Technical analysis is often seen as complex or only for experts. But Malkan simplifies it with one tool: price action.

Vishal Malkan

As India sees a record surge in stock market participation, one critical gap remains: education.

As India sees a record surge in stock market participation, one critical gap remains: education.

Millions are entering the markets, but most don’t know how to read a price chart. Instead, they rely on tips, tweets, or gut instinct. But trading isn’t guessing-it’s a skill, says trading coach Vishal B Malkan, who has been teaching for over 27 years.

“You can’t control the market. But if you learn to read the chart, you can control your trades.”

Start with the Basics: Price Action

Technical analysis is often seen as complex or only for experts. But Malkan simplifies it with one tool: price action.

Price action is the art of reading the price itself-without indicators or news. And it starts by understanding three core trends.

1. Uptrend (Bullish Market)

An uptrend is a series of Higher Highs (HH) and Higher Lows (HL). The price rises steadily, with every dip followed by a stronger bounce.

It reflects bullish sentiment, as buyers are willing to enter at higher levels.

Example: ₹100 → ₹110 → ₹105 → ₹115

Each high and low is higher than the last.

2. Downtrend (Bearish Market)

A downtrend shows Lower Highs (LH) and Lower Lows (LL). Price keeps falling, and even recovery attempts are weak.

This indicates selling pressure and lack of buyer strength.

Example: ₹150 → ₹140 → ₹145 → ₹130

Each high and low is lower than the previous one.

3. Sideways Trend (Range-Bound Market)

Here, the price fluctuates between support and resistance levels. There’s no clear direction-just consolidation.

This often comes before a strong breakout in either direction.

Example: A stock bouncing between ₹95 and ₹105 is in a sideways trend.

In the chart below, you’ll see how a stock can go through all three phases:

- Uptrend: Strong rally with Higher Highs and Higher Lows

- Sideways: Consolidation phase, price stuck in a range

- Downtrend: Breakdown with Lower Highs and Lower Lows

“Charts are the ECG of the market. You don’t need to know why a stock moves, just understand what it’s doing and where it could go next,” he explains.

India has passionate traders, but not always informed ones. If the goal is wealth and not just thrill, then education must come before execution.

Vishal B Malkan’s message is clear:

Don’t guess the market. Learn to read it with structure, discipline, and clarity.

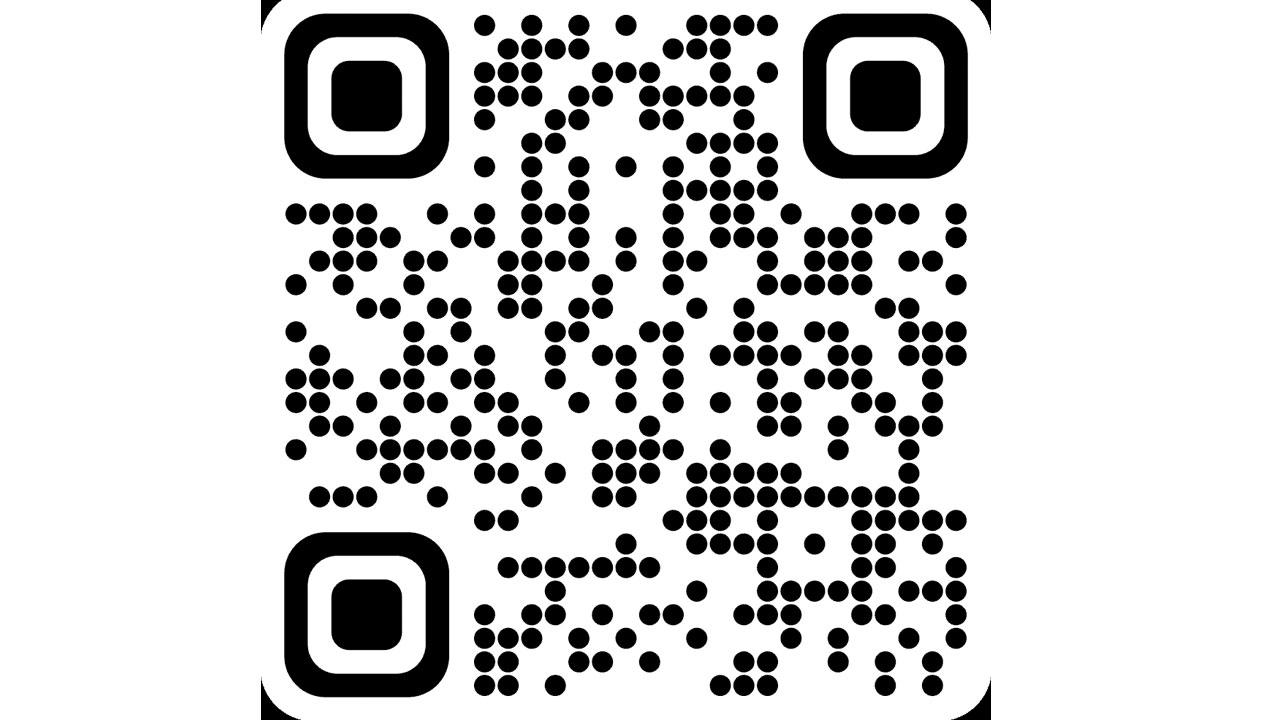

For a More Detailed Explanation (in Gujarati), you can watch a dedicated video in Gujarati on Vishal B Malkan’s YouTube channel.

https://www.youtube.com/@malkansview5305

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!