Insiders say demonisation won’t affect auction houses but could impact galleries that deal in cash; low liquidity may deter buyer for the time being

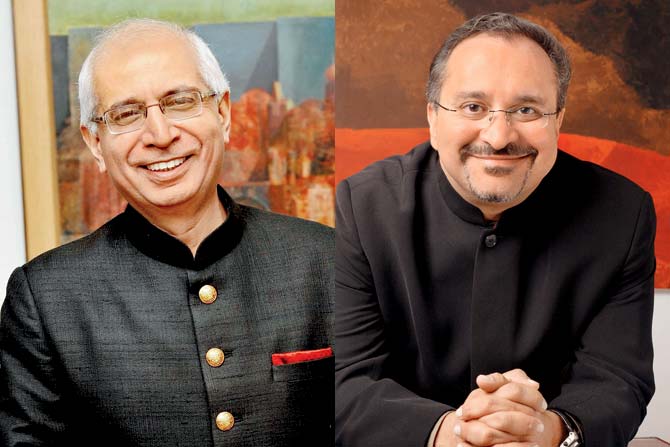

Kishore Singh and Dinesh Vazirani

Kishore Singh and Dinesh Vazirani

Following the announcement of the demonetisation of R500 and R1,000 notes to control the parallel economy, the art market has welcomed the move.

Known to be one of the sectors in which money laundering is seen as a threat, not just to the economy but also the credibility of artworks, the art market could be in for cleaner practices following the decision. PM Narendra Modi’s announcement comes at a time when galleries and leading auction houses in the city are gearing up for important shows and key sales.

Kishore Singh, director of DAG Modern, says that for “serious players” this is “a great confidence booster” as it ushers in transparency of prices. “We want to see how things roll out in the next couple of days, but deep down, all of us desire stability and confidence,” he said. “Auction houses – public forums which do not transact in cash – will not be affected in any way by the demonetisation,” said Ashvin Rajagopalan, director of Piramal Museum of Art. However, he added that gallery sales could be affected, if they deal in cash transactions.

The Indian art market, Singh observed, sees less money laundering practices when compared to the international ones. The reason – art investments are miniscule. Moreover, following the 2007 raid conducted by the Income Tax Department on 30 galleries in Mumbai and New Delhi, practices within the Indian art market have come a long way.

The price points of artworks are most likely to remain unaffected at upcoming sales and shows, therefore. Dinesh Vazirani, co-founder of auction house Saffronart, said that auctions see several international buyers, which remain outside the purview of the recent demonetization. Locally, he is certain that demonetization will elevate rather than detract from practices in the industry especially since auctions are public and payments are only by cheque. “Mid-range artists and primary shows of artists could be affected, however, this may be only for the short term,” he added.

Rajagopalan said that the next two months would reveal if the prices of artworks could be swayed to either extreme. “Sellers may want to drop the price points of their works or there is a chance that works may be withdrawn from sales. The latter will mean that the remainder works may become more expensive. We will have to wait and watch,” he said.

However, gallerists, auctioneers and artists have raised concerns about the surrounding cloud of caution with investments that weighs upon the public in the face of the announcement. With liquidity being paramount, there is a chance that investing in art, like with other assets, may be held back as well.

Dadiba Pundole, owner of Pundole’s auction house said that while auctions and sales would carry on unaffected, the sentiment could hit them. Will the oligarchs indulge in money laundering in the art market in the months to come? “That’s hardly likely as people who have unaccounted for monies are not typically clients of ours. As yet, wealthy Indians deploy a very small percentage of their income to art stemming from a love for the art, so the question of spurious practices is largely negated,” he said.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!