The SC on March 2 asked Securities and Exchange Board of India (SEBI) to conclude within two months its probe into allegations levelled by US short-seller Hindenburg Research against Adani Group. SEBI was to file a status report on May 2 but it made an application for extension on Saturday

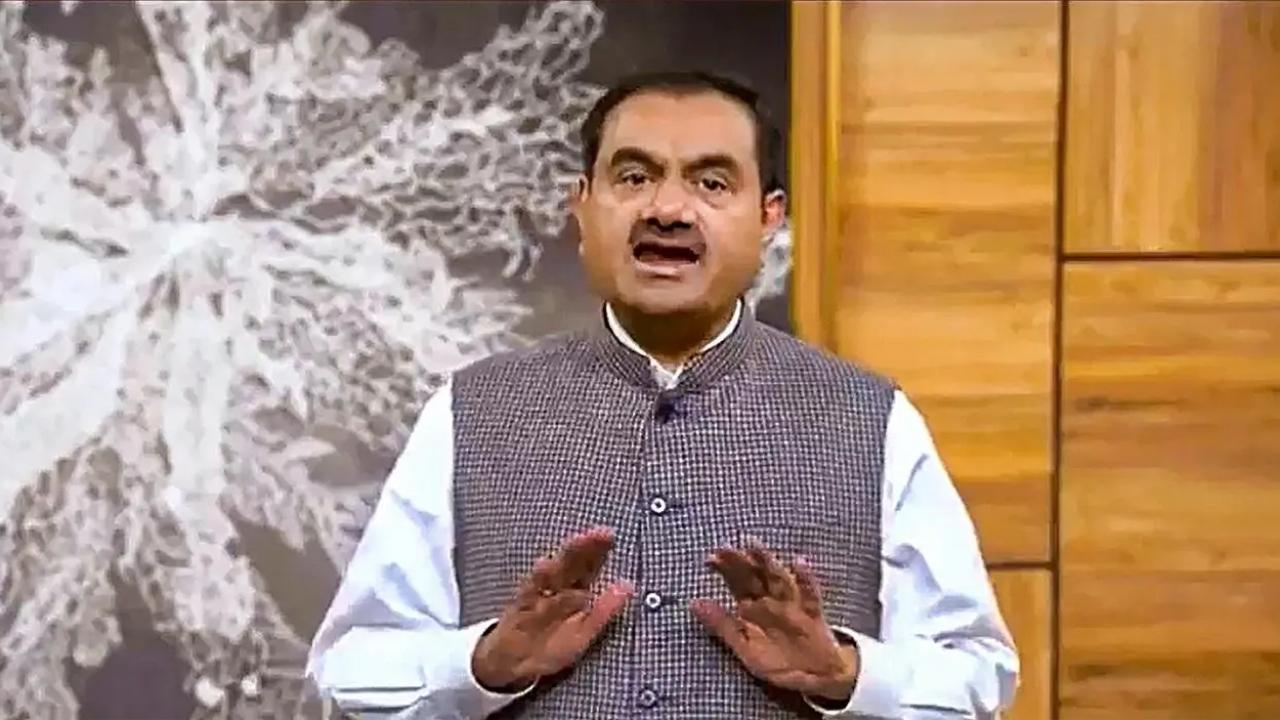

Adani Group Chairman Gautam Adani. File pic/PTI

Capital markets regulator SEBI has not concluded any wrongdoing in its application to the Supreme Court, seeking six more months to complete a probe into allegations against Adani Group, the conglomerate run by billionaire Gautam Adani said.

The SC on March 2 asked Securities and Exchange Board of India (SEBI) to conclude within two months its probe into allegations levelled by US short-seller Hindenburg Research against Adani Group. SEBI was to file a status report on May 2 but it made an application for extension on Saturday.

Also Read: Adani Group begins USD 130 mn debt buyback, first since Hindenburg report

Hindenburg in January accused Adani Group of accounting fraud and using firms in tax havens to inflate revenue and stock prices, even as debt piled up. “The SEBI application only cites the allegations made in the short-seller’s report, which are still under investigation,” Adani Group said.

The delay in the SEBI probe met with scepticism in some quarters. Priyanka Chaturvedi of Shiv Sena UBT tweeted, “The public deserves to know the truth, hopefully CJI (chief justice of India) will truly end the sealed cover based judgements for the sake of transparency.”

This story has been sourced from a third party syndicated feed, agencies. Mid-day accepts no responsibility or liability for its dependability, trustworthiness, reliability and data of the text. Mid-day management/mid-day.com reserves the sole right to alter, delete or remove (without notice) the content in its absolute discretion for any reason whatsoever

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!