A non-cognisable offence was registered against a Mulund restaurant after lawyer Abhishek Nakashe complained to the police about the Rs 39 service charge in his Rs 525 bill

When he headed out for lunch on July 18 with his sister, Amruta, Mulund lawyer Abhishek Nakashe didn’t imagine he would end up at a local police station. The siblings were at Secret Spice, a vegetarian global cuisine restaurant on LBS Marg, Mulund, enjoying a meal of Mushroom Hara Dhania, Masala Tandoori Roti and Cheese Mushroom Caps.

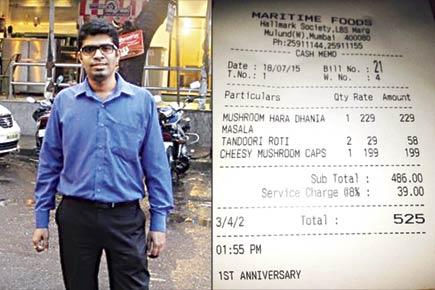

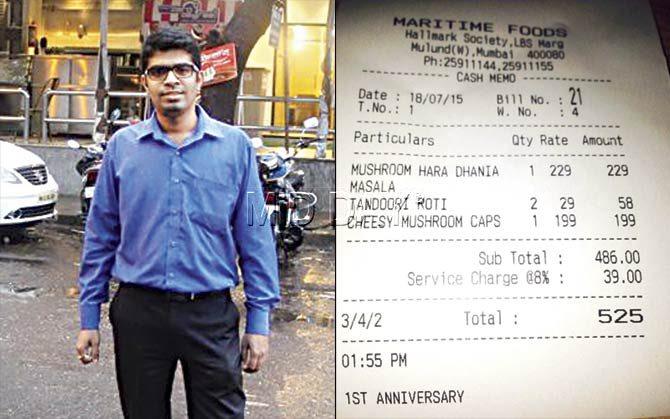

Abhishek Nakashe outside Secret Spice restaurant on LBS Marg in Mulund, where an 8% service charge on his bill. Pic/Rajesh Gupta

At the end of it, they were presented a bill of Rs 525, which included Rs 39 as service charge. Nakashe inquired about the component with a steward, refusing to pay it since the eatery’s menu didn’t carry a mention of the percentage it billed customers as service charge.

A heated argument later, the two claim they were confined to the restaurant for half an hour by manager Rama Murthy, and the staff, until the police were called. Nakashe filed a complaint against the restaurant with Mulund police station, making this possibly the first case in the suburb - if not the city - to have been registered for levying service charge.

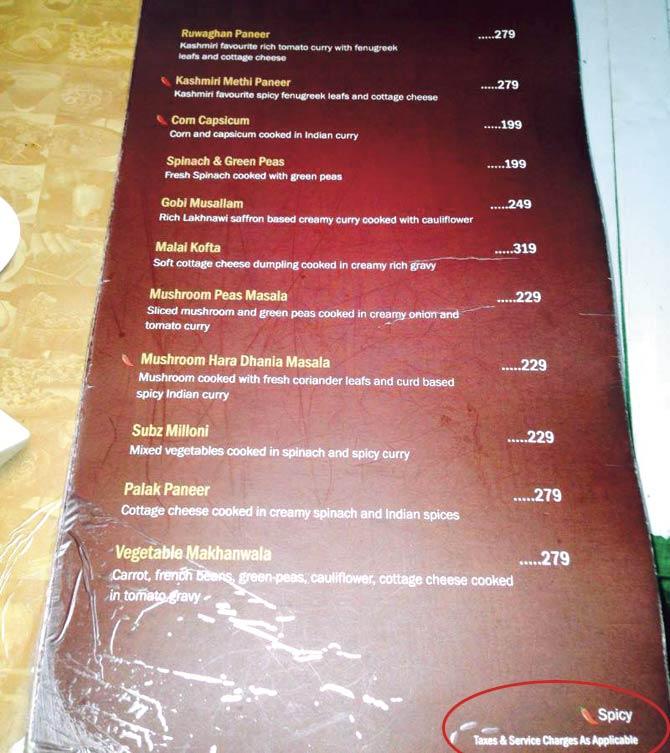

The menu at Secret Spice just mentions ‘Taxes and Service Charges as Applicable’. Pic/Sharad Vegda

“Service charge is a deceptive nomenclature, and rarely do restaurants clarify the per cent levied in their menus, although it is mandated that they do. While I usually pay up when eating out, I decided to take up the issue this time because there was ambiguity in the menu and the management wasn’t forthcoming with an explanation,” said Nakashe.

The siblings say they had to convince the police to act. Finally, a non-cognizable offence (NC) was registered. The police, for their part, were baffled about what section to charge the restaurant with. The section that was finally applied was 504 (intentional insult with intent to provoke breach of peace), which calls for imprisonment for up to two years, a fine, or both.

Duty officer Ankush Waghmode, who took Nakashe’s complaint, said it took him some time to investigate if specific taxation laws, if any, could be applied. Lawyers contacted by mid-day said that the NC can be converted into an FIR in a Magistrate Court, following which the police are free to investigate the matter. Nakashe could also choose to take up the matter with the Sales Tax Department or Consumer Court.

Murthy explained that service charge is levied by restaurant owners as payment for services rendered, including serving food, and is distributed among kitchen staff. “No restaurant declares service charge percentage in its menu. It’s a charge that’s levied because generous tips from customers have dried up,” he said.

Service charge is a variable component of the invoice, and falls between 5 per cent and 12 per cent (it was 8 per cent in the case of Nakashe’s bill). It’s usually charged for in-house dining, not takeaways. While tips go primarily to the stewards, service charge is evenly distributed among all staff, including the back-end guys, after taking breakage and damages into account.

While Chandrahas K Shetty, advisor to the Indian Hotel and Restaurant Association (AHAR), clarified that the management was liable to declare service charge percentage to customers, a top city restaurateur requesting anonymity, clarified, that the “commotion” over the levy was because in April this year, the government had upped another variable component of the restaurant bill the service tax by a percentage point.

“A menu is a bill of sale and must clearly mention the rate of service tax and service charge being imposed. If it doesn’t, there is a problem,” he said. While customers argue that since a bill incorporates all costs, including a profit, the service charge is an unnecessary burden.

Hospitality industry members, like Nachiket Shetye, however, hope that diners understand the significance of the service charge in time of inflation. The director of Cellar Door Hospitality, said, “It’s an important component to supplement the need of the staff that depends largely on tips and customer generosity for sustenance.

Most restaurant staffers remain loyally employed depending on the amount and fairness with which service charge is distributed among them, over and above their salary. But in the case that a customer has had a less than pleasant experience, we are more than happy to waive it off.”

Satish Shetty of Maritime Food, the hospitality firm that runs Secret Spice, has however, agreed to change the menu to print the charge levied clearly. “Restaurants in Mumbai have been levying service charge for the last 40 years, but yes, we will make a correction on the menu,” he said.

Decode your restaurant bill

Other than service charge, your dining out bill could have sundry components, inflating the amount you pay.

Service tax: This is a component that goes to the Central Government, who imposes a levy on the services you enjoy. Earlier, it covered restaurants that were air-conditioned, and served alcohol, but now applies to all eating joints. In the last budget, service tax was upped from 12.36 per cent to 14 per cent, and most restaurants charge it on 40 per cent of the total bill (including service charge). The resultant rate of service tax because of the cap of 40% works out to be 5.6%. This rise, say hoteliers, is responsible for growing consumer resistance.

Service charge: It's a variable component of the invoice, and falls between 5 per cent and 12 per cent.

Value Added Tax (VAT): VAT varies between states (Maharashtra charges 12.5%) and differs according to category of beverage and food item. For instance, it is 20 per cent for hard liquor, 5% for wine.

Charity: Some eateries that tie up with non-profits, add a nominal amount to the bill, which they then pass on to the charity. The fine print of the bill tends to mention it but most guests are unaware that they are playing Good Samaritan, and may even oversee the additional charge on the bill.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!