In her first Budget in 2019, Sitharaman replaced the decades-old leather briefcase with a traditional red ‘bahi-khata’, symbolising a shift in presentation style. Continuing the practice of recent years, the Union Budget 2026–27 will be paperless, marking the fifth consecutive digital Budget

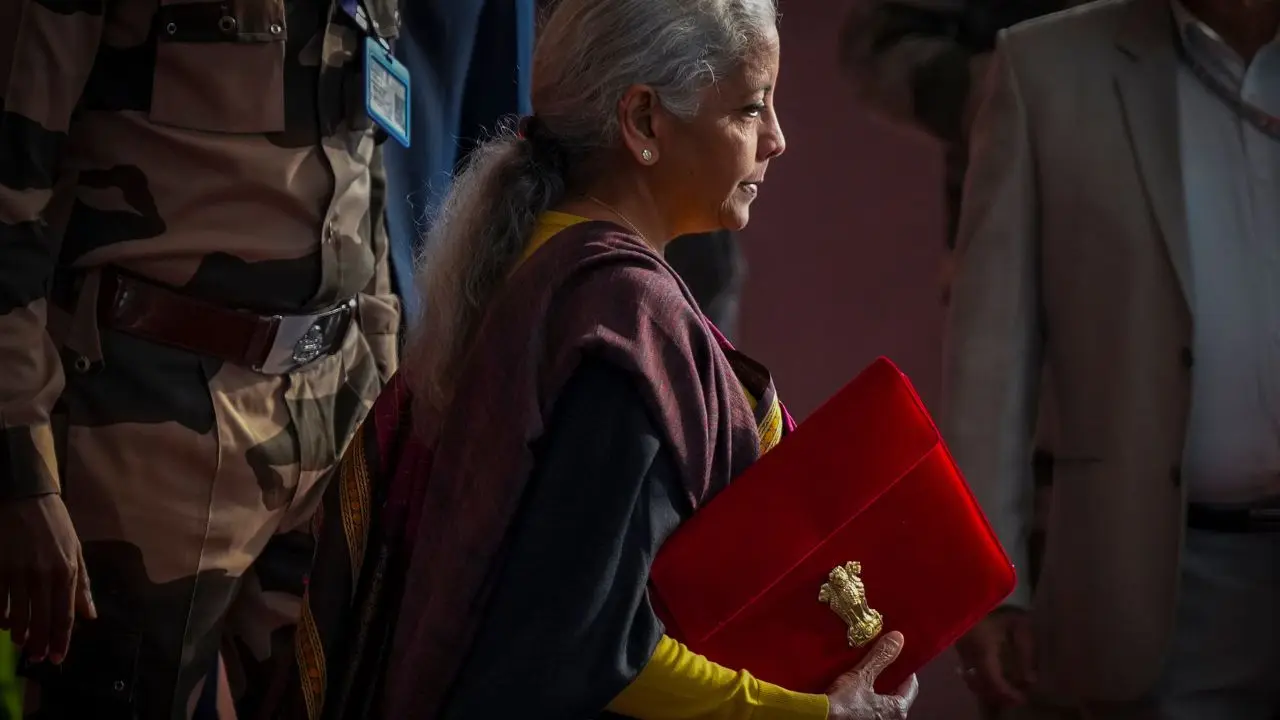

FM Nirmala Sitharaman with her traditional red ‘bahi-khata’ on Sunday. Pic/ PTI

In her first Budget in 2019, Sitharaman replaced the decades-old leather briefcase with a traditional red ‘bahi-khata’, symbolising a shift in presentation style. Continuing the practice of recent years, the Union Budget 2026–27 will be paperless, marking the fifth consecutive digital Budget.

Union Budget 2026: Assessing India’s current financial health ahead of FY27

India heads into Union Budget 2026 at a moment of relative strength—but with limited room for error. The macroeconomic backdrop remains supportive, though increasingly fragile amid global uncertainties.

Economic growth is holding firm. The Economic Survey projects real GDP growth of 6.8–7.2 per cent in FY 2026–27, a moderation from the 7.4 per cent estimated for the current year, yet still among the fastest growth rates globally.

The government’s fiscal stance remains calibrated. The fiscal deficit stood at 4.8 per cent of GDP in FY25 and is targeted at 4.4 per cent in FY26, even as public investment continues to play a central role in sustaining growth.

Capital expenditure remains a key anchor. Budgeted capex for FY26 stands at Rs 11.21 lakh crore, while effective capex—including grants for asset creation—reaches Rs 15.48 lakh crore, reinforcing the government’s infrastructure-led growth strategy.

Inflation has eased significantly, averaging 1.7 per cent between April and December 2025, providing policymakers with some headroom. However, external pressures persist, with exports facing global trade frictions, keeping the focus firmly on domestic demand and public investment.

While domestic demand remains resilient, global headwinds are intensifying. Rising US tariffs and sluggish global growth have weighed on exports, while private investment continues to remain cautious.

As a result, economists expect the government to continue leaning on public spending, particularly in sectors such as roads, ports, energy and defence, even as it remains committed to fiscal consolidation. Capital expenditure is likely to rise further, alongside a gradual lowering of the fiscal deficit target.

Here are the key numbers and themes to watch in the Union Budget for FY 2027

Fiscal deficit

The budgeted fiscal deficit for the current financial year (FY26: April 2025–March 2026) is estimated at 4.4 per cent of GDP.

Having achieved a fiscal consolidation target below 4.5 per cent, markets will look for clarity on the debt-to-GDP reduction roadmap and whether the government provides a specific fiscal deficit target for FY27. Expectations are that the deficit could be pegged at around 4 per cent of GDP.

What is capital expenditure and why is it crucial for economic growth?

The government’s planned capital expenditure for FY26 stands at Rs 11.2 lakh crore. The upcoming Budget is expected to maintain a strong capex push, with a 10–15 per cent increase likely, even as private sector investment remains cautious.

With major pay revisions due only in FY28, the government may have room to raise capex beyond Rs 12 lakh crore.

Why do markets closely track the government’s debt-to-GDP roadmap?

In the 2024–25 Budget, Sitharaman stated that from FY27 onwards, fiscal policy would aim to place central government debt on a declining path as a percentage of GDP.

Markets will closely watch the debt consolidation roadmap and timelines for bringing general government debt-to-GDP down to the 60 per cent target. Currently, the ratio is estimated at over 85 per cent, including around 55 per cent central government debt.

What is gross market borrowing and why does the government rely on it?

Gross market borrowing for FY26 was budgeted at Rs 14.80 lakh crore. The FY27 borrowing number will be closely tracked as it signals the government’s fiscal position, revenue mobilisation, and overall borrowing needs.

Tax revenue

The FY26 Budget pegged gross tax revenues at Rs 42.70 lakh crore, an 11 per cent increase over FY25. This includes:

Rs 25.20 lakh crore from direct taxes (personal income tax and corporate tax)

Rs 17.50 lakh crore from indirect taxes (customs, excise duty and GST)

GST

Goods and Services Tax (GST) collections in FY26 are estimated to rise 11 per cent to Rs 11.78 lakh crore.

FY27 GST projections will be keenly watched, especially as revenue growth is expected to gain momentum following rate rationalisation measures introduced since September 2025.

What is the difference between nominal GDP growth and real GDP growth?

India’s nominal GDP growth for FY26 was initially estimated at 10.1 per cent, while real GDP growth stood at 7.4 per cent, as per NSO data. However, nominal growth was revised down to around 8 per cent due to lower-than-expected inflation.

FY27 nominal GDP projections—expected between 10.5 and 11 per cent—will offer cues on the government’s inflation outlook.

How does a higher-than-expected RBI dividend affect fiscal deficit calculations?

The government has budgeted Rs 1.50 lakh crore in dividend income, including Rs 1.02 lakh crore from the RBI and financial institutions, and Rs 48,000 crore from CPSEs.

With the RBI already paying a higher-than-expected dividend of Rs 2.69 lakh crore in FY26, Budget estimates are likely to be revised upward. Dividend assumptions will be closely scrutinised, given recent tax relief measures.

What is the total subsidy allocation?

Total subsidy allocation for FY26 stands at Rs 3.83 lakh crore, with food subsidy capped at Rs 2.03 lakh crore.

What are the key schemes and sectors?

The spotlight will also be on allocations for flagship schemes such as VBG RAM G, along with spending on health, education, and other priority sectors.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!