From 2023 to Q1 2025 alone, 106.4 Mn sq. ft. of new Grade A office space have been added across major cities. ANAROCK notes that out of the 850 Mn sq. ft. of total Grade A office inventory in these cities, nearly 47 per cent (400 Mn sq. ft.) is over a decade old and ripe for upgradation to REIT standards, potentially unlocking further listings

Mindspace Business Parks REIT delivered a 23.34 per cent annual return. Pic/ ANAROCK Research

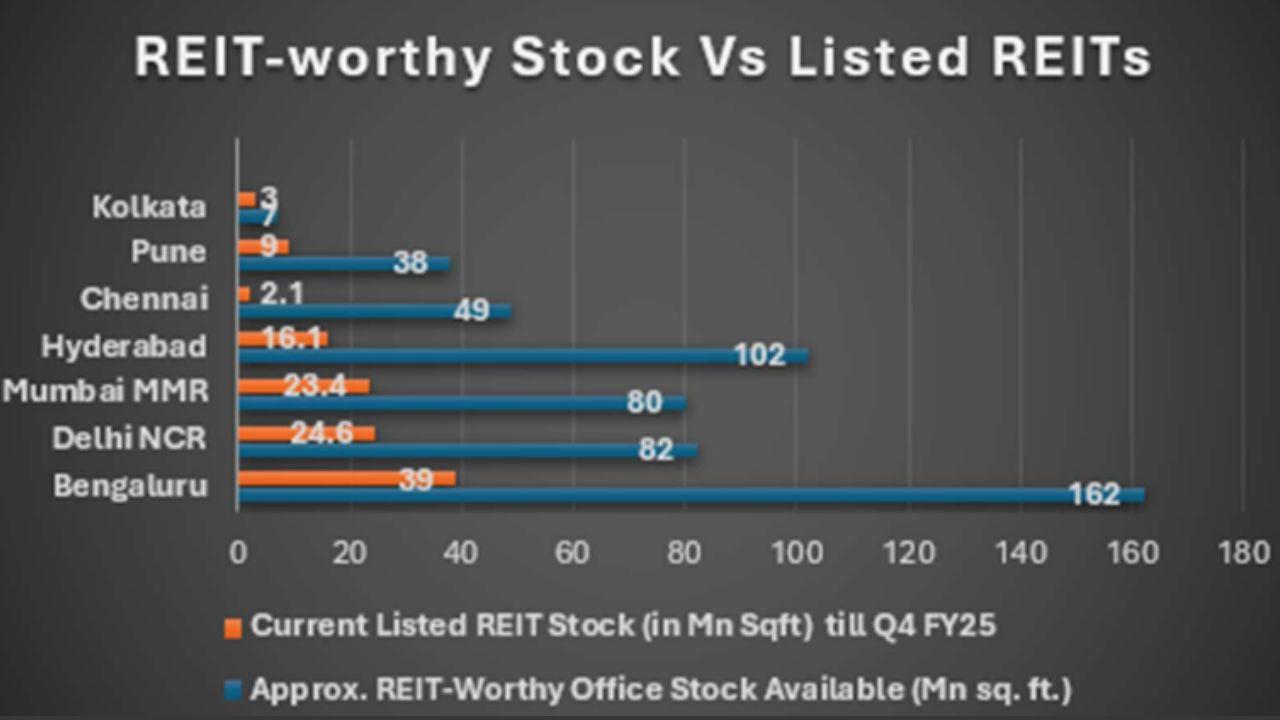

Despite a strong trajectory since the launch of Real Estate Investment Trusts (REITs) in 2019, India’s REIT landscape remains largely underpenetrated. According to the latest data by ANAROCK Research, only 23 per cent of the total REIT-worthy office stock, estimated at around 520 million sq. ft. across the top seven cities, is currently listed under existing REIT portfolios.

Anuj Puri, Chairman of ANAROCK Group, highlighted the untapped potential, “The three listed REITs in India—Embassy Office Parks, Mindspace Business Parks, and Brookfield India—currently manage a combined office portfolio of 117.2 million sq. ft., reflecting just a fraction of the total REIT-able space. This points to considerable headroom for further listings and market consolidation.”

Southern cities hold the largest REITable stock.

Southern metros remain the biggest contributors to potential REIT listings:

Bengaluru leads with approx. 162 Mn sq. ft. of REIT-suitable office space, though only 24 per cent (approx. 39 Mn sq. ft.) is currently listed.

Hyderabad has 102 Mn sq. ft., with just 16 per cent listed.

Chennai, despite having 49 Mn sq. ft. of qualifying stock, has only 4 per cent listed.

Western and Northern markets show similar trends

Mumbai Metropolitan Region (MMR) has approx. 80 Mn sq. ft. of REITable space, with 29 per cent listed.

Pune follows with 38 Mn sq. ft., and 24 per cent listed.

In Delhi-NCR, about 30 per cent of the total 82 Mn sq. ft. REIT-suitable stock is listed.

Kolkata, although smaller in volume, has the highest listing ratio with 43 per cent of its 7 Mn sq. ft. already under REITs.

Significant Growth in REIT-Ready Stock Since 2023

India’s REIT-worthy office stock has grown by 36 per cent over the last two years, from 383 Mn sq. ft. in 2023 to 520 Mn sq. ft. in 2025.

This growth is attributed to both the influx of new Grade A office developments and the upgradation of older office buildings to modern standards.

From 2023 to Q1 2025 alone, 106.4 Mn sq. ft. of new Grade A office space have been added across major cities. ANAROCK notes that out of the 850 Mn sq. ft. of total Grade A office inventory in these cities, nearly 47 per cent (400 Mn sq. ft.) is over a decade old and ripe for upgradation to REIT standards, potentially unlocking further listings and rental growth of 10–30 per cent.

REIT performance remains strong

India’s listed REITs have shown robust performance over the past year, buoyed by steady leasing demand and rental escalations:

Mindspace Business Parks REIT delivered a 23.34 per cent annual return.

Brookfield India REIT recorded a 15.19 per cent return.

Embassy Office Parks REIT followed with a 9.17 per cent gain.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!