A 10-month delay in issuing bills last year wiped out crores from BMC’s earnings, pushing it to desperate measures

The BMC reversed its decision to hike property tax after citizens objected

While the Brihanmumbai Municipal Corporation’s (BMC) revenue model has taken a hit with the civic body being unable to hike property tax for the last four years, the situation has become worse due to the 10-month delay in issuing bills this year. The delay has resulted in a loss worth crores of rupees which the BMC earns as interest while only 20 per cent of the bill amount was collected till December 31 as compared to the same period last year.

The corporation usually starts issuing property tax bills in April—the first month of the financial year—while it starts action against the defaulters in January. Last year (2022-23), the BMC was able to collect Rs 3,175 crore till December 31 despite a few months delay in issuing the bills. This year only Rs 638 crore was added to the BMC kitty during the same period. The corporation hasn’t handed over tax bills till now and the amount collected is mostly pending tax or disputed tax amounts from earlier years. Now, with the end of the financial year just months away, it will be extremely difficult for the civic body to collect the target amount of Rs 6,000 crore.

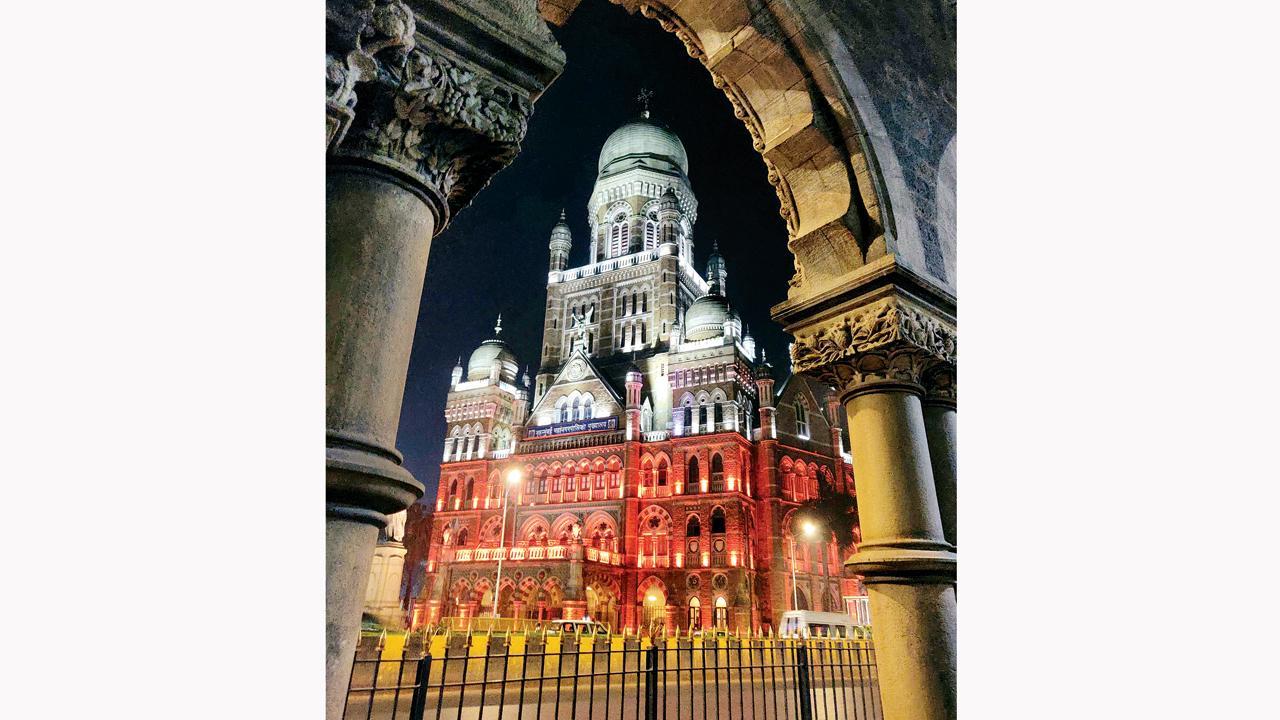

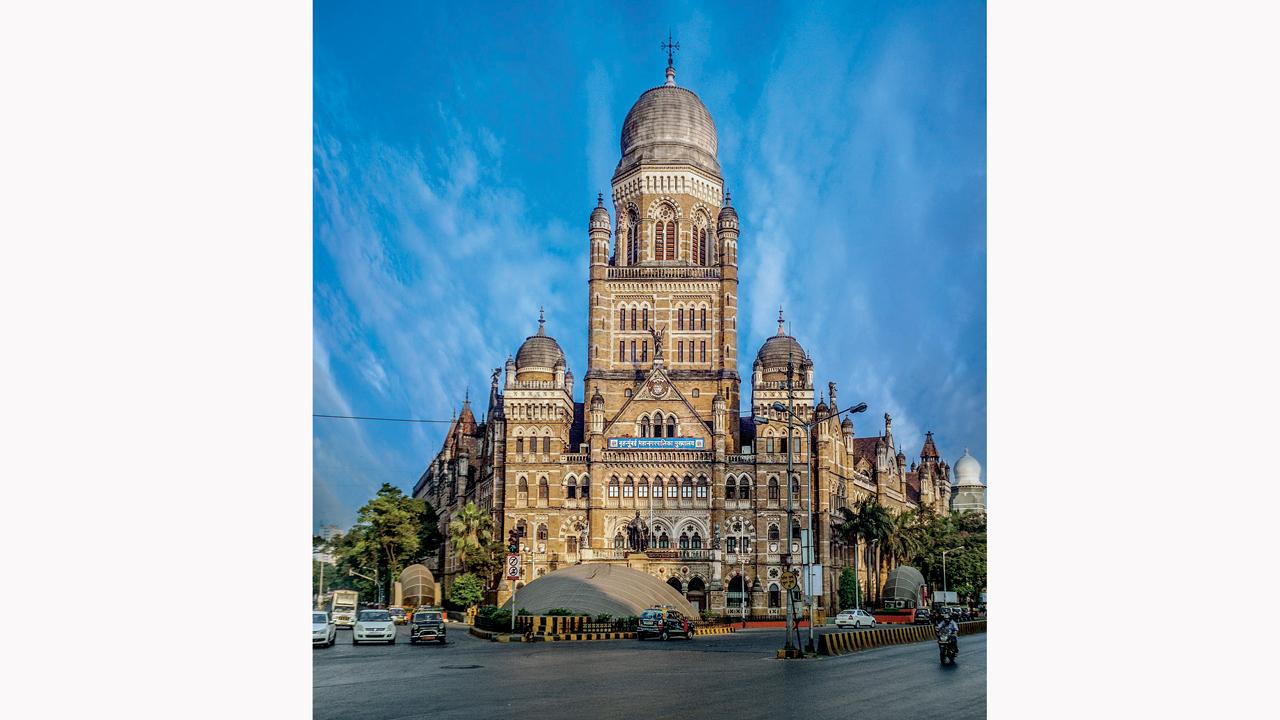

The last time property tax was revised was in 2015. File pic

The last time property tax was revised was in 2015. File pic

In the last four years, the BMC missed the first month of collection in an attempt to increase the property tax amount later in the year. But in general, the bills were issued within the first half (six months) of financial years. Taxpayers settle the first bill (April 1 to September 30) by September and the remaining six-month bill (October 1 to March 31) by March. This year, the civic body waited for nine months to issue bills. The BMC finally started uploading bills after December 25 with a 15-20 per cent higher amount with a footnote of it being a security amount. Civic officials also started sending SMSs to citizens to collect the physical bill copies from their respective wards.

However, after citizens started objecting to the bills and news about the same was published, the BMC reversed the decision and withdrew the online bills. According to a statement of I S Chahal, administrator of the BMC, the civic body will send physical copies of the bills, with the exact amount like the last year, without any hike. Now the BMC is in the process of printing the new bills. The process will take at least another month to print the bills and then distribute them. In other words, the BMC can collect the tax only in February and will have only two months for collection.

Mahesh Patil, assistant municipal commissioner of the assessment and collection department, did not respond to messages and calls. Another civic official said, “Though the amount this year is comparatively less than the last year, once we start issuing bills, the amount will increase sharply as citizens have been waiting to clear their bills.”

Rs 6,000cr

Target collection for property tax

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!