Youth gets big push; Budget looks at India through a global lens

The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) were open today as the Budget was announced. Sensex, Nifty tanked post finance minister Nirmala Sitharaman’s speech; L&T, UltraTech, SBI and PowerGrid were top losers. Pic/Sayyed Sameer Abedi

With Budget 2025, our Finance Minister Nirmala Sitharaman, is telling the youth of India, much like Coldplay’s Chris Martin did a few days ago, to come together, hand in hand.

With Budget 2025, our Finance Minister Nirmala Sitharaman, is telling the youth of India, much like Coldplay’s Chris Martin did a few days ago, to come together, hand in hand.

The paradise

The new slab rates along with the provisions for rebate, if applicable, will virtually lead to savings of tax upto 33 per cent.

Streamline strength

The Indian tax authorities have introduced a policy where transfer pricing assessments conducted for a given year will now be applicable for the subsequent two years. This change aims to provide businesses with greater tax certainty and stability. To make India an electronic manufacturing global hub, benefits via a presumptive taxation scheme have been provided. This incentive is designed to boost semiconductor manufacturing, allowing India to compete with global leaders like Taiwan. Additionally, reduced customs rates on EVs/lithium batteries, LCDs and mobile accessories will further enhance local production of phones, vehicles, and televisions.

The fix

The FIIs who were enjoying a basic rate of 10 per cent on long term gains (other than listed securities), as compared to all others including residents who were liable @12.50 per cent have now been standardised. Here, it is important to note that Significant Economic Presence (SEP) with regard to foreign entities operating with indian entities, involving imports primarily for exports, deterred India’s promotion as an export hub. The new provision now aims to exclude such transactions from the definition of significant economic presence leading to non-taxation.

Young rung

Under the new provisions, two self-occupied houses will be permitted to be declared in the tax return without any notional value being included for taxation purposes. It is dial Y which means yeah for youth as the extension of benefits to start-ups all the way upto 2030, will lead to the growth of younger businesses. This coupled with the impetus to medical institutions/ IIT with increase in seats, will help build the Youth for India Tomorrow. From there we move onto the rationalisation of TDS and TCS, where we see strategic reductions in rates and adjustments in thresholds such as interest, rent, etc. Further, TCS on remittance under LRS for purpose of education, financed by loan from specified financial institution has been reduced to nil.

Higher Power

Till now, u/s 139 (8A) one could file revised/updated tax returns at any time within 24 months from the end of the relevant Assessment year. Now, this time limit has been extended to 48 months along with additional tax. In case of search and raid actions, earlier the provisions allowed retention of seized records and books for a period of 30 days from the date of the assessment order, which has now been extended to 30 days from the end of the quarter in which the assessment order is passed. The rationale for why such records should be retained is unexplainable.

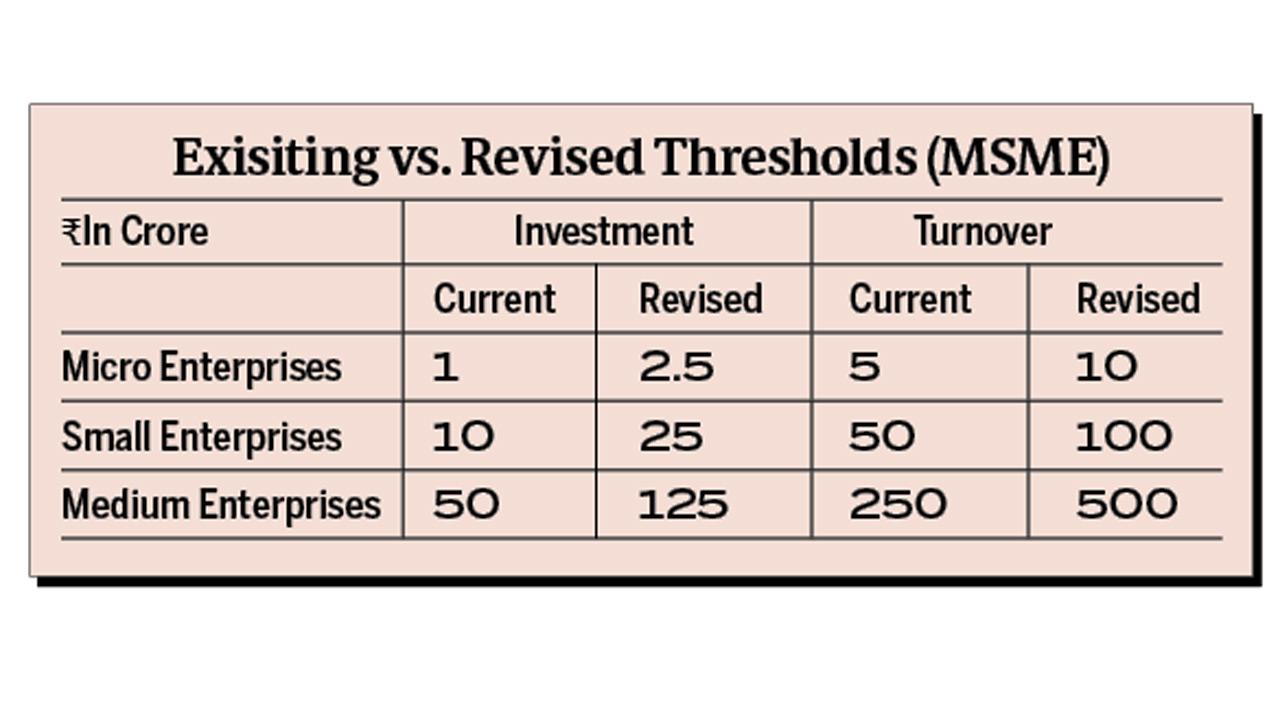

MSME Limits

These revisions to the threshold limits for MSME classification now allow businesses with a turnover between '250 crores and '500 crores to fall under the MSME regulations, thereby enabling them to avail themselves of the associated benefits. These increments expand the horizon and potential for businesses to access a wider range of benefits. However, clarity is required for completed registrations (requiring reclassification due to change in limits). Overall, this Finance Bill is simple, easy, youth-friendly and aimed at growth derived from consumer spending. We say high five for Budget 2025.

The columnist, Dr Mitil Chokshi, is CA and Senior Partner, Chokshi & Chokshi LLP, India — Tax, Advisory, Litigation, Assurance, Forensics, Technology, Audit

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!