume, to get the rush of serotonin from shopping, but the only products we can buy are the affordable ones, making a spike in lipstick sales a recession indicator. Sehgal says, “What’s interesting about the lipstick effect is that it isn’t obvious. No one would think lipstick sales going up equals a recession. Obviously a bad job market or lay-offs make you think of a recession, but even something as disconnected as lipsticks? That’s what gets me in.”

Indicator 2: ChatGPT is our best friend

Dipti Sant aspires to work in policymaking and international relations

Dipti Sant aspires to work in policymaking and international relations

Dipti Sant graduated with an undergraduate degree in Mass Media. She says, “For me, a big indicator is the rise of ChatGPT and losing our thinking capacities. I remember our late Head of Department, Ms Perrie Subramaniam, talking about how our generation is going to lose all our critical thinking skills in 10 years. And this was before ChatGPT, so that has for sure sped up that process by a mile.”

The 20-year-old says, “Honestly, recession indicators seem to be a joke to many people. I don’t think any of us are that read up on the subject, but I have seen a lot of content about it and it seems to make sense — especially losing critical thinking skills. When the going gets tough, you want to turn your brain off, or at least outsource that job.” Cognitive offloading refers to the use of external tools to finish mental tasks you could have done yourself, just to ease the load on our brains.

Examples of this are using calculators to add two numbers, or using Google Maps instead of remembering every route in your city.

Although cognitive offloading generally makes our lives much simpler, offloading our entire critical thinking skills may prove dangerous. “Obviously, students are abusing ChatGPT to write essays or finish assignments, but I know of people who cannot finish any task before running it past ChatGPT, asking it for relationship advice; I even know of someone who asked ChatGPT before naming their child. Thinking takes a lot of energy, and during a recession, you simply don’t have the bandwidth,” she concludes.

Indicator 3: Hemlines are getting longer

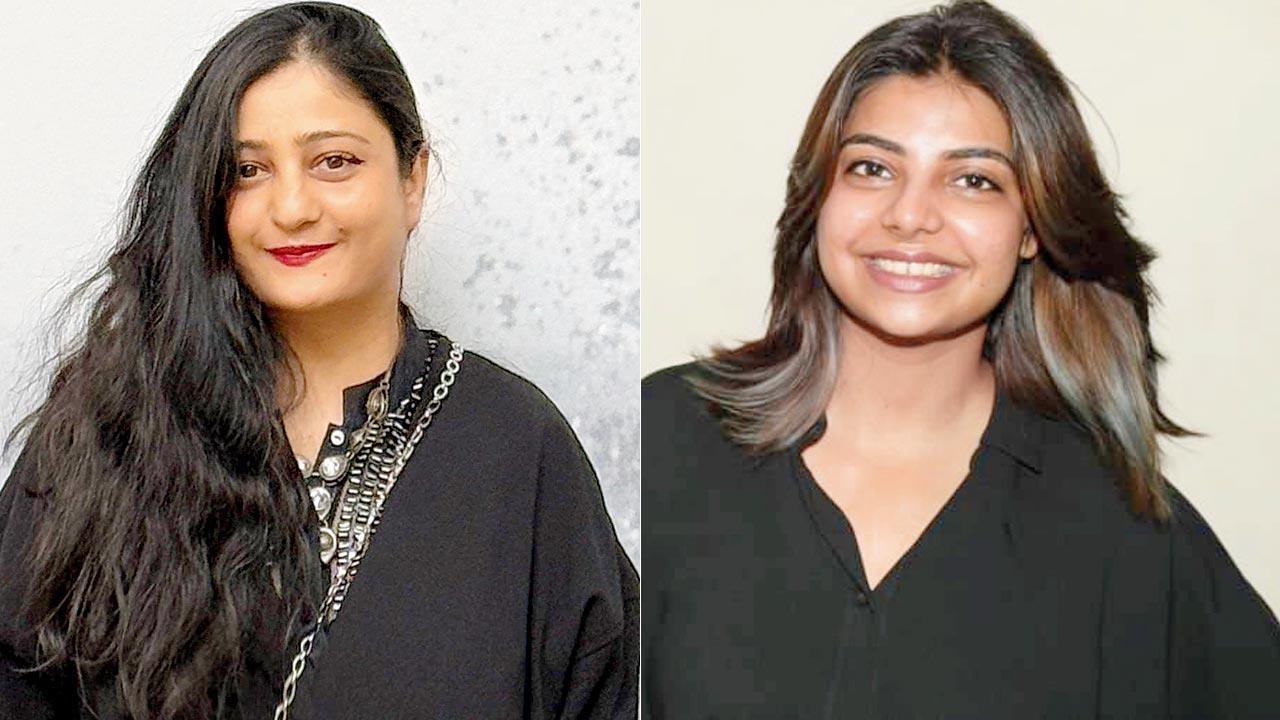

Charu Gaur, editor for Runway Square, and creative director and fashion strategist; (right) Lakshita Shivhare is a creative intern at a production house, here in Mumbai

Charu Gaur, editor for Runway Square, and creative director and fashion strategist; (right) Lakshita Shivhare is a creative intern at a production house, here in Mumbai

The Hemline Index seems to suggest that during economic downturns, women’s hemlines tend to go down. Lakshita Shivhare is a 21-year-old “chronically online” Gen Z, with a special interest in fashion history. “You can look throughout history. The Roaring Twenties are known to be a scandalous decade; skirt lengths only kept going up — until the Great Depression happened. Women’s fashion changed almost overnight. Suddenly, skirts were much longer. In the 1960s, when America was going through a huge boom, women were all about mini-skirts.”

When asked why she thinks this happens, she said, “Because when you don’t have money, you don’t really go out just to have fun. There are no ‘Roaring 20s’ parties. The only places you go to are work and home, and why would you wear a mini-skirt to either?” she says.

Charu Gaur, editor for fashion magazine Runway Square, as well as a creative director and strategist in fashion, tells us, “It’s highly debated whether this is a valid indicator. But it’s about how we feel. If we’re feeling joyous, we want to dress sexy. But if you’re feeling like you just need to get through this year somehow, you might dress more conservatively,” she concludes.

The Hemline index isn’t the only prevalent fashion-economic index though. Say hi to the “Men’s Underwear Index (MUI)”, an index that suggests that men’s underwear sales going up usually suggests an economic recovery. The logic is that when times are tough, men will often postpone underwear purchases because it isn’t considered an absolute essential. The idea was first popularised by Alan Greenspan, who was an American economist and served as the Chairman of the Federal Reserve for about two decades.

Indicator 4: It’s the era of the dance song

Rishi Pinjani is a media and communications student at Jai Hind College

Rishi Pinjani is a media and communications student at Jai Hind College

In hard times, a simple escapist fantasy is exactly what the doctor ordered. And hence, we have the birth of “recession pop” — a term that first gained popularity during the 2008 market crash — an era of music marked by fast, frenetic songs, each with a Beats Per Minute (BPM) higher than the last. Some highlights from the era are I Gotta Feeling by Black Eyed Peas, Teenage Dream by Katy Perry, and Just Dance by Lady Gaga. Similarly, even the 1980s saw the rise of disco when the economy was experiencing a brief recession.

A super fan of Charlie xcx’s album B and college-going student Rishi Pinjani explains the reasoning of recession pop: “The point of these songs wasn’t to write deep or intellectual lyrics; the focus was to be feel-good. The writing is right there on the wall. Brat by Charli XCX just won a Grammy, house music is on the rise,

and people simply cannot get enough of techno music.”

So are we really facing recession?

Madan Sabnavis, the chief economist at Bank of Baroda, opines, “I won’t agree that there is a recession coming. Technically speaking, a recession means two quarters of negative growth, and we’re definitely not in that situation. We are actually growing at a fairly decent pace of 6.5 per cent.”

He explains further, “The question is are people spending more? The FMCG segment shows that people are not spending, urban spending has come down on mere account of inflation. The lipstick effect does not gel with the fact that we have seen a tremendous increase in experience spending of Gen Z. For example, all the concerts that are taking place — everything has gone housefull, and the kids are spending like mad. I would say that the youth are spending more on, say, lipsticks, because they like to look good when they go to these concerts. Similarly, young people today are travelling a lot, in the country and outside.”

Ritu Dewan, however, disagrees, “GDP has been long debated as an imperfect measure of growth, as mere growth does not ensure development nor inclusion. We may be growing on paper but, we’ve been having signs of a recession for a long time. Profits may be increasing for large corporations, but wages are falling. Scooter sales are declining, but fancy car sales are going up. Affordable housing is nowhere to be found. So this means that a certain part of the economy isn’t affected by the recession, a larger majority is bearing the brunt of it. Lifestyle itself is determined by economy, they are both a mirror of each other. When you notice a shift in your lifestyle, when you have to cut down on expenses, and only stick to necessities, one can sense that the economy is not in a healthy state.” This obsession and hyper-analysis could just be a result of the immense anxiety faced by this generation. And after all, even the economy isn’t immune to a vibe check.”

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!