Chaired by Finance Minister Nirmala Sitharaman, the marathon 56th Council meeting lasted over 10 hours and saw the Centre and states reach consensus on sweeping reforms. Bihar Deputy Chief Minister Samrat Choudhary said that all states were on board for the rate rationalisation, and it was a “consensus-based decision"

Finance Minister Nirmala Sitharaman at the 56th GST Council meeting, in New Delhi, on Wednesday. PIC/PTI

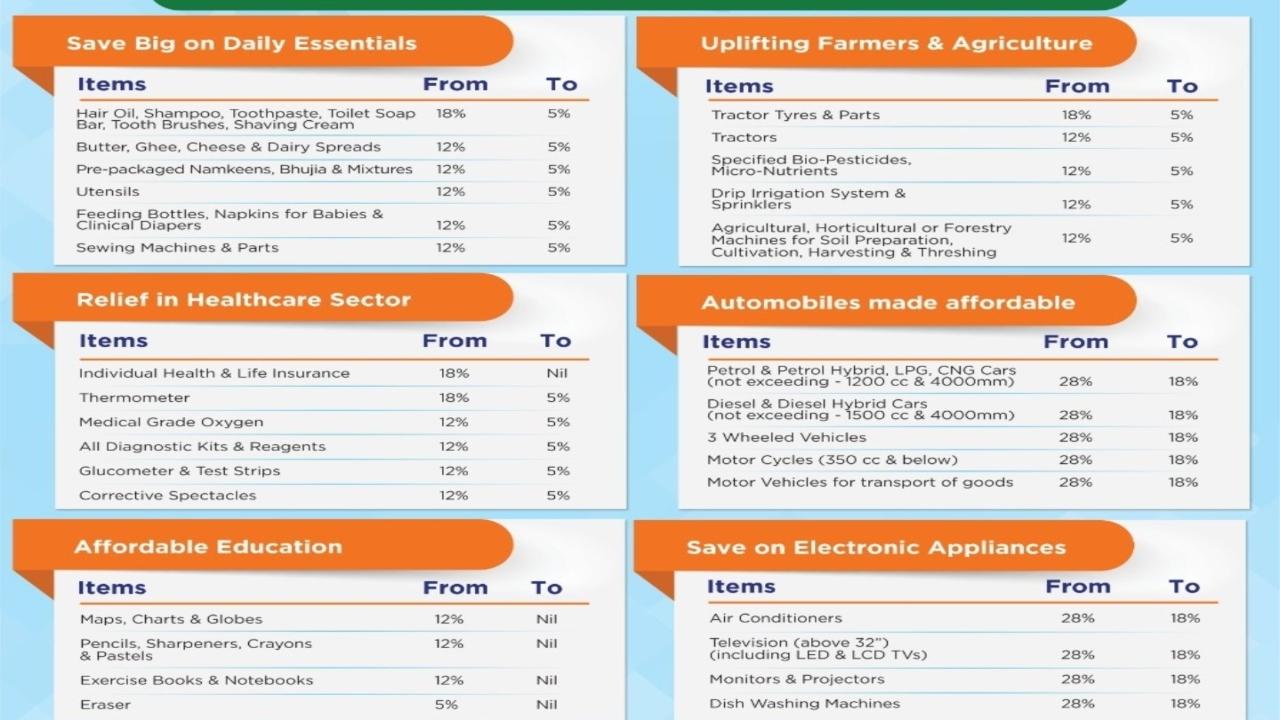

In a landmark decision aimed at rationalising India’s indirect tax regime, the goods and services tax (GST) Council on Wednesday scrapped the existing four-slab structure and approved a simplified two-tier rate system of 5 per cent and 18 per cent, effective from September 22.

GST reforms: Full list here

Chaired by Finance Minister Nirmala Sitharaman, the marathon 56th Council meeting lasted over 10 hours and saw the Centre and states reach consensus on sweeping reforms. Bihar Deputy Chief Minister Samrat Choudhary said that all states were on board for the rate rationalisation, and it was a “consensus-based decision.”

Under the revised structure, personal care items like hair oil, shampoo, toothpaste and dental floss will now attract 5 per cent GST instead of 18 per cent. Packaged snacks such as namkeens, bhujia, mixtures and chabena will also move to the 5 per cent slab from 12 per cent, providing relief to consumers.

GST on all TV sets at 18 pc; small cars, motorcycles up to 350 cc will be charged 18 pc: FM Sitharaman.

— Press Trust of India (@PTI_News) September 3, 2025

GST on handicrafts, marbles, granite blocks to be 5 pc: FM Sitharaman.

GST rate on cement to come down to 18 pc from 28 pc; tax on three-wheelers down to 18 pc from 28 pc: FM… pic.twitter.com/PtfTQcZzvo

Conversely, the Council has raised the tax on tobacco products, including cigars, cigarettes, cheroots and substitutes, from 28 per cent to 40 per cent. Goods with added sugar, sweeteners or flavours, such as aerated waters, will also face a steep 40 per cent tax.

GST Council Meet Updates: "Individual Health & Life Insurance are now GST free," posts @cbic_india #NextGenGST pic.twitter.com/WoV9FhfLDR

— Press Trust of India (@PTI_News) September 3, 2025

West Bengal Finance Minister Chandrima Bhattacharya said the total loss due to GST rate rationalisation would be Rs 47,700 crore, while Uttar Pradesh Finance Minister Suresh Khanna said no decision has been taken on the tax incidence on demerit goods, and imposing a levy over and above the 40 per cent would be decided later.

Prime Minister Narendra Modi had stated in his Independence Day speech that the Central government is proposing significant reforms in GST, focused on three pillars of structural reforms, rate rationalisation, and ease of living. The reforms, he said, would strengthen key economic sectors, stimulate economic activity, and enable sectoral expansion. "During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST. The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and strengthening the economy. Glad to state that @GST_Council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Government on GST rate cuts & reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth. The wide ranging reforms will improve lives of our citizens and ensure ease of doing business for all, especially small traders and businesses," he wrote.

PM Modi (@narendramodi) posts: "During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST. The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of… pic.twitter.com/pQnmAgQeJK

— Press Trust of India (@PTI_News) September 3, 2025

The GST Council also said the new tax regime will provide greater rate stability and improve compliance, while easing the cost burden on essential goods and services.

(With IANS and PTI inputs)

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!